|

|

发表于 23-9-2016 12:23 AM

|

显示全部楼层

发表于 23-9-2016 12:23 AM

|

显示全部楼层

本帖最后由 icy97 于 23-9-2016 02:30 AM 编辑

GLOMAC(5020)高美达 -- 青中带红!

2016年9月23日星期五

http://wesharenwetrade.blogspot.my/2016/09/glomac5020.html

最新季报:

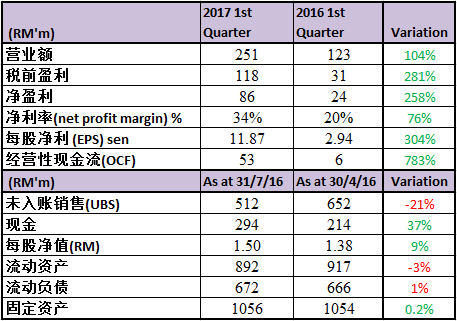

高美达今天公布了2017年度第一季的财报,营业额和净利都翻倍了。主要是因为进账了去年年尾宣布脱售给一马公司的地皮。在这产业市场低迷的时候还能售地并赚入一笔可观的盈利,实在不简单。可能是因为拜得神多自有神庇佑。随着利好消息的宣布,高美达今天股价一度上涨7仙(+9%)。收市时微涨4仙,以0.795仙挂收。成交量是过去一年里最高,达两百二十万股。

高美达脱售地皮后现金充裕,不排除会发放特别股息或留作扩展地库的可能性。集团也在昨天的股东大会已经通过了分发两仙终期股息的建议,除权日28/11,派发日8/12。负载率因为售地而再度走地至0.2倍的低水平,当便宜地皮浮现时,对集团举债扩展地库有利。

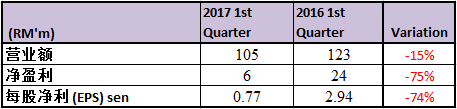

扣除七月脱售CHERAS 16.9Hectares 永久地契的地皮给一马发展公司后:

售价:RM145.6M

净赚:RM80M

在扣除售地获得的一次性收入后,我们可以看见高美达的业绩实际上相比去年同期逊色了许多。不过高美达的CEO同是马来西亚房地产发展商公会主席(REHDA)拿督斯里法迪依斯干达表示说接下来三个季度将推出十亿令吉的新产业计划来推高销售额,而且超过80%的新产业是需求较高的有地城镇计划和可负担房屋。但是笔者过去的观察发现,高美达每年实际推出市场的新产业都会比计划来得低,这也许是近几年产业市场低迷的缘故。另外,超过五亿的未入账销售将继续扶持高美达接下来一年的盈利。而目前手头上地皮的发展总值高达70亿令吉。

整体而言,产业市场依然低迷,相信高美达在接下来的季度也难有作为。唯有期待十月份的2017年财政预算案,政府采取更多振兴产业市场的措施。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 23-9-2016 02:37 AM

|

显示全部楼层

发表于 23-9-2016 02:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Statement on Glomac Berhad's Unaudited Results for the 1st Quarter ended 31 July 2017 | We are pleased to enclose herewith the press release made by Glomac Berhad dated 21 September 2016 in conjuction with the announcement of Glomac Berhad's unaudited results for the 1st Quarter ended 31 July 2016.

Please refer attachment below.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5210493

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-9-2016 03:56 AM

|

显示全部楼层

发表于 24-9-2016 03:56 AM

|

显示全部楼层

本帖最后由 icy97 于 24-9-2016 04:29 AM 编辑

高美达

5.12亿销售待进账

2016年9月23日

分析:达证券

目标价:76仙

最新进展:

高美达(GLOMAC,5020,主板产业股)2017财年首季营业额与税前盈利,个别报2亿5140万令吉与1亿1780万令吉,按年增104%和284%。

但是,在扣除脱售蕉赖土地所获得1亿4560万令吉收益后,营业额与税前盈利实为按年下跌14%和60%。

此外,高美达实收营业额与税前盈利的按季表现,也个别走低38%和30%。

行家建议:

高美达净利在扣除脱售收益后,2017年首季只录得640万令吉,表现低于预期,只占我们与业界全年预测的9%。

业绩逊色,归咎于赚幅疲弱,但扣除脱售收益的营业额,却符合预期,达1亿580万令吉,占全年预测的22%。

另外,首季新销售达3100万令吉,按年持平,只占全年4亿令吉目标8%,也是在预料之中,因为上财年首季新销售只占全年目标的10%。

预计公司在下半年会增加推介新项目。

公司截至年7月的未入账销售,从上一季的6亿5200万令吉,下滑至5亿1200万令吉,可维持盈利表现12个月。

【e南洋】

业绩料急起直追.高美达财测维持

2016-09-22 18:51

http://www.sinchew.com.my/node/1569935/

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-12-2016 02:48 PM

|

显示全部楼层

发表于 4-12-2016 02:48 PM

|

显示全部楼层

本帖最后由 icy97 于 13-12-2016 04:37 AM 编辑

营业额挫43%

高美达次季赚1825万

2016年12月2日

(吉隆坡1日讯)因脱售地皮获得收益,高美达(GLOMAC,5020,主板产业股)截至10月杪次季,净利按年增加4.10%至1824万8000令吉,或每股盈利2.53仙。

上财年同期为1753万令吉,或每股净利2.45仙。

不过,营业额则按年下挫42.50%至8398万5000令吉,去年同期为1亿4605万4000令吉。

高美达发表文告指,由于Glomac Centro和Reflection Residences的项目已经完成,导致营业额下跌。

当季营业额主要来源,分别是Saujana KLIA项目、蒲种湖滨花园(Lakeside Residences)和哥打丁宜Sri Saujana项目。

半年净利飙1.69倍

累计首半年,高美达净利按年暴涨168.88%至1亿378万6000令吉,而营业额则增加24.66%,达3亿3540万5000令吉。

展望未来,高美达董事认为,未来的营运环境充满挑战,但是在脱售地皮取得1亿4560万令吉、未入账销售和未来推介项目,预计公司2017财年全年业绩会令人满意。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2016 | 31 Oct 2015 | 31 Oct 2016 | 31 Oct 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 83,985 | 146,054 | 335,405 | 269,051 | | 2 | Profit/(loss) before tax | 25,711 | 29,028 | 143,520 | 59,720 | | 3 | Profit/(loss) for the period | 17,052 | 19,497 | 103,528 | 43,317 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 18,248 | 17,530 | 103,786 | 38,599 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.53 | 2.45 | 14.41 | 5.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5000 | 1.3800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-12-2016 03:01 PM

|

显示全部楼层

发表于 4-12-2016 03:01 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Statement on Glomac Berhad's Unaudited Results for the Second Quarter ended 31 October 2016 | We are pleased to enclose herewith the press release made by Glomac Berhad dated 30 November 2016 in conjuction with the announcement of Glomac Berhad's unaudited results for the Second Quarter ended 31 October 2016.

Please refer to the attachments below.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5276369

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-12-2016 06:55 AM

|

显示全部楼层

发表于 13-12-2016 06:55 AM

|

显示全部楼层

上半年放缓.将推新产业.高美达销售目标或下调

(吉隆坡1日讯)高美达(GLOMAC,5020,主板产业组)上半年业绩低于预期,尽管下半年销售有望获新产业发展计划支撑,分析员不排除销售目标存有下调风险。

丰隆研究指出,该公司仅于第二季取得4900万令吉新销售,带动上半年销售增至8000万令吉,按年成长持平。

上半年该公司因市场情绪疲弱,并未推出新产业发展计划,下半年放眼推出发展总值10亿令吉产业计划,62%为有地房产。

虽然该公司维持全年6亿令吉销售目标,但丰隆认为,若新产业发展计划出现任何潜在延迟状况,销售目标料面临下调风险。

盈利预测下调

该公司未结账销售按年走跌,从5亿1200万跌至4亿1500万令吉。丰隆研究的销售目标预测为5亿令吉。

因调低利润预测,丰隆下调2017、2018及2019财政年盈利预测42%、19%及25%。

马银行研究指出,该公司盈利料有望在下半年季节性走高,销售惨淡是因为上半年缺乏新推出产业,但管理层有信心从第三季起推出的新发展计划将推动全年销售预测达标。

MIDF研究认为,上半年销售放缓在预期内,8000万令吉销售只达到该公司6亿令吉目标的13%,不过,获价值9亿6600万令吉新产业发展计划支撑,接下来季度料有望取得强劲销售。

为反映较低营业额释放,MIDF下调2017财政年盈利预测14%至5750万令吉,预计2017财政年盈利将比2016财政年低。

文章来源:

星洲日报/财经‧报道:郭晓芳‧2016.12.01 |

|

|

|

|

|

|

|

|

|

|

|

发表于 18-12-2016 06:42 AM

|

显示全部楼层

发表于 18-12-2016 06:42 AM

|

显示全部楼层

高美达子公司接清盘令

2016年12月14日

(吉隆坡13日讯)高美达(GLOMAC,5020,主板产业股)独资子公司Glomac Regal私人有限公司上周四(8日)接到吉隆坡高庭发出清盘令。

该公司向交易所报备说,目前正与起诉方洽谈和解金额,同时会申请驳回清盘令。

报备文件指出,Bina Goodyear在11月25日,入禀吉隆坡高庭,向Glomac Regal追讨349万4997.88令吉,及申请后者清盘。

入禀书内容指Bina Goodyear在吉隆坡,为Glomac Regal承建2栋豪华公寓,但未如期付款。

高美达表示,Glomac Regal不是高美达的主要子公司,投资额只是500万令吉;清盘的影响就只是这家子公司关闭而已。【e南洋】

Type | Announcement | Subject | WINDING UP / RECEIVER & MANAGER / RESTRAINING ORDER / SPECIAL ADMINISTRATOR | Description | Winding Up Order on Glomac Regal Sdn Bhd, a wholly owned subsidiary of Glomac Berhad | INTRODUCTION The Board of Directors of Glomac Berhad (the "Company") wishes to announce that Glomac Regal Sdn Bhd (“GRSB”), a wholly owned subsidiary of the Company had, on 8 December 2016 received the sealed winding-up order dated 25 November 2016 from the High Court of Malaya at Kuala Lumpur in the matter of Section 218(1)(e) and (2) of the Companies Act, 1965.

INFORMATION ON THE WINDING-UP ORDER (a) Date of the presentation of the winding-up petition and the date of the winding up petition was served The petition was presented to the High Court of Malaya at Kuala Lumpur [Winding-up No. WA-28NCC-707-08/2016] by Messrs Jimmy Chong Tet Hin, solicitors for Bina Goodyear Berhad (18645-H) [the "Petitioner”] on 25 November 2016 and a copy was given to GRSB on 24 August 2016 and ordered for hearing on 21 October 2016.

(b) The particulars of the claim under the winding-up petition That GRSB is indebted to the Petitioner in the principal amount of RM3,494,997.88 only (the “Sum”) being the amount due for works done by the Petitioner in relation to a project known as “Cadangan Pembangunan 2 Blok Pangsapuri Mewah (138 unit) Di atas Lot 58 dan 122, Seksyen 63, Lorong Stonor, Bandar Kuala Lumpur, Wilayah Persekutuan”.

(c) Details of the default or circumstances leading to the filing of the winding-up petition against GRSB GRSB has been seen as neglecting the payment of the said Sum. On the contrary, GRSB is actively pursuing the Petitioner for a negotiable amount of settlement which has not been reached.

(d) Confirmation on status of GRSB as a major subsidiary of Glomac Berhad, and total cost of investment in GRSB GRSB is a non major subsidiary of Glomac Berhad, and the total cost of investment in GRSB is RM5,000,000.00.

(e) Financial and operational impact of the winding-up proceedings on the Group The financial and operational impact of the winding-up proceedings on the Group is that the Company would be dissolved, wound up and liquidated.

(f) Expected losses arising from the winding-up proceedings The expected losses, if any, arising from the winding-up proceedings is the Company would be dissolved, wound up and liquidated.

(g) Steps taken or proposed to be taken by GRSB in respect of the winding-up proceedings GRSB is currently negotiating with the Petitioner for a negotiable amount of settlement and concurrently, GRSB will file for a permanent stay to set aside the winding up order.

The announcement is dated 9 December 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2017 05:34 AM

|

显示全部楼层

发表于 24-2-2017 05:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2017 | 31 Jan 2016 | 31 Jan 2017 | 31 Jan 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 87,493 | 158,131 | 422,898 | 427,182 | | 2 | Profit/(loss) before tax | 9,740 | 34,179 | 153,260 | 93,899 | | 3 | Profit/(loss) for the period | 5,330 | 23,854 | 108,858 | 67,171 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,372 | 19,682 | 109,158 | 58,281 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.75 | 2.74 | 15.16 | 8.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 2.00 | 1.50 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5100 | 1.3800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2017 05:35 AM

|

显示全部楼层

发表于 24-2-2017 05:35 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | SINGLE-TIER INTERIM DIVIDEND IN RESPECT OF THE FINANCIAL YEAR ENDING 30 APRIL 2017 | Glomac Berhad ("the Company") is pleased to announce that the Board of Directors of the Company has declared a single-tier interim dividend of 1.50 sen per ordinary share in respect of the financial year ending 30 April 2017, of which the details of entitlement and payment dates of the above-said dividend will be determined and announced in due course.

This announcement is dated 22 February 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2017 05:35 AM

|

显示全部楼层

发表于 24-2-2017 05:35 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Statement on Glomac Berhad's Unaudited Results for the 3rd Quarter ended 31 January 2017 | We are pleased to enclose herewith the press release made by Glomac Berhad dated 22 February 2017 in conjuction with the announcement of Glomac Berhad's unaudited results for the 3rd Quarter ended 31 January 2017.

Please refer to the attachments below.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5343689

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-3-2017 02:25 AM

|

显示全部楼层

发表于 27-3-2017 02:25 AM

|

显示全部楼层

高美达可买进?

读者XYZ问:

请分析高美达(GLOMAC,5020,主板产业组)这只股的最新表现和前景,是否可以买进,合理价是多少?

答:

高美达赚幅承压

或延推新盘

高美达最新业绩低于预期,一众分析员预料该公司赚幅受压,并可能展延推出新产业项目,谨慎起见,一致下砍该公司未来盈利预测。

财测下砍

高美达2017财政年首9个月净利涨87.3%,至1亿915万8000令吉。

达证券表示,撇除脱售资产(获利8000万令吉)及一次性2630万令吉的奖掖,该公司首9个月的净利仅为1030万令吉,仅符合全年净利预测的20%。

马银行研究表示,高美达2016财政年的销售目标为6亿至6亿5000万令吉,但首9个月的销售仅取得2亿400万令吉,相等于目标的34%。尽管销售目标仍有差距,但该公司仍有信心可达到上述目标,因该公司在2017财政年第四季将会推出发展总值6亿9600万令吉的产业项目。

达证券补充,2016至2017年,巴生河流域服务式与共管公寓将竣工,该领域备受挑战,因供应过多之故,并认为有地产业的认购率为60%。

此外,达证券也假设,若该公司展延柯拉娜再也发展总值3亿6300万令吉的产业项目至2018财政年,预期高美达2017财政年的销售将为4亿令吉。

未入账销售4.84亿

丰隆研究表示,若高美达展延推出产业项目,将会影响该公司的销售目标,值得一提的是,该公司的未入账销售按季走高至4亿8400万令吉,此前为4亿1500万令吉,相等于2016财政年的0.8倍的营业额。

丰隆说,尽管该公司财务处于健康状态,负债比仅为0.14倍,周息率达4%,但基于缺乏吸引力觉得终止跟进高美达。

综合上述观点,一众分析员皆调低该公司2017财政年的净利预测,幅度介于8至30%。

马银行和丰隆给予守住评级,目标价分别是76仙和67仙,达证券较悲观,只给予卖出评级,目标价则是69仙。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2017.03.26 |

|

|

|

|

|

|

|

|

|

|

|

发表于 11-4-2017 04:15 AM

|

显示全部楼层

发表于 11-4-2017 04:15 AM

|

显示全部楼层

本帖最后由 icy97 于 11-4-2017 04:16 AM 编辑

项目推迟.广场亏损.高美达5亿销售难达标

http://www.sinchew.com.my/node/1632341/

(吉隆坡10日讯)高美达(GLOMAC,5020,主板产业组)的产业项目延迟推介,零售广场也亏损,分析员不仅认为2017财政年的5亿令吉销售目标难以达成,也预料2018至2019财政年盈利将毫无惊喜。

高美达2017财政年结算日落在本月30日,达证券认为,在过去9个月,该公司仅录得2亿零400万令吉的销售额,想要在2017财政年达到5亿令吉的销售目标,可谓是一项艰钜的任务。

达证券认为,高美达今年可透过已推介的有地房产及未出售房产,达到3亿5000万至4亿令吉的销售目标。

达证券探悉,高美达管理层寄望能够从2017财政年末季推出总值6亿9600万令吉的房产项目加强销售目标,惟该行相信,房贷严格审批将导致新销售额无法如期入账。

达证券表示,高美达积极在巴生河流域及柔佛州物色可作为城镇发展的地段。

“我们相信,短期而言,该公司拥有足够能力收购土地,因为早期脱售位于蕉赖的土地已经获得全部款项。”

另外,达证券表示,格拉那再也广场4(Plaza Kelana Jaya 4)的推介礼料推迟至2018财政年,因此料销售仅能反映在2018财政年上。

达证券指出,高美达旗下的Glo Damansara购物中心受出租率低迷及启动成本高涨所拖累,一直面对亏损,目前30%的出租面积(NLA)由主要客户Ben's Independent Grocer及人民银行(Bank Rakyat)所租用。

达证券探悉,该公司已经成功找到租户,在今年杪,出租率有望推高到50至60%。该行认为,在目前充满挑战性环境下,Glo Damansara购物中心尚需一段时日,才可能转亏为盈。

达证券指出,尽管预测2018财政年盈利有望增长超过100%,这却仅仅是因为2017财政年低比较基础所致,因此看淡未来两年盈利。

在缺乏短期催化剂下,达证券重申高美达“卖出”评级和69仙目标价。

达证券表示,高美达股价落后大市,今年至今仅上扬4%,落后产业指数的16%涨幅。

文章来源:

星洲日报‧财经‧报道:刘玉萍‧2017.04.10 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-4-2017 04:44 AM

|

显示全部楼层

发表于 14-4-2017 04:44 AM

|

显示全部楼层

EX-date | 27 Apr 2017 | Entitlement date | 02 May 2017 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | An interim single-tier dividend of 1.50 sen per ordinary share | Period of interest payment | to | Financial Year End | 30 Apr 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SHAREWORKS SDN BHDNo. 2-1, Jalan Sri Hartamas 8Sri Hartamas50480Kuala LumpurTel:0362011120Fax:0362013121 | Payment date | 15 May 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 02 May 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.015 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2017 02:21 AM

|

显示全部楼层

发表于 15-6-2017 02:21 AM

|

显示全部楼层

Date of change | 01 Jun 2017 | Name | DATUK SERI JOHAN BIN ABDULLAH | Age | 61 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | 1. MBA (FINANCE) - MOREHEAD STATE UNIVERSITY, KENTUCKY, USA2. BBA (FINANCE) - EASTERN MICHIGAN UNIVERSITY, MICHIGAN, USA3. DIPLOMA IN BANKING - INSTITUTE TECHNOLOGY MARA, SHAH ALAM, SELANGOR | Working experience and occupation | 1. LEMBAGA TABUNG HAJI - GROUP MANAGING DITRECTOR AND CHIEF EXECUTIVE OFFICER (JULY 2016 - PRESENT)2. LEMBAGA TABUNG HAJI - DEPUTY GROUP MANAGING DITRECTOR AND CHIEF EXECUTIVE OFFICER (JANUARY 2015 - JUNE 2016)3. BIMB HOLDINGS BERHAD - GROUP MANAGING DITRECTOR/CHIEF EXECUTIVE OFFICER (MAY 2008 - JANUARY 2015)4. BURSA MALAYSIA BERHAD - DEPUTY REGULATORY OFFICER (JANUARY 2008 - APRIL 2008)5. BURSA MALAYSIA BERHAD - HEAD, LISTING (JANUARY 1999 - DECEMBER 2007)6. DAMANSARA REALTY BERHAD - GENERAL MANAGER, CORPORATE PLANNING (1995 - 1998)7. BUMIPUTRA MERCHANT BANKERS BERHAD - SENIOR MANAGER, CORPORATE FINANCE (1989 - 1995)8. BURSA SAHAM KUALA LUMPUR - LISTING OFFICER (1987 - 1989) | Directorships in public companies and listed issuers (if any) | 1. TH PLANTATION BERHAD2. TH HEAVY ENGINEERING BERHAD |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2017 06:30 AM

|

显示全部楼层

发表于 22-6-2017 06:30 AM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2017 01:38 AM 编辑

高美达末季净利挫94%

2017年6月22日

(吉隆坡21日讯)高美达(GLOMAC,5020,主板产业股)截至4月30日末季,净利大挫94.4%,仅写127万7000令吉;但仍建议派息1.5仙。

同期营业额跌16.1%,报1亿5889万4000令吉。

全年净利扬37%

累计全年,净利则扬36.5%,达1亿1043万5000令吉;营业额萎缩5.6%,报5亿8179万2000令吉。

高美达向交易所报备,营业额滑落,主要归咎于Glomac Centro和Reflection Residences等项目已经完工。

当季盈利赚幅从33%,走高至37%;而全年赚幅则是从34%,增至42%。

执行主席丹斯里F.D.曼苏,通过文告表示,公司的资产负债表进一步巩固,总现金达3亿750万令吉,将净负债率降至0.2倍的舒适水平。

此外,每股净资产也攀至1.49令吉,去年为1.38令吉。

高美达建议派发每股1.5仙的终期股息,将全年的股息推高至3仙,相等于是4.3%的周息率。

展望未来,虽然公司手上握有未入账销售,明年也计划推出新楼盘,但相信营运环境将持续艰难,因此2018财年将持续面临挑战。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2017 | 30 Apr 2016 | 30 Apr 2017 | 30 Apr 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 158,894 | 189,421 | 581,792 | 616,603 | | 2 | Profit/(loss) before tax | 14,786 | 28,508 | 168,046 | 122,407 | | 3 | Profit/(loss) for the period | 1,935 | 18,489 | 110,793 | 85,660 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,277 | 22,644 | 110,435 | 80,925 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.18 | 3.14 | 15.32 | 11.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.50 | 2.00 | 1.50 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.4900 | 1.3800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2017 06:34 AM

|

显示全部楼层

发表于 22-6-2017 06:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Press Statement on Glomac Berhad's Unaudited Results for the 4th Quarter ended 30 April 2017 | We are pleased to enclose herewith the press release made by Glomac Berhad dated 21 June 2017 in conjuction with the announcement of Glomac Berhad's unaudited results for the 4th Quarter ended 30 April 2017.

Please refer to the attachments below.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5467357

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2017 06:41 AM

|

显示全部楼层

发表于 22-6-2017 06:41 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL SINGLE TIER DIVIDEND IN RESPECT OF THE FINANCIAL YEAR ENDED 30 APRIL 2017 | Glomac Berhad ("the Company") is pleased to announce that the Board of Directors of the Company has proposed a final single-tier dividend of 1.50 sen per ordinary share in respect of the financial year ended 30 April 2017 subject to the Shareholders’ approval at the forthcoming Annual General Meeting.

The details of entitlement and payment dates of the above-said dividend will be determined and announced in due course.

This announcement is dated 21 June 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-6-2017 03:21 AM

|

显示全部楼层

发表于 23-6-2017 03:21 AM

|

显示全部楼层

本帖最后由 icy97 于 23-6-2017 04:33 AM 编辑

高美达业绩低于预期

2017年6月22日

分析:达证券

目标价:70仙

最新进展:

高美达(GLOMAC,5020,主板产业股)截至4月30日末季,净利大挫94.4%至127万7000令吉;营业额年跌16.1%至1亿5889万4000令吉。

累计全年,净利扬36.5%至1亿1043万5000令吉;营业额萎缩5.6%至5亿8179万2000令吉。

营业额滑落,主要归咎于Glomac Centro和Reflection Residences等项目已经完工。

行家建议:

高美达在扣除脱售收益和一次性拨款后,本财年经调整后净利只录得1160万令吉,表现低于预期。

这是因为支付费用以释放未售出的土著单位,及高于预期的实际税率。

自宣布第三季业绩后,高美达股价已跌7.6%。无论如何,我们认为高美达在明后财年,可交出好成绩,因产业销售有复苏迹象。

因管理层没透露销售目标,我们猜想明后财年分别为5亿令吉和6亿9000万令吉,之前是5亿5000万令吉和7亿6600万令吉。

综合上述因素,我们将明后财年净利预测,分别下调10%和上调6%。

【e南洋】

业绩逊色.高美达两年财测下调

(吉隆坡22日讯)高美达(GLOMAC,5020,主板产业组)2017财政年业绩低于预期,分析员下调2018/2019财政年财测42至66%。

马银行研究示,该公司第四季净利按年跌90%至130万令吉,不包括售地净收益的8100万令吉,全年核心净利按年走低58%,仅达到该行及市场预测的56%及40%。

2017年净利走跌主要是释放土著单位开销、产业计划拖期罚款(LAD)及新开的GLO白沙罗商场营运亏损影响。

受产业计划延迟推出影响,产业销售虽然按年走扬38%至4亿2000万令吉,但依然低于市场预期,仅达到管理层及该行预测的67%及88%。

管理层预测销售为6亿至6亿5000万令吉,马银行研究预测4亿8000万令吉。

马银行研究指出,除了买气疲弱,销售走低是因为2项高楼产业计划延迟推出影响,分别是格拉纳再也4大厦(PKJ4)及Centro V。

管理层未提供2018财政年销售目标。截至2017年4月杪止,该公司未结账销售企于5亿5600万令吉。

为反映2017财政年业绩、PKJ4及Centro V产业延迟推出、GLO白沙罗商场销售延迟因素,马银行研究下调2018及2019财政年盈利42及66%,目标价下调5仙至71仙,维持“持有”评级。

文章来源:

星洲日报‧财经‧报道:郭晓芳‧2017.06.22 |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-8-2017 11:44 PM

|

显示全部楼层

发表于 2-8-2017 11:44 PM

|

显示全部楼层

本帖最后由 icy97 于 3-8-2017 06:03 AM 编辑

高美達建議10送1股

2017年8月02日

(吉隆坡2日訊)高美達(GLOMAC,5020,主要板房產)建議,每持有10現有股派送1股紅股形式,發行共7481萬7531紅股。

高美達向馬證交所報備,截至今年7月21日,高美達共發行了7億2782萬1313股,當中包括484萬8000庫存股 ,及僱員認購權證(ESOS)下發行的期權及未行使股票達2035萬4000股。

文告指出,上述紅股發行將從高美達的股票溢價戶頭完全資本化。【中国报财经】

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | GLOMAC BERHAD ("GLOMAC" OR THE "COMPANY")PROPOSED BONUS ISSUE OF UP TO 74,817,531 NEW ORDINARY SHARES IN GLOMAC ("BONUS SHARE(S)") ON THE BASIS OF 1 BONUS SHARE FOR EVERY 10 EXISTING ORDINARY SHARES IN GLOMAC ("GLOMAC SHARE(S)") HELD ON AN ENTITLEMENT DATE TO BE DETERMINED AND ANNOUNCED LATER ("PROPOSED BONUS ISSUE") | On behalf of the Board of Directors of Glomac, RHB Investment Bank Berhad wishes to announce that the Company proposes to undertake the bonus issue of up to 74,817,531 Bonus Shares on the basis of 1 Bonus Share for every 10 existing Glomac Shares held on an entitlement date to be determined and announced later.

Further details on the Proposed Bonus Issue are set out in the attachment.

This announcement is dated 2 August 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5504997

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-8-2017 03:10 AM

|

显示全部楼层

发表于 4-8-2017 03:10 AM

|

显示全部楼层

10送1红股 房市渐复苏

高美达展望看高一线

2017年8月3日

(吉隆坡2日讯)高美达(GLOMAC,5020,主板产业股)建议以10送1,派送高达7481万7531股红股,分析员认为是正面惊喜,因为将改善股票流通量。

该公司昨日向交易所报备,每持有高美达10股,股东可获赠1红股,以回馈他们对公司的信任与持续支持。

发送红股后,高美达的股票数额将从7亿2782万1000股,扩大至8亿2299万3000股,可改善公司的股票流通量。

3年财测不变

同时,该公司的股本将从3亿6391万1000令吉,提高至4亿1975万2000令吉。

达证券分析员对该红股计划正面,不过,不会调整2018至2020财年的盈利预测,该公司的基本面和盈利不变,但调整了每股盈利和股息的预测。

另一方面,该行分析员认为,该公司将在2018至2019财年内取得更好的盈利表现,因为产业销售有复苏的迹象,选择地点和推出产品的策略居功至伟。

将推10亿房产

高美达2017财年末季一共卖出总值2亿1600万令吉的产业,按季和按年分别增77%和25%,带动该公司全年营业额上升至4亿2000万令吉,按年增了38%。

虽然该公司没透露2018财年的销售目标,但分析员预计,高美达的营业额按年将有所增长,因为即将推出一连串大项目,发展总值达10亿令吉。【e南洋】 |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|