|

|

楼主 |

发表于 10-1-2018 06:09 AM

|

显示全部楼层

棕油产量看涨利赚幅

云顶种植今年看高一线

2018年1月10日

(吉隆坡9日讯)越来越多种植区成熟,市场乐观看待云顶种植(GENP,2291,主板种植股)的棕油产量,预计2018财年盈利和现金流持续走强。

彭博智库分析研究中心分析员陈艾文认为,云顶种植今年的赚幅和现金流表现将亮眼,归功于种植产量增加,抵消原棕油价格低迷的负面因素。

“早前产量低的棕油种植区,如今已步入成熟,预计棕油产量增加。”

云顶种植在国内的种植面积为5万9219公顷,在印尼共有7万1940万公顷。

印尼种植区的营运已经转亏为盈,且资本开销也减少,由此,哪怕面对国内园丘因树龄年长而导致增长停滞,印尼方面可提振整体公司表现。

房产发展贡献少

另一方面,位于沙巴的提炼厂将会贡献额外的营业额,但却拖累云顶种植赚幅,这是因为下游业务的赚幅,通常都比上游低。

除了种植相关业务外,产业发展的贡献仍小,且呈“自然增长”,因该公司经常将种植面积,转型发展成城镇。

“基于在柔佛项目的出售率低,云顶种植料不会频密推出产业新项目。”

分析员补充,云顶种植的上游业务赚幅可达36%至41%,而产业则仅20%赚幅。

对于2017财年表现,由于下游业务贡献显著营业额,分析员认为全年赚幅可达35%,稍微高于去年的33%。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-2-2018 01:26 AM

|

显示全部楼层

本帖最后由 icy97 于 28-2-2018 06:10 AM 编辑

末季淨利跌38% 雲頂種植仍派息20.5仙

2018年2月26日

(吉隆坡26日訊)雲頂種植(GENP,2291,主要板種植)截至12月底末季淨利下滑37.8%,達1億1770萬令吉,但仍建議每股派息20.5仙。

同時期營業額按年跌2.9%,至5億2842萬令吉。

該公司全年淨利從3億3821萬令吉,微跌至3億3771萬令吉;營業額則大漲21.9%,達18億425萬令吉,除了房產業務外,其它業務都交出增長表現。

雲頂種植發布文告稱,種植業務中的鮮果串產量按年增17%;下游製造業務亦交出更高的提煉棕油產品和生物柴油銷量。這抵消房產業務較低的營業額表現。

此外,該公司在2017財年的平均原棕油售價每公噸達2715令吉,主要是進口國的需求持續貢獻。

至于2018財年,雲頂種植相信種植業務的表現,將取決于棕油價和鮮果串產量。

該公司估計今年的鮮果串產量會持續增長,因印尼的種植地有更多的成熟地段,已經更佳的樹齡組合。房產業務方面,則會專注在可負擔房屋類型。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 528,417 | 513,414 | 1,804,250 | 1,480,079 | | 2 | Profit/(loss) before tax | 142,147 | 258,562 | 461,127 | 448,771 | | 3 | Profit/(loss) for the period | 111,913 | 191,732 | 344,788 | 327,491 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 117,697 | 189,249 | 337,710 | 338,213 | | 5 | Basic earnings/(loss) per share (Subunit) | 14.83 | 24.14 | 42.13 | 42.84 | | 6 | Proposed/Declared dividend per share (Subunit) | 20.50 | 19.00 | 26.00 | 21.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.4000 | 5.3900

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-2-2018 01:31 AM

|

显示全部楼层

EX-date | 09 Mar 2018 | Entitlement date | 13 Mar 2018 | Entitlement time | 04:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special Single-Tier Dividend of 11 sen per ordinary share. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Genting Management and Consultancy Services Sdn Bhd24th Floor, Wisma GentingJalan Sultan Ismail50250 Kuala LumpurTel: 03-21782266 | Payment date | 29 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.11 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-3-2018 05:56 AM

|

显示全部楼层

全年业绩达标.云顶种植财测调高

(吉隆坡27日讯)云顶种植(GENP,2291,主板种植组)全年业绩达标,分析员看好该公司来年鲜果串成长下,可驱动净利成长,纷纷上调该公司盈利预测。

艾毕斯研究表示,该公司全年核心净利成长15%,比预期的盈利预测高出15%,归功印尼业务取得更好的表现。

鲜果串产量料增20%

艾毕斯认为,该公司放眼2018财政年的鲜果串产量可走高20%,主要是来自印尼成熟及新种植地库的贡献,大马种植业务则维持现有表现不变。

此外,沙巴生物科技制造业务则专注改善产能使用率。

兴业研究表示,该公司种植成本从1420令吉走高至1600令吉,管理层期望可维持现有水平,至于产业业务税前盈利下滑19%,但名牌城则按年走高10%,预期名牌城业务来年成长率可取得15%至20%成长。

兴业预期,该公司2018及2019财政年的盈利可成长2至4%。

大众研究表示,该公司在印尼成熟地库为5万8000公顷,预期今年可再增加5000公顷成熟地库,2018财政年的资本开销料保持4亿1000万令吉。

联昌研究表示,该公司在2017财政年仅种植500公顷,是2007年以来最低的种植率,因种植需面对更严格的条例。值得一提的是,该公司的平均树龄平均为10.6年,未来有条件可生产更多的鲜果串。

联昌认为,该公司未来2年盈利可增加3%。

沙巴生物制造业务料转亏为盈

肯纳格研究表示,纳入该公司最近收购的12万9000公顷已种植地库,预期该公司2018及2019财政年的鲜果串产品产量成长为16%及6%,而沙巴的生物制造业务预期在更好的使用率下,可达到收支平衡,甚至转亏为盈。

肯纳格预期,在沙巴业务取得更好的表现,预期2018财政年的核心净利可走高9%至3亿5800万令吉,2019年则预期可获得4亿3400万令吉,成长幅度达21%。

艾芬黄氏研究看法较为谨慎,该公司需面对的风险包括经济成长低迷与消费蔬菜油量较高、原棕油价格走势、鲜果串产量及政策变动,因此维持原有盈利预测不变。

MIDF研究看好原棕油价格及鲜果串成长下,,该公司2018财政年的核心收入可达到3亿8500万令吉,2019财政年则为4亿零800万令吉。

丰隆研究看法最为悲观,认为原棕油生产成本高,再加上产业业务营运盈利较低,因此对该公司来年的盈利预测,调低3.7%及4.7%。

文章来源:

星洲日报‧财经‧报道:谢汪潮‧2018.02.27 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-3-2018 01:17 AM

|

显示全部楼层

| GENTING PLANTATIONS BERHAD |

EX-date | 05 Jun 2018 | Entitlement date | 07 Jun 2018 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single-Tier Dividend of 9.5 sen per ordinary share. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | GENTING MANAGEMENT AND CONSULTANCY SERVICES SDN BHD24th Floor, Wisma GentingJalan Sultan Ismail50250Kuala LumpurTel:03-21782266Fax:0321615304 | Payment date | 26 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 07 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.095 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-5-2018 04:30 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-5-2018 04:50 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 07:03 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 529,074 | 400,224 | 529,074 | 400,224 | | 2 | Profit/(loss) before tax | 130,610 | 107,358 | 130,610 | 107,358 | | 3 | Profit/(loss) for the period | 94,352 | 77,785 | 94,352 | 77,785 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 100,978 | 72,739 | 100,978 | 72,739 | | 5 | Basic earnings/(loss) per share (Subunit) | 12.57 | 9.13 | 12.57 | 9.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.3000 | 5.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-6-2018 05:51 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-7-2018 01:57 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-8-2018 03:07 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-8-2018 05:30 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 01:21 AM 编辑

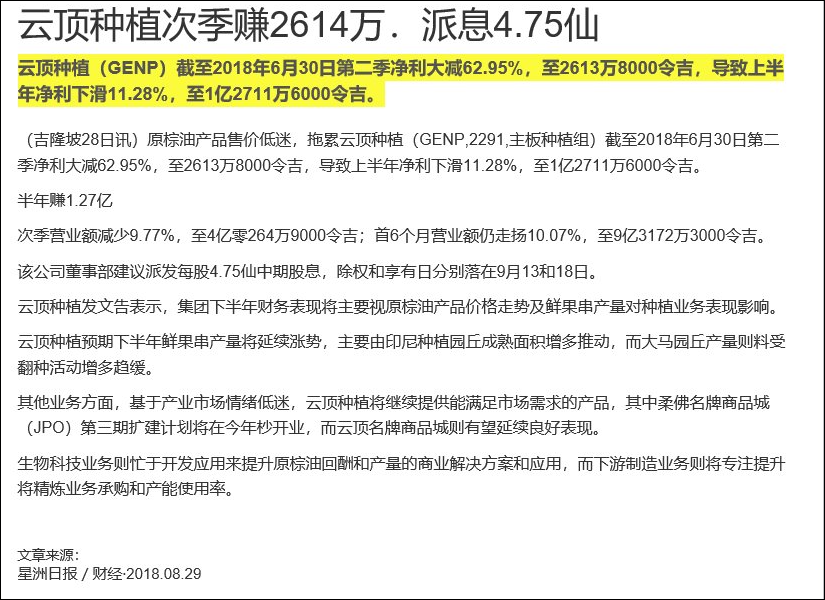

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 402,649 | 446,245 | 931,723 | 846,469 | | 2 | Profit/(loss) before tax | 37,203 | 103,213 | 167,813 | 210,571 | | 3 | Profit/(loss) for the period | 24,825 | 75,601 | 119,177 | 153,386 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 26,138 | 70,544 | 127,116 | 143,283 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.25 | 8.87 | 15.82 | 17.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 4.75 | 5.50 | 4.75 | 5.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.1900 | 5.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-8-2018 05:37 AM

|

显示全部楼层

EX-date | 13 Sep 2018 | Entitlement date | 18 Sep 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single-Tier Dividend of 4.75 sen per ordinary share. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | GENTING MANAGEMENT AND CONSULTANCY SERVICES SDN BHD24th Floor, Wisma GentingJalan Sultan Ismail50250 Kuala LumpurTel:03-21782266Fax:03-21615304 | Payment date | 08 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 18 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0475 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-12-2018 08:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-12-2018 07:23 AM

|

显示全部楼层

本帖最后由 icy97 于 8-1-2019 08:25 AM 编辑

棕榈产品价格下滑 云顶种植第三季净利大跌69%

Tan Xue Ying/theedgemarkets.com

November 29, 2018 18:58 pm +08

http://www.theedgemarkets.com/article/棕榈产品价格下滑-云顶种植第三季净利大跌69

(吉隆坡29日讯)棕榈产品价格下滑,拖累云顶种植(Genting Plantations Bhd)截至今年9月杪第三季净利按年狂泻69%至2350万令吉或每股2.93仙,上财年同季为7646万令吉或每股9.63仙。

下游制造业务改善及Indahpura项目销量上升,把营业额从4亿3389万令吉,按年推高12.7%至4亿8884万令吉。

现财年首9个月净利按年萎缩31.5%至1亿5063万令吉,上财年同期报2亿1974万令吉,营业额则按年上扬11%至14亿2000万令吉,上财年同期为12亿8000万令吉。

该集团表示,净利暴跌是因为棕榈产品价格持续下滑所致。该集团指出,这是因需求疲弱、库存增加及预期收成提高所造成。

“有鉴于此,平均原棕油价格分别跌至每吨2043令吉(2018财年第三季)及每吨2235令吉(从今年初至今)。”

“棕榈仁价格也分别降低至每吨1620令吉及1812令吉。”

该集团的鲜果串产量按年增加,归功于印尼收成提高,抵消了大马收成下滑所带来的影响。

基于产量呈上升趋势,因此该集团预计今年末季的产量将会增加。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 488,838 | 433,888 | 1,420,561 | 1,280,357 | | 2 | Profit/(loss) before tax | 25,084 | 108,164 | 192,897 | 318,735 | | 3 | Profit/(loss) for the period | 17,514 | 79,319 | 136,691 | 232,705 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 23,513 | 76,458 | 150,629 | 219,741 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.93 | 9.63 | 18.73 | 27.43 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 4.75 | 5.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.1300 | 5.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-1-2019 05:40 AM

|

显示全部楼层

Date of change | 01 Jan 2019 | Name | MR TAN KONG HAN | Age | 53 | Gender | Male | Nationality | Malaysia | Designation | Chief Executive Officer | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | MA | St. John's College, Cambridge | | | 2 | Others | Barrister-at-Law | Lincoln's Inn | | | 3 | Degree | BA | St. John's College, Cambridge | |

Working experience and occupation | Mr Tan Kong Han was appointed as the Deputy Chief Executive of Genting Plantations Berhad ("GENP") on 1 December 2010 prior to his appointment as Chief Executive and Executive Director of GENP on 1 January 2019. He is also the President and Chief Operating Officer of Genting Berhad, the Company's holding company. He has more than 13 years working experience in investment banking prior to joining Tanjong Public Limited Company as the Group Chief Operating Officer in 2003.He serves as a director of a variety of subsidiary companies within the Genting Berhad and Genting Plantations Berhad group. He is also a member of the Board of Trustees of Yayasan Genting and Yayasan Kebajikan Komuniti Malaysia, the Administrator of The Community Chest, Malaysia and the Managing Director of Pan Malaysian Pools Sdn Bhd as well as a director of Asian Centre for Genomics Technology Berhad and GB Services Berhad, both of which are public companies. | Directorships in public companies and listed issuers (if any) | Yayasan GentingYayasan Kebajikan Komuniti MalaysiaAsian Centre for Genomics Technology BerhadGB Services Berhad | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Mr Tan Kong Han holds 20,000 ordinary shares and 4,000 warrants in Genting Plantations Berhad. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-1-2019 05:54 AM

|

显示全部楼层

Date of change | 01 Jan 2019 | Name | MR LIM KEONG HUI | Age | 34 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Non Executive Director | New Position | Deputy Chief Executive Officer | Directorate | Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Master's Degree in International Marketing Management | Regent's Business School London, United Kingdom | | | 2 | Degree | Bachelor of Science (Honours) in Computer Science | Queen Mary University of London, United Kingdom | |

Working experience and occupation | Mr Lim Keong Hui was appointed as a Non-Independent Non-Executive Director of the Company on 23 November 2011 and was redesignated as a Non-Independent Executive Director, following his appointment as the Chief Information Officer ("CIO") of the Company on 1 January 2015. On 5 May 2017, he was redesignated as Non-Independent Non-Executive Director of the Company following his resignation as the CIO of the Company.He was also a Non-Independent Executive Director of Genting Berhad ("GENT") following his appointment as the Senior Vice President ("SVP") - Business Development on 1 March 2013 until he was redesignated as the Executive Director - Chairman's Office of GENT on 1 June 2013 and assumed additional role as the CIO on 1 January 2015. On 1 January 2019, he has been redesignated as Deputy Chief Executive and Executive Director of GENT. He has also been redesignated as Non-Independent Executive Director of Genting Malaysia Berhad ("GENM") following his appointment as the CIO of GENM on 1 January 2015. On 1 January 2019, he has been redesignated as Deputy Chief Executive and Executive Director of GENM. He is also a director of Genting UK Plc and a member of the Board of Trustees of Yayasan Lim Goh Tong.Prior to his appointment as the SVP - Business Development of GENT, he was the SVP - Business Development of Genting Hong Kong Limited ("GENHK") until he was redesignated as the Executive Director - Chairman's Office of GENHK following his appointment as an Executive Director of GENHK on 7 June 2013. He is currently the Executive Director - Chairman's Office and CIO of GENHK after taking up additional role of CIO of GENHK on 1 December 2014. Prior to joining GENHK in 2009, he had embarked on an investment banking career with The Hongkong and Shanghai Banking Corporation Limited. | Family relationship with any director and/or major shareholder of the listed issuer | Son of Tan Sri Lim Kok Thay, the Deputy Chairman and Executive Director and a major shareholder of Genting Plantations Berhad. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Mr Lim Keong Hui has deemed interests in 407,005,000 ordinary shares and 81,401,000 warrants of Genting Plantations Berhad ("GENP") by virtue of him being a beneficiary of discretionary trust of which Parkview Management Sdn Bhd ("PMSB") is the trustee. PMSB as trustee of the discretionary trust owns 100% of the voting shares of Kien Huat International Limited which in turn owns 100% of the voting shares in Kien Huat Realty Sdn Berhad ("KHR"). KHR owns more than 20% of the voting shares of Genting Berhad ("GENT") which owns these ordinary shares and warrants in GENP. As such, PMSB as trustee of the discretionary trust is deemed interested in the ordinary shares and warrants of GENP held by GENT as it is entitled to exercise or control the exercise of not less than 20% of the votes attached to the voting shares in GENT. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-1-2019 05:54 AM

|

显示全部楼层

Date of change | 01 Jan 2019 | Name | TAN SRI LIM KOK THAY | Age | 67 | Gender | Male | Nationality | Malaysia | Type of change | Redesignation | Previous Position | Chief Executive Officer | New Position | Deputy Chairman | Directorate | Executive |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science in Civil Engineering | University of London | |

Working experience and occupation | Tan Sri Lim Kok Thay is the Chief Executive and Director of the Company until he relinquished his position of Chief Executive and assumed the position of Deputy Chairman and Executive Director of the Company on 1 January 2019. He is the Chairman and Chief Executive of Genting Berhad and Genting Malaysia Berhad; and the Executive Chairman of Genting Singapore Limited and Genting UK Plc. He is the Chairman and Chief Executive Officer of Genting Hong Kong Limited ("GENHK"), a company listed on the Main Board of The Stock Exchange of Hong Kong Limited. He is also a Director of Travellers International Hotel Group, Inc., a company listed on the Main Board of The Philippine Stock Exchange, Inc. and an associate of GENHK.He joined the Genting Group in 1976 and has since served in various positions within the Group. He is a Founding Member and a Permanent Trustee of The Community Chest, Malaysia. He also sits on the Boards of other Malaysian and foreign companies as well as the Boards of Trustees of several charitable organisations in Malaysia. | Family relationship with any director and/or major shareholder of the listed issuer | Father of Mr Lim Keong Hui, the Deputy Chief Executive and Executive Director and a major shareholder of the Company. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Tan Sri Lim Kok Thay holds 369,000 ordinary shares and 73,800 warrants in Genting Plantations Berhad ("GENP").He has deemed interests in 407,005,000 ordinary shares and 81,401,000 warrants of GENP by virtue of him being a beneficiary of discretionary trust of which Parkview Management Sdn Bhd ("PMSB") is the trustee. PMSB as trustee of the discretionary trust owns 100% of the voting shares of Kien Huat International Limited which in turn owns 100% of the voting shares in Kien Huat Realty Sdn Berhad ("KHR"). KHR owns more than 20% of the voting shares of Genting Berhad ("GENT") which owns these ordinary shares and warrants in GENP. As such, PMSB as trustee of the discretionary trust is deemed interested in the ordinary shares and warrants of GENP held by GENT as it is entitled to exercise or control the exercise of not less than 20% of the votes attached to the voting shares in GENT. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-3-2019 07:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 482,338 | 528,417 | 1,902,899 | 1,808,774 | | 2 | Profit/(loss) before tax | 14,839 | 138,558 | 207,736 | 457,293 | | 3 | Profit/(loss) for the period | 10,262 | 109,182 | 146,953 | 341,887 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 14,269 | 115,348 | 164,898 | 335,089 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.78 | 14.53 | 20.50 | 41.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 8.25 | 20.50 | 13.00 | 26.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.1200 | 5.4000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-4-2019 05:47 AM

|

显示全部楼层

| GENTING PLANTATIONS BERHAD |

EX-date | 26 Jun 2019 | Entitlement date | 28 Jun 2019 | Entitlement time | 04:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single-Tier Dividend of 8.25 sen per ordinary share. | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Genting Management and Consultancy Services Sdn Bhd24th Floor, Wisma GentingJalan Sultan Ismail50250 Kuala LumpurTel: 03-21782266Fax: 03-21615304 | Payment date | 19 Jul 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 28 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0825 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-6-2019 05:44 AM

|

显示全部楼层

Expiry/Maturity of the securities| GENTING PLANTATIONS BERHAD |

Instrument Category | Securities of PLC | Instrument Type | Warrants | Type Of Expiry | Expiry/Maturity of the securities | Mode of Satisfaction of Exercise/Conversion price | Cash | Exercise/ Strike/ Conversion Price | Malaysian Ringgit (MYR) 7.7500 | Exercise/ Conversion Ratio | 1:1 | Settlement Type / Convertible into | Physical (Shares) | Last Date & Time of Trading | 28 May 2019 05:00 PM | Date & Time of Suspension | 29 May 2019 09:00 AM | Last Date & Time for Transfer into Depositor's CDS a/c | 10 Jun 2019 04:30 PM | Date & Time of Expiry | 17 Jun 2019 05:00 PM | Date & Time for Delisting | 18 Jun 2019 09:00 AM |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6159853

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|