|

|

楼主 |

发表于 6-4-2018 10:51 PM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-04042018-00001 | Subject | Acquisition of a 51% equity interest in SH Moment Builders Sdn Bhd (formerly known as Hong Seng Builder Sdn Bhd) (SH Moment) for a cash consideration of RM382,500 (Proposed Acquisition) | Description | Acquisition of a 51% equity interest in SH Moment Builders Sdn Bhd (formerly known as Hong Seng Builder Sdn Bhd) (SH Moment) for a cash consideration of RM382,500 (Proposed Acquisition) | Query Letter Contents | We refer to your Company’s announcement dated 3 April 2018 in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- - The terms of any arrangement for payment of the Purchase Consideration on a deferred basis.

- The Vendors’ date(s) of original investments in SH Moment.

- The net profits of SH Moment based on its latest audited financial statements.

- The effects of the Proposed Acquisition on the gearing of See Hup Consolidated Berhad group based on its latest audited financial statements.

- The prospects of SH Moment.

| Please refer to the attachment file for details of the announcement.

This announcement is dated 5 April 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5748797

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-6-2018 01:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,196 | 21,302 | 93,833 | 87,870 | | 2 | Profit/(loss) before tax | -352 | 389 | 1,884 | 88 | | 3 | Profit/(loss) for the period | -170 | 267 | 1,351 | -321 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -288 | 179 | 902 | -857 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.36 | 0.34 | 1.54 | -1.76 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.70 | 2.70 | 2.70 | 2.70 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5000 | 1.2694

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-8-2018 05:26 AM

|

显示全部楼层

本帖最后由 icy97 于 20-8-2018 02:41 AM 编辑

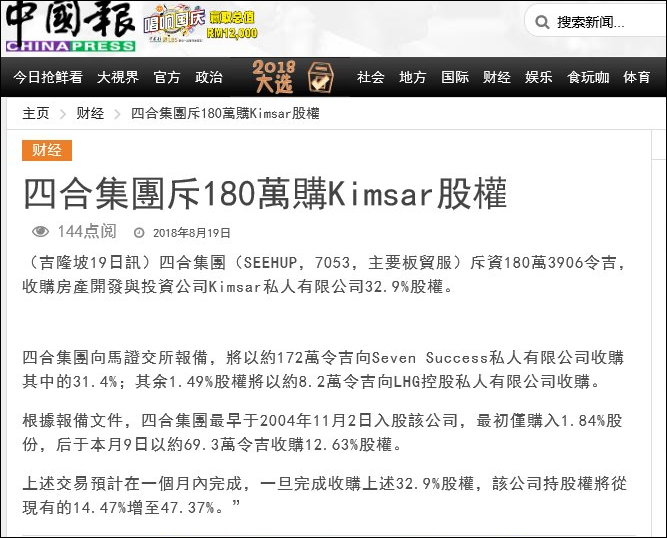

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

RELATED PARTY TRANSACTIONS | Description | SEE HUP CONSOLIDATED BERHAD ("SEE HUP" OR THE "COMPANY")ACQUISITION OF 32.9% EQUITY INTEREST IN KIMSAR SDN BHD FOR A TOTAL CASH CONSIDERATION OF RM1,803,906 ("THE ACQUISITION") | Please refer to the file attached herewith for details of the announcement.

This announcement is dated 17 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5887101

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-8-2018 04:52 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-21082018-00001 | Subject | Acquisition of 32.9% equity interest in Kimsar Sdn Bhd (Kimsar) for total cash consideration of RM1,803,906.00 (The Acquisition) | Description | SEE HUP CONSOLIDATED BERHAD ("SEE HUP" OR "THE COMPANY")Acquisition of 32.9% equity interest in Kimsar Sdn Bhd (Kimsar) for total cash consideration of RM1,803,906.00 (The Acquisition) | Query Letter Contents | We refer to your Company’s announcement dated 17 August 2018 in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- - The name of the independent registered valuer and method of valuation on the Property.

2. Proposed use of the Property. Where the Property is in the process of being developed or is intended to be developed, the following additional details: (a) the details of development potential, i.e. name of the project, type of development - residential, industrial or commercial, number of units in respect of each type of development; (b) the total development cost; (c) the expected commencement and completion date(s) of development; (d) the expected profits to be derived; (e) the stage or percentage of completion; (f) the sources of funds to finance the development cost; and (g) whether relevant approvals for the development have been obtained and date(s) obtained. 3. Quantification of the latest net assets of Kimsar which was based upon to arrive at the Purchase Consideration. 4. The original cost of investment in Kimsar by Seven Success Sdn Bhd and LHG Holdings Sdn Bhd respectively. | Please refer details for announcement.

This announcement is dated 23 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5891581

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-9-2018 06:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,645 | 20,469 | 22,645 | 20,469 | | 2 | Profit/(loss) before tax | -1,274 | -506 | -1,274 | -506 | | 3 | Profit/(loss) for the period | -1,525 | -531 | -1,525 | -531 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,529 | -630 | -1,529 | -630 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.90 | -1.21 | -1.90 | -1.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0751 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 2-1-2019 06:35 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 26,151 | 25,039 | 48,796 | 45,508 | | 2 | Profit/(loss) before tax | -1,225 | 753 | -2,499 | 247 | | 3 | Profit/(loss) for the period | -1,344 | 754 | -2,869 | 223 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -950 | 515 | -2,479 | -115 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.18 | 0.99 | -3.08 | -0.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0633 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-1-2019 07:18 AM

|

显示全部楼层

| SEE HUP CONSOLIDATED BERHAD |

EX-date | 10 Jan 2019 | Entitlement date | 14 Jan 2019 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Single-Tier Interim Dividend of 1.8 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Mar 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | PLANTATION AGENCIES SDN BERHAD3rd Floor, 2, Lebuh Pantai,10300 George Town, Penang.Tel:042625333Fax:042622018 | Payment date | 28 Jan 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 Jan 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 11-3-2019 04:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,665 | 24,129 | 73,461 | 69,637 | | 2 | Profit/(loss) before tax | -346 | 1,989 | -2,845 | 2,236 | | 3 | Profit/(loss) for the period | -886 | 1,298 | -3,735 | 1,521 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -599 | 1,305 | -3,078 | 1,190 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.74 | 2.47 | -3.83 | 2.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0379 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-7-2019 05:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 23,297 | 24,196 | 96,758 | 93,844 | | 2 | Profit/(loss) before tax | -1,522 | -352 | -4,367 | 1,830 | | 3 | Profit/(loss) for the period | -1,076 | -170 | -4,811 | 1,297 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -483 | -288 | -3,561 | 846 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.60 | -0.36 | -4.43 | 1.43 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.80 | 2.70 | 1.80 | 2.70 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0319 | 1.5000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-7-2019 05:21 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SEE HUP CONSOLIDATED BERHAD (SEE HUP OR THE COMPANY)SUBSCRIPTION BY SEE HUP OF 4,400,000 NEW ORDINARY SHARES IN ITS ASSOCIATE, MARUZEN SH LOGISTICS SDN. BHD. FOR A TOTAL CASH CONSIDERATION OF RM4,400,000 (THE SUBSCRIPTION) | Please refer to attachment for details of the announcement.

This announcement is dated 26 June 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6203777

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-8-2019 05:09 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 31-8-2019 04:49 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,849 | 22,645 | 22,849 | 22,645 | | 2 | Profit/(loss) before tax | -1,231 | -1,274 | -1,231 | -1,274 | | 3 | Profit/(loss) for the period | -1,313 | -1,525 | -1,313 | -1,525 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,041 | -1,529 | -1,041 | -1,529 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.29 | -1.90 | -1.29 | -1.90 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.0065 | 1.0194

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-3-2020 04:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 24,495 | 26,151 | 47,344 | 48,796 | | 2 | Profit/(loss) before tax | -1,175 | -1,225 | -2,406 | -2,499 | | 3 | Profit/(loss) for the period | -1,282 | -1,344 | -2,595 | -2,869 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -869 | -950 | -1,910 | -2,479 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.08 | -1.18 | -2.37 | -3.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9957 | 1.0194

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-4-2020 07:52 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2019 | 31 Dec 2018 | 31 Dec 2019 | 31 Dec 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 25,527 | 24,665 | 72,871 | 73,461 | | 2 | Profit/(loss) before tax | -994 | -346 | -3,400 | -2,845 | | 3 | Profit/(loss) for the period | -1,278 | -866 | -3,873 | -3,735 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,000 | -599 | -2,910 | -3,078 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.24 | -0.74 | -3.62 | -3.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9830 | 1.0194

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 11-10-2020 09:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2020 | 31 Mar 2019 | 31 Mar 2020 | 31 Mar 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,693 | 23,297 | 95,564 | 95,825 | | 2 | Profit/(loss) before tax | -3,971 | -1,522 | -7,371 | -4,375 | | 3 | Profit/(loss) for the period | -3,974 | -1,076 | -7,847 | -4,819 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -3,708 | -483 | -6,618 | -4,561 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.61 | -0.60 | -8.23 | -5.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 1.80 | 0.00 | 1.80 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9368 | 1.0194

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-1-2021 09:10 AM

|

显示全部楼层

本帖最后由 icy97 于 16-9-2021 11:05 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2020 | 30 Jun 2019 | 30 Jun 2020 | 30 Jun 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 13,544 | 22,849 | 13,544 | 22,849 | | 2 | Profit/(loss) before tax | -3,568 | -1,231 | -3,568 | -1,231 | | 3 | Profit/(loss) for the period | -3,721 | -1,313 | -3,721 | -1,313 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,912 | -1,041 | -2,912 | -1,041 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.64 | -1.29 | -3.64 | -1.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9048 | 0.9411

|

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2020 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2020 | 30 Sep 2019 | 30 Sep 2020 | 30 Sep 2019 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,856 | 24,495 | 31,400 | 47,344 | | 2 | Profit/(loss) before tax | -313 | -1,175 | -3,881 | -2,406 | | 3 | Profit/(loss) for the period | -600 | -1,282 | -4,321 | -2,595 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -316 | -869 | -3,228 | -1,910 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.39 | -1.08 | -4.03 | -2.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9008 | 0.9411

|

| SEE HUP CONSOLIDATED BERHAD |

Entitlement subject | Interim Dividend | Entitlement description | Single-Tier Interim Dividend of 1.17 sen per share | Ex-Date | 30 Dec 2020 | Entitlement date | 31 Dec 2020 | Entitlement time | 5:00 PM | Financial Year End | 31 Mar 2021 | Period |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 15 Jan 2021 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 31 Dec 2020 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0117 |

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | SEE HUP CONSOLIDATED BERHAD ("SEE HUP" OR "COMPANY")PROPOSED DISPOSAL | On behalf of the board of directors of See Hup (“Board”), Affin Hwang Investment Bank Berhad (“Affin Hwang IB”) wishes to announce that Limsa Ekuiti Sdn Bhd (“Limsa Ekuiti” or “Vendor”), a wholly-owned subsidiary of See Hup, had on 14 January 2021, entered into a conditional sale and purchase agreement (“SPA”) with Wangsaga Industries Sdn Bhd (“Wangsaga Industries”) and Tek Seng Properties & Development Sdn Bhd (“Tek Seng Properties”) (collectively referred to as the “Purchasers”) for the disposal of a parcel of industrial land formed by nine (9) adjoining lots (“Land”) and warehouse and structure erected thereon measuring approximately 853,863 square feet, held under Geran Mukim 996, 997, 998, 988, 989, 991, 992, 993 and 994, Lot Nos. 324, 640, 642, 1504, 1505, 1664, 1667, 1669 and 1702, all within Mukim 14, Daerah Seberang Perai Tengah, Negeri Pulau Pinang (“Property”) for a total cash consideration of RM46,962,465 (“Disposal Consideration”) (“Proposed Disposal”).

Please refer to the attachment for further details.

This announcement is dated 14 January 2021.

|

https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3121183

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-2-2022 01:01 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2021 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2021 | 30 Sep 2020 | 30 Sep 2021 | 30 Sep 2020 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 22,735 | 17,856 | 44,627 | 31,400 | | 2 | Profit/(loss) before tax | 25,417 | -313 | 23,484 | -3,881 | | 3 | Profit/(loss) for the period | 25,306 | -600 | 23,171 | -4,321 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 26,006 | -316 | 24,445 | -3,228 | | 5 | Basic earnings/(loss) per share (Subunit) | 32.49 | -0.39 | 30.54 | -4.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.80 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1936 | 0.8883

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-3-2022 08:48 AM

|

显示全部楼层

| SEE HUP CONSOLIDATED BERHAD |

Entitlement subject | Interim Dividend | Entitlement description | Single-Tier Second Interim Dividend of 1.80 sen per share | Ex-Date | 30 Dec 2021 | Entitlement date | 31 Dec 2021 | Entitlement time | 05:00 PM | Financial Year End | 31 Mar 2022 | Period |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 19 Jan 2022 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 31 Dec 2021 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0180 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-9-2023 01:32 PM

|

显示全部楼层

| SEE HUP CONSOLIDATED BERHAD |

Date of change | 19 Sep 2023 | Name | MR LEE HEAN HUAT | Age | 75 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Retirement |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information |

Working experience and occupation | | Family relationship with any director and/or major shareholder of the listed issuer | Mr. Lee Hean Huat is uncle of Mr. Lee Chor Min, the Group Managing Director.He is the sibling of the substantial shareholders of the Company, namely Dato' Lee Hean Guan, Mr. Lee Hean Beng, Mr. Lee Hean Teik and Mr. Lee Hean Seng. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | (1) Direct InterestHe holds 574,530 ordinary shares representing 0.723% equity interest of the Company.(2) Deemed InterestHe holds 12,601,994 ordinary shares representing 15.854% equity interest of the Company by virtue of his shareholdings in Hean Brothers Holdings Sdn Bhd pursuant to Section 8 of the Companies Act, 2016 and shares held in the name of spouse and children pursuant to Section 59(11)(c) of the Companies Act, 2016. |

Date of change | 19 Sep 2023 | Name | MR LAI YEW CHONG | Age | 51 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Advanced Diploma in Logistics Management | The Chartered Institute of Transport, United Kingdom | The Advanced Diploma above is declared by the Public Service Department of Malaysia as equivalent to a Bachelor Degree awarded by the Public Institutions of Higher Learning in Malaysia | | 2 | Others | Nil | The Society of Logisticians Malaysia | Member |

Working experience and occupation | Mr. Lai Yew Chong embarked on his professional journey in total logistics in 1993 when he joined Malaysia Airlines System as an Import & Export Cargo Officer. This initial role provided him with valuable experience and knowledge in the intricacies of logistics operations, laying the groundwork for his subsequent career progression in the field.Building upon his foundation, Mr. Lai transitioned to FM Global Logistics Sdn Bhd, where he served as a Sales Manager from 1994 to 1997. He was subsequently promoted to Penang Branch & Country Manager and later as General Manager, overseeing crucial aspects such as business directions, marketing strategies and corporate accounts.In 2015, Mr. Lai made a significant career move to join a subsidiary of See Hup Consolidated Berhad, where he plays a vital role in driving growth in both our air freight division and cross-border logistics between Malaysia and Thailand. | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | He holds 8.33% equity interest in SH Worldwide Logsitics Sdn. Bhd., a subsidiary of the Company |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|