|

|

【SEM 5250 交流专区】7-11大马控股

[复制链接]

[复制链接]

|

|

|

发表于 23-4-2018 02:51 AM

|

显示全部楼层

发表于 23-4-2018 02:51 AM

|

显示全部楼层

本帖最后由 icy97 于 10-5-2018 06:40 PM 编辑

EX-date | 07 May 2018 | Entitlement date | 14 May 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single-tier cash dividend of 2.7 sen per ordinary share | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN. BHD. Lot 06-03, Level 6, East Wing,Berjaya Times Square, No. 1, Jalan Imbi, 55100 Kuala Lumpur Tel: 03- 2145 0533 | Payment date | 22 May 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.027 | Par Value (if applicable) | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-4-2018 02:51 AM

|

显示全部楼层

发表于 23-4-2018 02:51 AM

|

显示全部楼层

本帖最后由 icy97 于 10-5-2018 06:38 PM 编辑

EX-date | 07 May 2018 | Entitlement date | 14 May 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single-tier dividend via a share dividend distribution of treasury shares on the basis of one (1) treasury share for every sixty (60) existing ordinary shares held. | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BERJAYA REGISTRATION SERVICES SDN. BHD. Lot 06-03, Level 6, East Wing,Berjaya Times Square, No. 1, Jalan Imbi, 55100 Kuala Lumpur Tel: 03-2145 0533 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 14 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 1 : 60 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-5-2018 04:55 AM

|

显示全部楼层

发表于 28-5-2018 04:55 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 535,688 | 522,528 | 535,688 | 522,528 | | 2 | Profit/(loss) before tax | 12,209 | 10,900 | 12,209 | 10,900 | | 3 | Profit/(loss) for the period | 8,933 | 8,005 | 8,933 | 8,005 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 8,933 | 8,005 | 8,933 | 8,005 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.80 | 0.72 | 0.80 | 0.72 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0747 | 0.0667

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2018 04:39 AM

|

显示全部楼层

发表于 11-8-2018 04:39 AM

|

显示全部楼层

本帖最后由 icy97 于 12-8-2018 03:05 AM 编辑

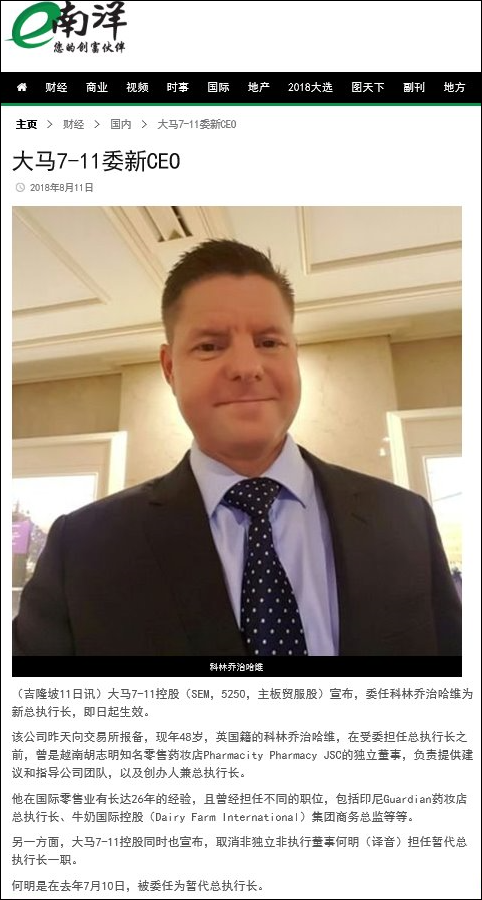

Date of change | 10 Aug 2018 | Name | MR COLIN GEORGE HARVEY | Age | 48 | Gender | Male | Nationality | United Kingdom | Type of change | Appointment | Designation | Chief Executive Officer | Qualifications | Mr. Colin George Harvey ("Mr. Colin") graduated from University of Sterling, UK with a Master of Business Administration (MBA). He obtained his Bachelor of Commerce in Management, Marketing and Human Resource from University of South Africa. | Working experience and occupation | Mr. Colin is a career retailer with total 26 years of experience through his various positions held in the international retail industry, as follows:1. Chief Executive of Guardian Pharmacy in Indonesia, Dairy Farm International Holdings Limited (September 2011 to November 2017)2. Group Commercial Director (Food Division), Dairy Farm International Holdings Limited (December 2008 to August 2011)3. Senior Merchandising Manager of Giant Hypermarket (Fresh Foods Division), Dairy Farm International Holdings Limited (December 2004 to December 2008)4. General Manager of Plentong Giant Hypermarket, Dairy Farm International Holdings Limited (January 2004 to December 2004)5. General Manager Hypermarket, Shoprite Checkers Group (2001 to 2003)6. National Produce Buyer, Shoprite Checkers Group (1999 to 2001)Prior to his appointment as Chief Executive Officer ("CEO") of 7-Eleven Malaysia Holdings Berhad, Mr. Colin served as an independent director of the Board of Pharmacity Pharmacy JSC, a retail pharmacy leader in Ho Chi Minh City, Vietnam, where his role was to advise and coach the pharmacity team and the founder CEO. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2018 04:40 AM

|

显示全部楼层

发表于 11-8-2018 04:40 AM

|

显示全部楼层

Date of change | 10 Aug 2018 | Name | MR HO MENG | Age | 58 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Others | Description | Cessation as Acting Chief Executive Officer | Qualifications | | Working experience and occupation | | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest: 91,500 ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 03:24 AM

|

显示全部楼层

发表于 31-8-2018 03:24 AM

|

显示全部楼层

本帖最后由 icy97 于 4-9-2018 04:43 AM 编辑

赚幅提高 7-Eleven次季净利升29%

Billy Toh/theedgemarkets.com

August 29, 2018 20:01 pm +08

(吉隆坡29日讯)7-Eleven控股(7-Eleven Malaysia Holdings Bhd)第二季净利跳升29.4%,主要由于盈利赚幅提高0.6%。

该集团今日向大马交易所报备,截至6月杪次季净利报1310万令吉,或每股1.17仙,高于上财年同期的1020万令吉,或每股0.91仙。

新店增长和更佳的消费者促销活动带动,季度营业额从5亿5520万令吉,微起0.44%至5亿5760万令吉。

该集团在2018财政年首半年取得2210万令吉的净利,较同期的1820万令吉,按年增长21.5%;营业额微升1.45%至10亿9000万令吉,一年前报10亿8000万令吉。

集团总执行长Collin Harvey在文告表示:“我们对于本季度的净利增长29.4%感到满意,单人位在一些关键指标方面仍有改进的空间。”

“我个人很高兴在两周前加入,我相信重点加强分类、供应链、卓越营运、商店和数字化组织等关键领域的策略路线图,将在财务表现和整体客户购物体验取得成果。”

展望未来,该集团董事部认为,考虑到消费者信心升高,下一季度的贸易环境可能有所改善。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 557,633 | 555,213 | 1,093,321 | 1,077,741 | | 2 | Profit/(loss) before tax | 18,331 | 13,837 | 30,540 | 24,737 | | 3 | Profit/(loss) for the period | 13,132 | 10,151 | 22,065 | 18,156 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 13,132 | 10,151 | 22,065 | 18,156 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.17 | 0.91 | 1.98 | 1.64 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0592 | 0.0667

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-9-2018 06:51 AM

|

显示全部楼层

发表于 8-9-2018 06:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | 7-Eleven Malaysia Holdings Berhad - Internal Reorganisation | 1.0 INTRODUCTION 1.1 The Board of Directors of 7-Eleven Malaysia Holdings Berhad (“SEM” or “the Company”) wishes to announce that SEM has undertaken an internal reorganisation within the SEM group of companies (“SEM Group”) (“Internal Reorganisation”) as follows:- (a) the acquisition by SEM of the entire 2,000,000 ordinary shares in Convenience Shopping (Sabah) Sdn. Bhd. (“CSSSB”), representing 100% of the issued and paid-up share capital of CSSSB (“CSSSB Shares”) from its wholly-owned subsidiary, 7-Eleven Malaysia Sdn. Bhd. (“7EMSB”) for a cash consideration of RM2,291,174 (“Acquisition”); and (b) the subscriptions by SEM (“Subscriptions”) of: (i) 15,000,000 new ordinary shares, representing 83.3% equity interest in the enlarged share capital of 18,000,000 ordinary shares in Teluk Juara Sdn. Bhd. (“TJSB”) for a cash consideration of RM15.0 million; and (ii) 7,000,000 new ordinary shares, representing 70.0% equity interest in the enlarged share capital of 10,000,000 ordinary shares in 7 Properties Sdn. Bhd. (“7PSB”) for a cash consideration of RM7.0 million. Prior to the Subscriptions, both TJSB and 7PSB were wholly-owned subsidiaries of 7EMSB.

2.0 DETAILS OF THE INTERNAL REORGANISATION 2.1 The Internal Reorganisation will enable SEM to have direct shareholding and control in CSSSB, TJSB and 7PSB. 2.2 The CSSSB Shares acquired free from all encumbrances, charges, pledges and liens whatsoever together with all rights attaching thereto. 2.3 The new TJSB and 7PSB shares issued pursuant to the Subscriptions shall rank pari passu in all respect with the existing ordinary shares of TJSB and 7PSB. 2.4 The Acquisition and the Subscriptions were funded from internally generated funds within the SEM Group. 2.5 Following the completion of the Internal Reorganisation:- (i) CSSSB has become a 100%-owned subsidiary of SEM; (ii) TJSB has become a 83.3% direct subsidiary of SEM and the remaining 16.7% equity interest is held by 7EMSB; and (iii) 7PSB has become a 70% direct subsidiary of SEM and the remaining 30% equity interest is held by 7EMSB. TJSB and 7PSB remain effectively 100%-owned subsidiaries of SEM.

3.0 RATIONALE FOR THE INTERNAL REORGANISATION 3.1 The Internal Reorganisation will streamline the business segments of the SEM Group for operating efficiencies.

4.0 EFFECTS OF THE INTERNAL REORGANISATION 4.1 The Internal Reorganisation has no effect on the issued share capital and substantial shareholders’ shareholdings of SEM. 4.2 The Internal Reorganisation also has no material effect on the earnings and net assets of the SEM Group for the current financial year ending 31 December 2018.

5.0 CONDITIONS OF THE INTERNAL REORGANISATION 5.1 The Internal Reorganisation is not subject to the approval of the shareholders of SEM or any relevant authorities.

6.0 DIRECTORS' AND MAJOR SHAREHOLDERS' INTERESTS 6.1 None of the Directors and major shareholders of SEM and/or persons connected with them have any interest, directly or indirectly, in the Internal Reorganisation.

7.0 STATEMENT BY DIRECTORS 7.1 Having considered all aspects of the Internal Reorganisation, the Board of Directors of SEM is of the opinion that the Internal Reorganisation is in the best interest of the Company.

This announcement is dated 7 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-9-2018 05:13 AM

|

显示全部楼层

发表于 10-9-2018 05:13 AM

|

显示全部楼层

本帖最后由 icy97 于 13-9-2018 06:11 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2018 06:32 AM

|

显示全部楼层

发表于 3-10-2018 06:32 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | 7-Eleven Malaysia Holdings Berhad ("the Company")- Proposed Acquisition of 60% Equity Interest in Café Decoral Sdn. Bhd. by Convenience Shopping (Sabah) Sdn. Bhd. | (Unless otherwise stated, definitions used in this announcement shall have the same meaning as defined in the Company's announcement dated 18 April 2018.)Reference is made to the Company's announcement dated 18 April 2018 in relation to the Proposed Acquisition, the Board of Directors of the Company wishes to inform that the Proposed Acquisition has been duly completed on 28 September 2018.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 07:36 AM

|

显示全部楼层

发表于 18-11-2018 07:36 AM

|

显示全部楼层

Name | DYMM SULTAN IBRAHIM JOHOR | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 05 Nov 2018 | 118,000,000 | Disposed | Direct Interest | Name of registered holder | DYMM Sultan Ibrahim Johor | Address of registered holder | Istana Pasir Pelangi, 80500 Johor Bahru, Johor Darul Takzim | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via direct business transaction. | Nature of interest | Direct Interest | Direct (units) | 57,242,833 | Direct (%) | 5.071 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 57,242,833 | Date of notice | 08 Nov 2018 | Date notice received by Listed Issuer | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2018 07:36 AM

|

显示全部楼层

发表于 18-11-2018 07:36 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)| 7-ELEVEN MALAYSIA HOLDINGS BERHAD |

Particulars of Substantial Securities HolderName | CLASSIC UNION GROUP LTD. | Address | Sea Meadow House, Blackburne Highway,

(P. O. Box 116), Road Town,

Tortola

Virgin Islands, British. | Company No. | 1035497 | Nationality/Country of incorporation | Virgin Islands, British | Descriptions (Class) | Ordinary shares | Name & address of registered holder | Classic Union Group Ltd.Sea Meadow House, Blackburne Highway, (P. O. Box 116), Road Town, Tortola, British Virgin Islands |

| Date interest acquired & no of securities acquired | Date interest acquired | 05 Nov 2018 | No of securities | 118,000,000 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares via direct business transaction. | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 118,000,000 | Direct (%) | 10.453 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 05 Nov 2018 | Date notice received by Listed Issuer | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-1-2019 07:05 AM

|

显示全部楼层

发表于 2-1-2019 07:05 AM

|

显示全部楼层

本帖最后由 icy97 于 11-1-2019 03:58 AM 编辑

大马7-11第三季赚1676万

http://www.enanyang.my/news/20181204/大马7-11第三季赚1676万/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 568,515 | 563,121 | 1,661,836 | 1,640,862 | | 2 | Profit/(loss) before tax | 22,197 | 19,203 | 52,737 | 43,940 | | 3 | Profit/(loss) for the period | 16,757 | 16,096 | 38,822 | 34,252 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 16,757 | 16,096 | 38,822 | 34,252 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.48 | 1.45 | 3.46 | 3.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0739 | 0.0667

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-1-2019 04:12 AM

|

显示全部楼层

发表于 11-1-2019 04:12 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 16-1-2019 04:59 AM

|

显示全部楼层

发表于 16-1-2019 04:59 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | 7-ELEVEN MALAYSIA HOLDINGS BERHAD ("THE COMPANY" OR "SEM") - CLARIFICATION ON THE ARTICLES IN THE STAR BIZ AND THE EDGE FINANCIAL DAILY | We refer to the following articles that were published in today’s the Star Biz newspaper and the Edge Financial Daily entitled:-

- Vincent Tan makes his move. Tycoon plans to take private 7-Eleven and BLand, list Mobile and hotel business;

- Vincent Tan to restructure his business empire. The plan may involve privatising 7-Eleven Malaysia Holdings and Berjaya Land.

The Board of Directors of 7-Eleven Malaysia Holdings Berhad (“SEM”) wishes to clarify that the SEM delisting plan mentioned in the above articles is the personal idea and strategies of Tan Sri Dato’ Seri Vincent Tan Chee Yioun who is the controlling major shareholder of SEM.

The Board of Directors of SEM is totally not aware of and has not deliberated any of the plans or proposals relating to the delisting of SEM.

This Announcement is dated 20 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-1-2019 12:30 PM

来自手机

|

显示全部楼层

发表于 17-1-2019 12:30 PM

来自手机

|

显示全部楼层

icy97 发表于 18-11-2018 07:36 AM

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities Holder

SEM昨晚公告,委任這間公司的代表進入董事局,我查了他名字發現竟然是台灣最大的國泰金控準接班人蔡宗翰。他們家族應該是台灣前三大富豪,是台灣國泰人壽及國泰世華銀行的大股東。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2019 10:46 PM

来自手机

|

显示全部楼层

发表于 18-1-2019 10:46 PM

来自手机

|

显示全部楼层

國泰少東蔡宗翰傳任大馬7-11獨董 與成功集團發展引揣測

2019-01-18 20:08經濟日報

記者葉憶如╱即時報導

據外電報導,國泰集團少東蔡宗翰元月16日起將擔任7-ELEVEn馬來西亞控股公司的獨立及非執行董事。由於大馬7-ELEVEn背後控股是馬來西亞前五大集團、亞洲富豪陳志遠擁有的「成功集團」,蔡宗翰將任新職務,是否國泰與成功二大集團未來有多種發展可能?引發市場揣測。公司發言人鄧崇儀指出,國泰金控本身無涉及此投資,目前尚無任何資訊。

據馬來西亞《每日太陽報》報導,42歲的蔡宗翰是國泰金旗下國泰世華銀行副董事長。他同時也是國泰人壽董事。7-ELEVEn馬來西亞控股公司已任命蔡宗翰擔任非獨立及非執行董事,2019年1月16日生效。

這次傳出蔡宗翰將任7-ELEVEn馬來西亞控股公司擔任獨董,最受關注的是其背後控股是馬來西亞前五大集團的「成功集團」,集團總裁陳志遠是馬來西亞拿督與亞洲重量級華裔企業家。

成功集團旗下包括7-11、麥當勞、星巴克、多家大型購物中心、吉隆坡成功集團時代廣場,40多個渡假村、建設公司、保險公司、物流等150餘家企業與十餘家上市公司。國泰集團與成功集團,未來是否攜手在馬來西亞或其他東南亞國家有進一步的合作,尤其國泰世華在新南向、東協布局已是國內民營銀行之首,未來動向備受矚目的焦點。

目前擔任國泰世華銀行副董的蔡宗翰,本人非常低調,在媒體面前絕不發言,一律以「謝謝」兩字回應,但近年來逐步協助集團年輕化,決策也講求效率與活潑,近來集團繳出不少亮眼成績,外界也大都習慣歸功於他,也一度傳出讓老父蔡宏圖有點意見。不過因為蔡宏圖多次表達希望讓公司「所有權跟經營權分開」,讓國泰金這個台灣首富集團的接班問題,屢屢成為市場熱議的話題,而對少主蔡宗翰未來的安排更是揣測紛紛。

蔡宗翰2015年加入國泰世華銀行擔任策略長,2016年成為副董事長,持續監督策略規劃、財富管理、數位銀行,數據分析,近來被冠以的亮眼成績單,最為人津津樂道的Cotsco聯名卡一戰,以租約換發卡權方式,從強勁對手中國信託銀行手中搶下發行權,也讓國泰世華與中國信託去年數度爭霸國內信用卡霸主寶座,同時2017年國泰世華銀拿下國內7-ELEVEN單行後,也鎖定全家便利商店及全聯超市進擊,除此之外,以國泰人壽資源投入高鐵桃園站產業專區開發、收購丹麥的資產管理公司股權等,也都讓市場留下深刻的印象。 |

|

|

|

|

|

|

|

|

|

|

|

发表于 2-2-2019 06:49 AM

|

显示全部楼层

发表于 2-2-2019 06:49 AM

|

显示全部楼层

Date of change | 16 Jan 2019 | Name | MR TSAI, TZUNG-HAN | Age | 42 | Gender | Male | Nationality | China | Designation | Non Executive Director | Directorate | Non Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Law | Georgetown University Law Center, U.S.A | | | 2 | Degree | Economics | Economics, Harvard University, U.S.A | |

Working experience and occupation | Mr. Tsai, Tzung-Han ("Mr. Tsai") is currently the Vice Chairman of Cathay United Bank, a subsidiary of Cathay Financial Holdings, a publicly listed company in Taiwan. He also serves as a director on the board of Cathay Life Insurance, the largest life insurer in Taiwan and also a subsidiary of Cathay Financial Holdings. After returning from the US in 2005, he served in various capacities at Cathay Life Insurance, including senior vice president in charge of alternative investments and executive vice president in charge of real estate acquisitions and development, human resources and strategic planning. He also ran the strategic planning department for Cathay Financial Holdings from 2010 until 2016 and oversaw the strategic investments into Bank Mayapada in Indonesia, Rizal Commercial Banking Corporation in Philippines and Conning Asset Management in the US. He joined Cathay United Bank in 2015 and served as the Head of Strategic Planning until he became the Vice Chairman in 2016, where he continues to oversee the strategic planning, wealth management, digital banking, data analytics and overseas banking departments.Prior to returning to Taiwan, Mr. Tsai worked briefly in private equity at Goldman Sachs in New York and in venture capital at Pacific Venture Partners in San Francisco. From 2001 until 2003, he was a practicing attorney in the real estate department at Hale and Dorr LLP, currently known as Wilmer Hale, in Boston.Mr. Tsai has over ten (10) years experience in investment and business development in finance industry. | Directorships in public companies and listed issuers (if any) | NIL | Family relationship with any director and/or major shareholder of the listed issuer | NIL | Any conflict of interests that he/she has with the listed issuer | NIL | Details of any interest in the securities of the listed issuer or its subsidiaries | Indirect Interest: 138,500,000 ordinary shares |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-3-2019 06:43 AM

|

显示全部楼层

发表于 3-3-2019 06:43 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 554,263 | 546,240 | 2,216,099 | 2,187,102 | | 2 | Profit/(loss) before tax | 21,122 | 26,556 | 73,859 | 70,496 | | 3 | Profit/(loss) for the period | 12,508 | 15,855 | 51,330 | 50,107 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 12,485 | 15,855 | 51,307 | 50,107 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.11 | 1.43 | 4.57 | 4.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.0822 | 0.0667

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-4-2019 06:41 AM

|

显示全部楼层

发表于 8-4-2019 06:41 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)| 7-ELEVEN MALAYSIA HOLDINGS BERHAD |

Particulars of Substantial Securities HolderName | BERJAYA ASSETS BERHAD | Address | Lot 13-01A, Level 13 (East Wing),

Berjaya Times Square, No. 1 Jalan Imbi,

Kuala Lumpur

55100 Wilayah Persekutuan

Malaysia. | Company No. | 3907-W | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary shares | Date of cessation | 26 Mar 2019 | Name & address of registered holder | Berjaya Times Square Sdn. Bhd.Lot 08-16, Level 8,Berjaya Times Square,No. 1, Jalan Imbi,55100 Kuala Lumpur. |

No of securities disposed | 17,700,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Cessation as a substantial shareholder following the disposal of shares via direct deal. | Nature of interest | Deemed Interest |  | Date of notice | 26 Mar 2019 | Date notice received by Listed Issuer | 27 Mar 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-4-2019 05:15 AM

|

显示全部楼层

发表于 10-4-2019 05:15 AM

|

显示全部楼层

Name | CLASSIC UNION GROUP LTD. | Address | Sea Meadow House, Blackburne Highway,

(P.O. Box 116), Road Town,

Tortola

Virgin Islands, British. | Company No. | 1035497 | Nationality/Country of incorporation | Virgin Islands, British | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 26 Mar 2019 | 20,000,000 | Acquired | Direct Interest | Name of registered holder | Classic Union Group Ltd. | Address of registered holder | Sea Meadow House, Blackburne Highway, (P.O. Box 116), Road Town, Tortola, British Virgin Islands. | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Acquisitions of shares. | Nature of interest | Direct Interest | Direct (units) | 206,500,000 | Direct (%) | 18.292 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Total no of securities after change | 206,500,000 | Date of notice | 28 Mar 2019 | Date notice received by Listed Issuer | 28 Mar 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|