|

|

楼主 |

发表于 28-9-2015 10:22 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2015 | 31 Jul 2014 | 31 Jul 2015 | 31 Jul 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 115,475 | 123,347 | 485,950 | 487,299 | | 2 | Profit/(loss) before tax | 1,933 | 3,200 | 9,962 | 11,386 | | 3 | Profit/(loss) for the period | 3,759 | 3,020 | 10,546 | 9,791 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,967 | 2,992 | 10,316 | 9,498 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.31 | 2.49 | 8.60 | 7.92 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.25 | 2.25 | 2.25 | 2.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7400 | 0.6700 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-9-2015 10:23 PM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | A-RANK BERHAD ("A-RANK" OR "THE COMPANY") - PROPOSED FIRST AND FINAL SINGLE TIER DIVIDEND OF 2.25 SEN PER ORDINARY SHARE OF RM0.50 EACH IN RESPECT OF THE FINANCIAL YEAR ENDED 31 JULY 2015. | The Board of Directors of A-Rank is pleased to propose a first and final single tier dividend of 2.25 sen per ordinary share of RM0.50 each in respect of the financial year ended 31 July 2015. The proposed dividend is subject to the approval of shareholders at the annual general meeting to be held on a date which shall be announced later. The date of payment of the dividend and the date for the determination of dividend entitlement would also be announced later.

This announcement is dated 28 September 2015. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-9-2015 10:31 PM

|

显示全部楼层

发表于 28-9-2015 10:31 PM

|

显示全部楼层

本帖最后由 icy97 于 29-9-2015 12:03 AM 编辑

递延纳税多缴付税款 亿能末季净利劲扬32.8%

By Yimie Yong / theedgemarkets.com | September 28, 2015 : 9:06 PM MYT

http://www.theedgemarkets.com/my/article/递延纳税多缴付税款-亿能末季净利劲扬328

(吉隆坡28日讯)铝合金棒(Aluminum billets)制造商亿能(A-Rank Bhd ( Valuation: 3.00, Fundamental: 0.90))截至7月杪的2015财年末季净利劲扬32.8%至398万令吉,上财年净赚299万令吉。

亿能向大马交易所报备指出,由于之前几年因递延纳税而多缴付税款,其末季净利才会增加。

亿能的每股盈利也由2.49仙,增加至3.31仙。

不过,亿能的末季营业额则按年下跌6.4%至1亿1548万令吉,上财年末季的营业额报1亿2335万令吉。

文告指出,尽管原料成本增加致使平均售价提高,惟业务量走低,营业额也跟着减少。

同时,亿能也建议派发每股2.25仙的首次和终期单层股息,相等于270万令吉。

综合2015财年的业绩表现,亿能净赚1032万令吉,上财年净利为950万令吉,涨幅为8.63%;营业额则持平于4亿8595万令吉,上财年同期营业额报4亿8730万令吉。

亿能表示,铝价和令吉走弱对盈利赚幅构成不利影响,而天然气价格上涨也促使赚幅受压。

“尽管如此,我们仍时刻保持警觉,准备就绪以应对市场波动和未来的挑战。像往常一样,我们将着重于提高成本效益,以减低对业务构成的不利影响。”

闭市时,亿能起0.5仙或1.1%,收报于46仙,市值为5520万令吉。 |

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-11-2015 05:28 AM

|

显示全部楼层

EX-date | 08 Dec 2015 | Entitlement date | 10 Dec 2015 | Entitlement time | 04:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 2.25 sen per ordinary share in respect of the financial year ended 31 July 2015 | Period of interest payment | to | Financial Year End | 31 Jul 2015 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHDLot 10, The Highway CentreJalan 51/20546050Petaling JayaTel:0377843922Fax:0377841988 | Payment date | 22 Dec 2015 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 10 Dec 2015 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit | 10 Dec 2015 | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0225 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-12-2015 09:08 PM

|

显示全部楼层

本帖最后由 icy97 于 10-12-2015 05:54 PM 编辑

亿能首季赚373万

财经新闻 财经 2015-12-10 13:05

(吉隆坡9日讯)销量减少,亿能(ARANK,7214,主板工业产品股)成功提高营运赚幅,让截至10月31日的首季净利,从去年同期的264万9000万令吉,年增40.7%,至372万6000令吉。

该季营业额从去年同期的1亿2980万4000令吉,减少2%至1亿2722万3000令吉。【南洋网财经】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2015 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2015 | 31 Oct 2014 | 31 Oct 2015 | 31 Oct 2014 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 127,223 | 129,804 | 127,223 | 129,804 | | 2 | Profit/(loss) before tax | 4,315 | 3,204 | 4,315 | 3,204 | | 3 | Profit/(loss) for the period | 3,745 | 2,752 | 3,745 | 2,752 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,726 | 2,649 | 3,726 | 2,649 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.11 | 2.21 | 3.11 | 2.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.7400

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-2-2016 03:30 AM

|

显示全部楼层

Name | A-RANK GROUP SDN. BHD. | Address | Chamber E, Lian Seng Courts, 275 Jalan Haruan 1, Oakland Industrial Park

Seremban

70200 Negeri Sembilan

Malaysia. | NRIC/Passport No/Company No. | 445273-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary shares of RM0.50 each | Name & address of registered holder | A-Rank Group Sdn. Bhd. Chamber E, Lian Seng Courts275 Jalan Haruan 1, Oakland Industrial Park70200 Seremban, N.S.D.K |

Details of changesCurrency: Malaysian Ringgit (MYR) | Type of transaction | Description of Others | Date of change | No of securities

| Price Transacted (RM)

| | Disposed | Ordinary Shares | 16 Feb 2016 | 31,790,991

| 0.600

|

Circumstances by reason of which change has occurred | Disposal of shares | Nature of interest | Direct | Direct (units) | 6,000,000 | Direct (%) | 5 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 6,000,000 | Date of notice | 16 Feb 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 17-2-2016 03:34 AM

|

显示全部楼层

本帖最后由 icy97 于 18-2-2016 04:38 PM 编辑

廖忠华1907万购亿能26.49%

财经新闻 财经 2016-02-18 09:02

(吉隆坡17日讯)廖兄弟制铝厂(LB Aluminium Berhad)执行主席拿督廖忠华,通过旗下的City Data公司,崛起成为亿能(ARANK,7214,主板工业产品股)大股东。

根据文告,City Data公司在周二(16日),以每股6仙的价格,向亿能董事经理陈万磊(译音)购入3179万991股或26.49%股权,成为公司大股东。

这宗交易总值1907万4594.60令吉,而陈万磊卖出这批股权后,持股率已降低至600万股或5%。

廖忠华已通过City Data公司,间接持有亿能的3329万991股,相等于27.74%股权。【南洋网财经】

Notice of Interest Sub. S-hldr (29A)Particulars of Substantial Securities HolderName | CITY DATA LIMITED | Address | P.O Box 957

Offshore Incorporation Centre

Road Town Tortola

Virgin Islands, British. | NRIC/Passport No/Company No. | 1886291 | Nationality/Country of incorporation | Virgin Islands, British | Descriptions (Class & nominal value) | Ordinary shares of RM0.50 each. | Name & address of registered holder | CITY DATA LIMITEDRoad TownOffshore Incorporation CentreTortolaVirgin Islands, British |

| Date interest acquired & no of securities acquired | Currency |

| | Date interest acquired | 16 Feb 2016 | No of securities | 31,790,991 | Circumstances by reason of which Securities Holder has interest | Acquisition of shares through off market. | Nature of interest | Direct | Price Transacted ($$) |

|

| | Total no of securities after change | Direct (units) | 31,790,991 | Direct (%) | 26.492 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Date of notice | 16 Feb 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-3-2016 11:23 AM

|

显示全部楼层

发表于 13-3-2016 11:23 AM

|

显示全部楼层

本帖最后由 icy97 于 13-3-2016 12:06 PM 编辑

億能和廖兄弟製鋁協同效益大

2016-03-13 09:04

http://biz.sinchew.com.my/node/132937?tid=6

(吉隆坡12日訊)將億能(ARANK,7214,主板工業產品組)和廖兄弟製鋁(LBALUM,9326,主板工業產品組)相提並論,許多人或許不會發現箇中關聯;然而,其實兩家鋁業公司如今已擁有共同大股東,即低調的本地企業家拿督廖忠華。

廖忠華為2鋁業公司共同大股東

上個月,現年57歲廖忠華崛起成億能最大股東,控制了27.74%股權。資料顯示,廖忠華也持有廖兄弟製鋁30.17%股權,同時是公司執行主席。

億能官方網站資料顯示該公司是國內最大的鋁坯製造和供應商,也是亞洲領先的壓制鋁製品供應商。廖兄弟製鋁則自稱是大馬最大壓制鋁製品供應商,也是東南亞最大的製造商之一。

考慮到兩家公司都自稱是區域最大業者,廖忠華所掌握的盤算,和兩家公司之間的潛在協同效益,相信非常有趣。

鋼鐵領域專家稱,廖兄弟製鋁可以向億能採購鋁坯,用作壓制鋁製品的生產原料。

一家鋼鐵公司的代表則表示,廖忠華同時掌握億能和廖兄弟製鋁的控制性股權,生意角度來看非常合理,因為兩家公司業務能夠互補。

“透過向億能採購鋁坯,廖兄弟製鋁能夠享有穩定和具競爭力的原料供應,另一方面,億能則會因迎來穩定訂單而雀躍。”

分析員認為,兩家公司的合作也能降低供應鏈上的潛在風險,避免面對來自供應商的漲價壓力,尤其是一些議價能力偏高的供應商。

不過,億能和廖兄弟製鋁至今未回答《The Edge》所提出的問題。

資料顯示,廖忠華是在2月期間,耗1千907萬令吉向億能原有最大股東陳萬利(譯音)買下26.49%股權,相當於每股60仙,崛起成最大股東。

不過,在廖忠華入股後,仍掌握億能9.68%股權的陳萬利,將繼續擔任董事經理。

有趣的是,陳萬利之前曾是廖忠華的同事,更精確地說,曾是廖忠華的員工。

億能年報顯示陳萬利在壓制鋁製品領域擁有20年經驗,他在1986年加入廖兄弟製鋁,擔任生產部經理,直到1993年才離開。(星洲日報/財經‧The Edge專版)

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 23-3-2016 03:09 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2016 | 31 Jan 2015 | 31 Jan 2016 | 31 Jan 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 128,075 | 122,756 | 255,298 | 252,560 | | 2 | Profit/(loss) before tax | 4,064 | 2,725 | 8,379 | 5,929 | | 3 | Profit/(loss) for the period | 3,313 | 2,282 | 7,058 | 5,034 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,423 | 2,163 | 7,149 | 4,812 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.85 | 1.80 | 5.96 | 4.01 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7800 | 0.7400

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 22-4-2016 04:14 AM

|

显示全部楼层

Date of change | 21 Apr 2016 | Name | DATUK LEOW CHONG HOWA | Age | 57 | Nationality | Malaysia | Designation | Non Executive Director | Directorate | Non Independent and Non Executive | Type of change | Appointment | Qualifications | Businessman | Working experience and occupation | He is the Executive Chairman of LB Aluminium Berhad. Prior to assuming his current position, he was the Managing Director of LB Aluminium Berhad since its incorporation in 1985. | Directorship of public companies (if any) | LB Aluminium Berhad | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Datuk Leow Chong Howa's interests in A-Rank Berhad are as follows:a) Direct Interest: 22,500 ordinary shares of RM0.50 each.b) Indirect interest: 33,313,491 ordinary shares of RM0.50 each. The details of Indirect interest are held as follows:-i) 1,500,000 ordinary shares of RM0.50 each through LB Aluminium Berhad pursuant to Section 6A of the Companies Act 1965;ii) 22,500 ordinary shares of RM0.50 each through spouse, Lim Siew Fah pursuant to Section 6A of the Companies Act 1965; andiii) 31,790,991 ordinary shares of RM0.50 each through City Data Limited pursuant to Section 6A of the Companies Act 1965. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-6-2016 12:33 AM

|

显示全部楼层

发表于 28-6-2016 12:33 AM

|

显示全部楼层

本帖最后由 icy97 于 28-6-2016 01:03 AM 编辑

【亿能高升】- 浅谈ARANK(7214), 盈利YOY进步116%,PE= 6.32!

Monday, June 27, 2016

Aluminium的价格在最近几个月开始回弹,而PMETAL的股价更是因为这样儿突破了52周新高,今年上涨了60%之多。而LBALUM以及ARANK都身处Aluminium- 铝的领域,这个月公布的盈利YOY分别上涨了123%以及116%。

Aluminium的的价格从2015年11月底谷的1435, 一度上涨到4越月底的1,673左右,而这几天的价格也站稳在1,600左右。总体而言,Aluminium的需求以及价格很大可能会在2016年回扬,因此以上几家公司都可以多多注意。ARANK的盈利刚刚出炉,在这里跟大家分享ARANK的一些功课。

- ARANK的营业额相比上个季度下跌了10.45%,但是YOY却上涨了116%。

- 大家仔细看的话会发现ARANK的EPS已经连续4个季度都在下跌,这到底是为什么呢?让笔者跟大家解释解释。

- 大家仔细看2015Q4的PBT是1.933 mil,可是PAT却变成了3.967 mil,这是因为overprovision of deferred taxation in prior years。因此这个季度的EPS有高达2 mil以上的水分存在。

- 而FY16Q1的时候,Net profit里面有0.7 mil是insurance claim,所以Operating profit大约只有3.0 mil左右。

- 因此FY16Q2才是这5年来盈利最高的一个季度,而当时的铝价也不理想,这主要都归功于更高的销售额。

- 今天公布的盈利是3.321 mil,比上个季度下跌了2.98%,主要是因为营业额下跌。

- 不过大家仔细看Net Profit Margin的话,这个季度2.9%的才是最高的一次,因为完全没有参杂任何的水分(例如Insurance clain或其他等)。

- 而美金在最近两个季度开始回调,所以过去两个季度都蒙受外汇亏损。而在最新的3个季度里,外汇盈利只有RM22,000,也证明公司不会被外汇影响太多。

- 而公司的现金也有了很大的进步,从FY15Q1的7.271 mil增加到现在的19.728 mil。而Total borrowing也从FY15Q1的57.364 mil减少到现在的23.47 mil。

- 无论是现金以及债务都有了非常大的改善,现在的Net debt = 3.742 mil,相信下个季度就可以变成Net cash公司。

- 最后,公司的D/E ratio也处于0.24的健康水平,所基本面来看这家公司是非常不错的。

从上图我们可以看到公司的盈利已经连续4年进步,FY2016在短短3个季度的盈利就超越了去年,只要下个季度的盈利可以保持2.5 - 3.0 mil, 那么盈利就可以突破公司上市以来的历史新高。最难能可贵的是,过往5年铝价都处于低迷,但是ARANK的盈利却能稳健的增长,这都得归功于管理层优良的成本控制。

此外,大家也可以看到ARANK的Profit Margin也是5年来的高点,相信铝价走高将会提高ARANK的毛利率。

从上图我们可以看到,公司将会因为raw material cost增加而导致average selling price上升。5月1号 - 今天的平均Aluminium price大约是1,572左右,这比FY16Q3的1,543上升了接近2%,这对ARANK来说将会是利好消息。

公司现在的PE = 6.32, NTA 大过股价,ROE超过15,Dividend yield大约是2.96%。总体而言是属于安全地带,估值也不贵。长期而言,公司的股价或许会有惊喜。

以上纯属分享,买卖自负。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-6-2016 03:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2016 | 30 Apr 2015 | 30 Apr 2016 | 30 Apr 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 114,689 | 117,915 | 369,987 | 370,475 | | 2 | Profit/(loss) before tax | 3,491 | 2,100 | 11,870 | 8,029 | | 3 | Profit/(loss) for the period | 3,003 | 1,753 | 10,061 | 6,787 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,321 | 1,537 | 10,470 | 6,349 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.77 | 1.28 | 8.73 | 5.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8000 | 0.7400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2016 12:17 AM

|

显示全部楼层

发表于 30-9-2016 12:17 AM

|

显示全部楼层

本帖最后由 icy97 于 30-9-2016 12:32 AM 编辑

ARANK(7214) 提升为Net Cash公司,全年EPS = 13.2仙,派发3仙股息!

Wednesday, September 28, 2016

http://harryteo.blogspot.my/2016/09/1352-arank7214-net-casheps-1323.html

笔者一直有追踪的ARANK(7214)今天公布了非常出色的盈利,EPS=4.47仙是历史新高。最难能可贵的是,公司终于转为净现金公司,因此派发了3仙的股息,比去年的2.25仙相比足足进步了33%之多。今年是钢铁之年,而铝业也拥有不错的表现,下面的图表是ARANK最近几个季度的分析。

- 虽然ARANK的营业额跟上季相比小幅度下跌了0.65%,但是Net Profit按年比较上涨了35%,而且5.368 mil的净利更是历史新高。

- 虽然汇率下跌了0.06%,但是公司却有0.691 mil的外汇盈利,比上个季度的0.533 mil外汇亏损进步了1.224 mil。

- 3个月前笔者预计ARANK将会在这个季度转变成Net Cash也终于实现,公司现在手握25.261 mil的现金以及22.312 mil的债务。债务减低了1.158 mil的同时,现金也增加了5.533 mil。

- 因此公司现在的Net Cash = 2.949 mil,相当于2.46仙。在盈利进步的情况下,ARANK公布了3仙的股息,比笔者预期的2.5仙高了不少。

- Gearing Ratio从0.24降低到0.22,NTA更是从0.80进步到0.85。整体而言,ARANK这个季度表现是非常出色的。

公司的Net Profit Margin从去年的2.1%进步到3.3%,这也是为什么盈利会在营业额下跌的情况下进步。ARANK交出历史新高的15.838 mil Net Profit,比去年进步了53.53%。

公司的盈利上涨主要是因为更高的毛利率,因为Aluminium的价格在FY2016Q4比Q3进步了不少。

上图是ALUMINIUM每个月的平均价格,4-7月平均价格是USD1,597.48, 比1-4月的USD1,543.22上涨了3.52%。这很可能是导致Core Earning Profit Margin上涨的主因。

公司展望未来会努力提升成本控制以及努力克服障碍,并在下个财政年继续为公司创造盈利。

大家仔细留意的话,公司这个季度因为过去几年Overprovision of deffered tax获得了1.805 mil的Income tax回扣。这也是导致Net Profit比Profit Before Tax高的原因。此外,出口的Special export Incentive也是拉低税务的主因。

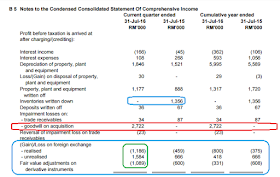

假设大家担心ARANK是因为Off gain而导致盈利大涨,那么大家要仔细留心阅读它的Income stamement。因为这个季度有2.722 mil的Impairment losses on goodwill on acquisition,这只是一次性的折损。而上个财政年有1.356的Inventories written down也是拉低去年盈利的主因之一。

ARANK的PBT是3.544 mil,而Impairment loss是2.722 mil,还有0.691 mil的Forex Gain。

假设Exclude了这个季度的Impairment以及外汇盈利,ARANK的Core Profit Before Tax将会是:

3.544 + 2.722 - 0.691 = 5.575 mil.

假设正常的Corporate Tax是24%, 那么ARANK的Net Profit :

5.575 mil x 0.76 = 4.237 mil.

因此从Core Profit的角度来计算,ARANK这个季度是靠实力赚到新高的盈利。在业绩公布之前,ARANK的PE = 7.77, 业绩出炉后就变成7.08。

净现金 + 3仙股息 + 低PE = ???

公司的股价表现就交给市场先生决定吧。

以上纯属分享,买卖请自负。

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-10-2016 05:27 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2016 | 31 Jul 2015 | 31 Jul 2016 | 31 Jul 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 113,857 | 115,475 | 483,844 | 485,950 | | 2 | Profit/(loss) before tax | 3,544 | 1,933 | 15,414 | 9,962 | | 3 | Profit/(loss) for the period | 5,349 | 3,759 | 15,410 | 10,546 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,368 | 3,967 | 15,838 | 10,316 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.47 | 3.31 | 13.20 | 8.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 2.25 | 3.00 | 2.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8500 | 0.7400

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 1-10-2016 05:28 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FIRST AND FINAL SINGLE TIER DIVIDEND | The Board of Directors of A-Rank Berhad ("the Company") is pleased to propose a First and Final Single Tier Dividend of 3.00 sen per ordinary share of RM0.50 each in respect of the financial year ended 31 July 2016 for the approval of the shareholders at the forthcoming Annual General Meeting of the Company. The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly.

This announcement is dated 28 September 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-10-2016 05:46 AM

|

显示全部楼层

Particulars of Substantial Securities HolderName | A-RANK GROUP SDN. BHD. | Address | Chamber E, Lian Seng Courts

275 Jalan Haruan 1

Oakland Industrial Park

Seremban

70200 Negeri Sembilan

Malaysia. | Company No. | 445273-M | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary shares of RM0.50 each. | Date of cessation | 06 Oct 2016 | Name & address of registered holder | A-RANK GROUP SDN. BHD.Chamber E, Lian Seng Courts275 Jalan Haruan 1Oakland Industrial Park 70200, Seremban, Negeri Sembilan |

Currency |

| | No of securities disposed | 3,000,000 | Price Transacted ($$) |

| | Circumstances by reason of which Securities Holder has interest | Transfer of shares. | Nature of interest | Direct |

| Date of notice | 06 Oct 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-10-2016 05:47 AM

|

显示全部楼层

Name | MR TAN WAN LAY | Nationality/Country of incorporation | Malaysia | Descriptions (Class & nominal value) | Ordinary shares of RM0.50 each. | Name & address of registered holder | (1) TAN WAN LAYNo. 93, Kampung Baru Pajam 71700 MantinNegeri Sembilan Darul Khusus(2) A-RANK GROUP SDN. BHD.Chamber E, Lian Seng Courts275 Jalan Haruan 1Oakland Industrial Park 70200, Seremban, Negeri Sembilan |

Details of changesCurrency: Malaysian Ringgit (MYR) | Type of transaction | Description of Others | Date of change | No of securities

| Price Transacted ($$)

| | Transferred | | 06 Oct 2016 | 3,000,000

| 0.850

|

Circumstances by reason of which change has occurred | Transfer of 3,000,000 shares from indirect interest to direct interest. | Nature of interest | Direct and Indirect | Direct (units) | 8,619,000 | Direct (%) | 7.183 | Indirect/deemed interest (units) | 3,000,000 | Indirect/deemed interest (%) | 2.5 | Total no of securities after change | 11,619,000 | Date of notice | 06 Oct 2016 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-11-2016 02:09 AM

|

显示全部楼层

EX-date | 06 Dec 2016 | Entitlement date | 08 Dec 2016 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 3.00 sen per ordinary share of RM0.50 each in respect of the financial year ended 31 July 2016. | Period of interest payment | to | Financial Year End | 31 Jul 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Bina Management (M) Sdn BhdLot 10, The Highway CentreJalan 51/20546050 Petaling JayaSelangor Darul EhsanTelephone: 03-7784 3922Fax: 03-7784 1988 | Payment date | 21 Dec 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 08 Dec 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-12-2016 05:09 AM

|

显示全部楼层

本帖最后由 icy97 于 18-12-2016 05:38 AM 编辑

亿能首季赚466万

2016年12月9日

(吉隆坡8日讯)亿能(ARANK,7214,主板工业产品股)截至10月杪首季,净赚按年涨24.93%,至465万5000令吉,或每股净利3.88仙,高于上财年同季372万6000令吉。

不过,营业额按年跌2.71%,从上财年同季的1亿2722万3000令吉,萎缩至1亿2377万7000令吉。

虽然业务提升,但因销售组合变化,使当季铝坯(Aluminium Billets)取得较低营业额。

与上季度相比,营业额按年增长8.7%至1亿2380万令吉,归功于原材料成本增加,推动业务量和平均销售价格走高。上季度营业额报1亿1390万令吉。

亿能相信,明年仍充满挑战,因为市场和经营环境受国内外不确定因素影响。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2016 | 31 Oct 2015 | 31 Oct 2016 | 31 Oct 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 123,777 | 127,223 | 123,777 | 127,223 | | 2 | Profit/(loss) before tax | 5,165 | 4,315 | 5,165 | 4,315 | | 3 | Profit/(loss) for the period | 4,530 | 3,745 | 4,530 | 3,745 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,655 | 3,726 | 4,655 | 3,726 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.88 | 3.11 | 3.88 | 3.11 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8900 | 0.8500

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-1-2017 05:10 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | PROPOSED DISPOSAL OF 55% EQUITY INTEREST IN HONGLEE GROUP (M) SDN. BHD. BY A-RANK BERHAD ("A-RANK" OR THE "COMPANY"). | The Board of Directors of A-Rank is pleased to announce that the Company had on 25 January 2017 entered into a Share Sale Agreement for the proposed disposal of 4,950,000 ordinary shares of RM1.00 each in HongLee Group (M) Sdn. Bhd. (Company No. 1024793-M) ("HongLee Group") representing A-Rank's 55% equity interest in HongLee Group for a total cash consideration of RM2,105,400.00 (Ringgt Malaysia: Two Million One Hundred Five Thousand and Four Hundred only) ("Proposed Disposal") to Mr Lim Cheen Heng, Ms Liew Wan Ling and Mr Tan Joo Thean.

Please refer to the attachment for further details on the Proposed Disposal. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5325041

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|