|

|

发表于 27-4-2017 04:28 AM

|

显示全部楼层

发表于 27-4-2017 04:28 AM

|

显示全部楼层

| HONG LEONG INDUSTRIES BERHAD |

EX-date | 12 May 2017 | Entitlement date | 16 May 2017 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A second interim single tier dividend of 20.0 sen per share and a special interim single tier dividend of 10.0 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | HONG LEONG SHARE REGISTRATION SERVICES SDN BHDLevel 5, Wisma Hong Leong18 Jalan Perak50450 Kuala LumpurTel No.: 03-21641818 | Payment date | 30 May 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 16 May 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.3 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-8-2017 05:50 AM

|

显示全部楼层

发表于 3-8-2017 05:50 AM

|

显示全部楼层

丰隆工业联号公司.新闻纸工业清盘

(吉隆坡1日讯)丰隆工业(HLIND,3301,主板消费品组)宣布,联号公司——大马新闻纸工业有限公司(MNI)董事部,于今日委任普华永道谘询服务有限公司的林善宾(译音)为临时清盘师,以启动债权人自动清盘程序。

该公司文告指出,公司在大马新闻纸工业有限公司持有33.65%股权,惟不是公司主要的联号公司。大马新闻纸工业有限公司是于1967年8月4日创立,主要涉足制造及销售新闻纸。

文告指出,大马新闻纸工业有限公司董事部认为,它不能继续其业务,因在非常困难市况中营运,特别是新闻纸需求下跌,使它在过去3年都蒙受亏损。

拨备1.7亿

文告指出,随着上述债权人自动清盘行动,公司将会做出1亿7150万令吉的全部减记拨备,即是公司截至2017年6月30日在大马新闻纸工业有限公司的同等投资额,这将对公司截至2017年6月30日为止季度带来负面影响。

它指出,除了一次过减记,大马新闻纸工业有限公司的清盘,将不会有其他负面影响冲击公司,展望未来,公司将不会把大马新闻纸工业有限公司的业绩列入其股份账目。若是清盘行动出现任何遗留价值,公司将会在未来期间,确认任何回收。

文章来源:

星洲日报‧财经‧2017.08.02

Type | Announcement | Subject | WINDING UP / RECEIVER & MANAGER / RESTRAINING ORDER / SPECIAL ADMINISTRATOR | Description | Creditors' Voluntary Winding-Up Of An Associated Company | Hong Leong Industries Berhad (“HLI”) wishes to inform that the Board of its associated company, Malaysian Newsprint Industries Sdn Bhd (“MNI”), had on 1 August 2017, appointed Mr Lim San Peen of PricewaterhouseCoopers Advisory Services Sdn Bhd as the Interim Liquidator to commence creditors’ voluntary winding-up proceedings of MNI in accordance with Section 440(1) of the Companies Act 2016 (“Creditors’ Voluntary Winding-Up”).

MNI, in which HLI has a 33.65% interest, is not a major associated company of HLI. MNI was incorporated in Malaysia on 4 August 1976 and is principally engaged in the manufacture and sale of newsprint.

The Board of MNI was of the opinion that MNI could not continue its business. MNI had been operating under very difficult market conditions, especially declining newsprint demand, and has incurred losses for the past 3 years.

Arising from the Creditors’ Voluntary Winding-Up, HLI Group will make a full impairment provision of RM171.5 million which is HLI Group’s carried amount of investment in MNI as at 30 June 2017, and this will have an adverse impact on its financial quarter ended 30 June 2017. Apart from the one-off impairment, the liquidation of MNI will not have any other adverse impact on HLI Group, and going forward, HLI Group will no longer have to equity account the results of MNI. In the event of any residual value from the liquidation process, HLI Group will recognise any recoveries in future periods.

This announcement is dated 1 August 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2017 08:38 PM

|

显示全部楼层

发表于 17-8-2017 08:38 PM

|

显示全部楼层

本帖最后由 icy97 于 18-8-2017 04:13 AM 编辑

丰隆工业末季亏1.05亿

2017年8月18日

(吉隆坡17日讯)丰隆工业(HLIND,3301,主板消费产品股)截至6月杪末季,净亏1亿456万9000令吉,或每股33.78仙。

丰隆工业向交易所报备,末季营业额微跌0.8%,录得5亿6901万2000令吉。

累计全年,净利下滑58.3%至1亿308万7000令吉;营业额微涨4.18%至22亿8211万5000令吉。

联营公司清盘减值1.72亿

丰隆工业文告指出,联营公司大马新闻纸工业因宣布清盘,需纳入总值1亿7200万令吉的减值,影响2017财年业绩表现。

若排除1亿7200万令吉的减值,公司税前盈利相比去年同期实为增加。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 569,012 | 573,603 | 2,282,115 | 2,190,629 | | 2 | Profit/(loss) before tax | -92,713 | 97,299 | 192,309 | 343,144 | | 3 | Profit/(loss) for the period | -92,549 | 83,583 | 150,959 | 290,580 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -104,569 | 69,494 | 103,087 | 247,223 | | 5 | Basic earnings/(loss) per share (Subunit) | -33.78 | 22.53 | 33.37 | 80.16 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 45.00 | 42.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.1000 | 4.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2017 03:56 AM

|

显示全部楼层

发表于 10-11-2017 03:56 AM

|

显示全部楼层

本帖最后由 icy97 于 10-11-2017 04:53 AM 编辑

首季净利扬26%

丰隆工业派息15仙

2017年11月10日

(吉隆坡9日讯)丰隆工业(HLIND,3301,主板消费产品股)截至9月杪首季,净利年增26.4%,同时宣布派发每股15仙股息。

丰隆工业今天向交易所报备,该季净利从去年同期的6476万6000令吉或每股20.99仙,增加至8185万9000令吉或每股26.44仙。

营业额也从去年同期的5亿6575万4000令吉,年增11.3%,至6亿2942万6000令吉。

丰隆工业在财报说明,该季营收双涨,归功于旗下消费产品业务营业额和收益提高。

另外,丰隆工业也宣布派发每股15仙的首次中期股息,与去年同期派息额持平,除权日为本月23日,派息日在12月12日。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 629,426 | 565,754 | 629,426 | 565,754 | | 2 | Profit/(loss) before tax | 117,544 | 91,441 | 117,544 | 91,441 | | 3 | Profit/(loss) for the period | 99,470 | 77,309 | 99,470 | 77,309 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 81,859 | 64,766 | 81,859 | 64,766 | | 5 | Basic earnings/(loss) per share (Subunit) | 26.44 | 20.99 | 26.44 | 20.99 | | 6 | Proposed/Declared dividend per share (Subunit) | 15.00 | 15.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.3800 | 4.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-11-2017 03:57 AM

|

显示全部楼层

发表于 10-11-2017 03:57 AM

|

显示全部楼层

EX-date | 23 Nov 2017 | Entitlement date | 27 Nov 2017 | Entitlement time | 04:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single tier dividend of 15.0 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | HONG LEONG SHARE REGISTRATION SERVICES SDN BHDLevel 5, Wisma Hong Leong18 Jalan Perak50450 Kuala LumpurTel No.: 03-21641818 | Payment date | 12 Dec 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 27 Nov 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2018 01:36 AM

|

显示全部楼层

发表于 6-2-2018 01:36 AM

|

显示全部楼层

本帖最后由 icy97 于 6-2-2018 03:23 AM 编辑

丰隆工业次季净利扬21%

2018年2月6日

(吉隆坡5日讯)丰隆工业(HLIND,3301,主板消费产品股)截至12月31日次季,净利扬20.8%,写8294万4000令吉;营业额也扩大12.6%,报6亿3231万1000令吉。

累计上半年,净利起23.5%,达1亿6480万4000令吉;营业额涨11.9%,报12亿6173万7000令吉。

丰隆工业向交易所报备,当季税前盈利走高至1.18亿令吉,归功于消费者产品的销量增加,因销售组合有利。

如无意外,董事部相信,消费者产品和工业产品业务能在2018财年交出称心业绩。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 632,311 | 561,525 | 1,261,737 | 1,127,279 | | 2 | Profit/(loss) before tax | 117,504 | 90,979 | 235,049 | 182,420 | | 3 | Profit/(loss) for the period | 99,552 | 79,052 | 199,023 | 156,361 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 82,944 | 68,667 | 164,804 | 133,433 | | 5 | Basic earnings/(loss) per share (Subunit) | 26.77 | 22.27 | 53.21 | 43.26 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.4400 | 4.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2018 05:13 AM

|

显示全部楼层

发表于 2-4-2018 05:13 AM

|

显示全部楼层

Date of change | 01 Apr 2018 | Name | MISS CHEE SOO YUEN | Age | 47 | Gender | Female | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Pursue other career opportunities |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-4-2018 05:13 AM

|

显示全部楼层

发表于 2-4-2018 05:13 AM

|

显示全部楼层

Date of change | 01 Apr 2018 | Name | MR GOH ENG TATT | Age | 44 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | Mr Goh graduated from University Utara Malaysia with a Bachelor (Honours) Degree in Accountancy. He holds a professional accountancy qualification from the Malaysian Institute of Certified Public Accountants and is a Member of the Malaysian Institute of Accountants. | Working experience and occupation | Mr Goh is currently the Group Chief Financial Officer of Hong Leong Manufacturing Group Sdn Bhd, the holding company. He has over 7 years of auditing experience before joining Southern Steel Berhad ("SSB") in 2004 where he held various financial positions for more than 10 years within SSB Group. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 04:03 AM

|

显示全部楼层

发表于 27-4-2018 04:03 AM

|

显示全部楼层

本帖最后由 icy97 于 4-5-2018 03:50 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 637,625 | 585,824 | 1,899,362 | 1,713,103 | | 2 | Profit/(loss) before tax | 97,401 | 102,602 | 332,450 | 285,022 | | 3 | Profit/(loss) for the period | 80,593 | 87,147 | 279,616 | 243,508 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 63,236 | 74,223 | 228,040 | 207,656 | | 5 | Basic earnings/(loss) per share (Subunit) | 20.40 | 24.02 | 73.60 | 67.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 32.00 | 30.00 | 47.00 | 45.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.5600 | 4.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 04:04 AM

|

显示全部楼层

发表于 27-4-2018 04:04 AM

|

显示全部楼层

本帖最后由 icy97 于 10-5-2018 06:41 PM 编辑

EX-date | 08 May 2018 | Entitlement date | 15 May 2018 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | A second interim single tier dividend of 22 sen per share and a special interim single tier dividend of 10 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | HONG LEONG SHARE REGISTRATION SERVICES SDN BHDLevel 5, Wisma Hong Leong18 Jalan Perak50450 Kuala LumpurTel No.: 03-21641818 | Payment date | 25 May 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 May 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.32 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-5-2018 06:39 AM

|

显示全部楼层

发表于 9-5-2018 06:39 AM

|

显示全部楼层

本帖最后由 icy97 于 13-5-2018 03:22 AM 编辑

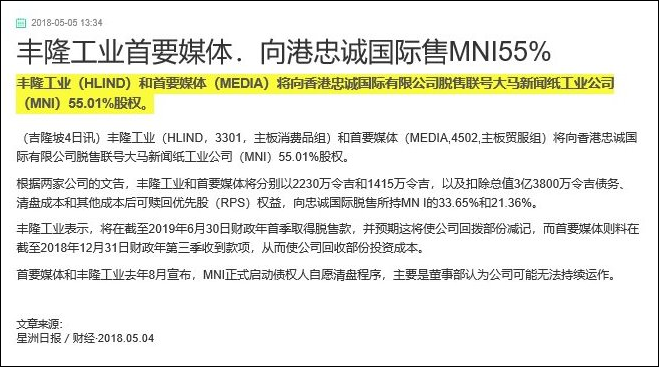

Type | Announcement | Subject | OTHERS | Description | PROPOSED DISPOSAL OF THE ENTIRE INTERESTS HELD IN 33.65% ASSOCIATED COMPANY, MALAYSIAN NEWSPRINT INDUSTRIES SDN BHD (IN CREDITORS' VOLUNTARY LIQUIDATION) ("MNI") | Hong Leong Industries Berhad (“HLI” or “the Company”) writes to inform that HLI together with other shareholders of MNI, entered into a Shares Sale Agreement (“SSA”) on 2 May 2018 to sell their entire interests in MNI to Asia Honour (Hong Kong) Limited (“Asia Honour”), with the consent of the Liquidator, Mr Lim San Peen of PricewaterhouseCoopers Advisory Services Sdn Bhd.

Pursuant to the terms of the SSA, HLI has agreed to dispose of its: a. entire interest in ordinary shares of MNI for cash consideration of RM22.3 million; and b. entire interest in redeemable preference shares (“RPS”) of MNI for an amount equivalent to HLI’s portion of the balance consideration after deducting inter alia all secured debts, admitted debts, liquidation costs and other agreed costs from the sum of RM338.0 million,

to Asia Honour free from encumbrances (“Proposed HLI’s Disposal”).

The sale consideration was arrived at on a willing buyer willing seller basis, taking into account the value of the assets in MNI.

The Proposed HLI’s Disposal will be completed on the eighth (8th) business day from the date of the SSA. The full sale consideration is expected to be received by HLI by the first quarter of the next financial year ending 30 June 2019.

The Liquidator will apply to the Court for the termination of the Creditors’ Voluntary Winding-Up of MNI after the payments of inter alia all secured debts, admitted debts, liquidation costs and other agreed costs.

The Proposed HLI’s Disposal will enable HLI Group to write back part of its investment in MNI which has been fully written down.

The Proposed HLI’s Disposal is not subject to the approval of the shareholders of HLI or any regulatory authorities.

None of the Directors and major shareholders of HLI and/or persons connected with them have any interest, direct or indirect, in the Proposed HLI’s Disposal. The Directors of HLI are of the opinion that the Proposed HLI’s Disposal is in the best interest of the HLI Group.

Based on the audited consolidated financial statements of HLI for the financial year ended 30 June 2017 and the estimated sale consideration for the Proposed HLI’s Disposal, the highest percentage ratio applicable to the Proposed HLI’s Disposal pursuant to Paragraph 10.02(g) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad (“MMLR”) is estimated to be less than 5% and hence, announcement of the Proposed HLI’s Disposal in accordance with Chapter 10 of the MMLR is not required. This announcement is made pursuant to Chapter 9 of the MMLR.

This announcement is dated 4 May 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 02:26 AM

|

显示全部楼层

发表于 31-8-2018 02:26 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 603,604 | 569,012 | 2,502,966 | 2,282,115 | | 2 | Profit/(loss) before tax | 131,948 | -92,713 | 464,397 | 192,309 | | 3 | Profit/(loss) for the period | 122,737 | -92,549 | 402,352 | 150,959 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 106,554 | -104,569 | 334,593 | 103,087 | | 5 | Basic earnings/(loss) per share (Subunit) | 34.11 | -33.78 | 107.77 | 33.37 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 47.00 | 45.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.7100 | 4.1000

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-11-2018 02:37 AM

|

显示全部楼层

发表于 14-11-2018 02:37 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 06:25 AM

|

显示全部楼层

发表于 24-11-2018 06:25 AM

|

显示全部楼层

本帖最后由 icy97 于 15-12-2018 07:15 AM 编辑

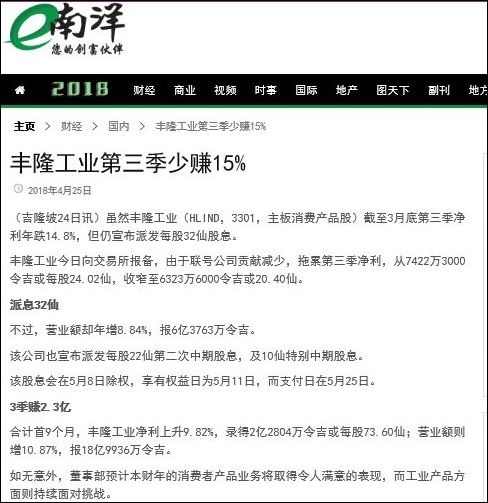

联号公司贡献下滑 丰隆工业首季净利挫15.5%

Samantha Ho/theedgemarkets.com

November 12, 2018 20:49 pm +08

http://www.theedgemarkets.com/article/联号公司贡献下滑-丰隆工业首季净利挫155

(吉隆坡12日讯)联号公司贡献下滑,拖累丰隆工业(Hong Leong Industries Bhd)截至今年9月杪首季(2018财年首季)净利按年降低15.54%至7005万令吉,上财年同季报8186万令吉。

每股盈利从26.44仙,跌至22.33仙。

然而,营业额从6亿2943万令吉,按年增长6.91%至6亿7291万令吉。

该集团说:“在任何无可预见的情况下,董事部估计,现财年消费产品业务的表现将让人满意,但工业产品的市况仍将面临挑战。”

该集团建议派发每股15仙中期股息,将于12月13日支付。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 672,914 | 629,426 | 672,914 | 629,426 | | 2 | Profit/(loss) before tax | 107,843 | 117,544 | 107,843 | 117,544 | | 3 | Profit/(loss) for the period | 88,025 | 99,470 | 88,025 | 99,470 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 70,046 | 81,859 | 70,046 | 81,859 | | 5 | Basic earnings/(loss) per share (Subunit) | 22.33 | 26.44 | 22.33 | 26.44 | | 6 | Proposed/Declared dividend per share (Subunit) | 15.00 | 15.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.8900 | 4.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 06:27 AM

|

显示全部楼层

发表于 24-11-2018 06:27 AM

|

显示全部楼层

EX-date | 27 Nov 2018 | Entitlement date | 29 Nov 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim single tier dividend of 15 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | HONG LEONG SHARE REGISTRATION SERVICES SDN BHDLevel 5, Wisma Hong Leong18 Jalan Perak50450 Kuala LumpurTel No.: 03-21641818 | Payment date | 13 Dec 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 29 Nov 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-2-2019 06:51 AM

|

显示全部楼层

发表于 22-2-2019 06:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 702,847 | 632,311 | 1,375,761 | 1,261,737 | | 2 | Profit/(loss) before tax | 127,255 | 117,504 | 235,098 | 235,049 | | 3 | Profit/(loss) for the period | 106,224 | 99,552 | 194,249 | 199,023 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 86,739 | 82,944 | 156,785 | 164,804 | | 5 | Basic earnings/(loss) per share (Subunit) | 27.63 | 26.77 | 49.96 | 53.21 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 15.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 4.9900 | 4.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 08:34 AM

|

显示全部楼层

发表于 2-7-2019 08:34 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 693,526 | 637,625 | 2,069,287 | 1,899,362 | | 2 | Profit/(loss) before tax | 138,436 | 97,401 | 373,534 | 332,450 | | 3 | Profit/(loss) for the period | 113,462 | 80,593 | 307,711 | 279,616 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 90,396 | 63,236 | 247,181 | 228,040 | | 5 | Basic earnings/(loss) per share (Subunit) | 28.80 | 20.40 | 78.75 | 73.60 | | 6 | Proposed/Declared dividend per share (Subunit) | 35.00 | 32.00 | 50.00 | 47.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.2800 | 4.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 08:34 AM

|

显示全部楼层

发表于 2-7-2019 08:34 AM

|

显示全部楼层

| HONG LEONG INDUSTRIES BERHAD |

EX-date | 14 Jun 2019 | Entitlement date | 17 Jun 2019 | Entitlement time | 04:30 PM | Entitlement subject | Interim Dividend | Entitlement description | A second interim single tier dividend of 25.0 sen per share and a special interim single tier dividend of 10.0 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | HONG LEONG SHARE REGISTRATION SERVICES SDN BHDLevel 25, Menara Hong LeongNo. 6, Jalan DamanlelaBukit Damansara50490 Kuala LumpurTelephone No. 03-20888818 | Payment date | 28 Jun 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 17 Jun 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2019 04:22 AM

|

显示全部楼层

发表于 31-8-2019 04:22 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 681,095 | 603,604 | 2,750,382 | 2,502,966 | | 2 | Profit/(loss) before tax | 127,240 | 131,958 | 500,774 | 464,407 | | 3 | Profit/(loss) for the period | 101,586 | 122,747 | 409,297 | 402,362 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 79,904 | 106,564 | 327,085 | 334,603 | | 5 | Basic earnings/(loss) per share (Subunit) | 25.45 | 34.11 | 104.20 | 107.77 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 50.00 | 47.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.1800 | 4.6500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 12-2-2020 05:38 AM

|

显示全部楼层

发表于 12-2-2020 05:38 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 777,238 | 672,914 | 777,238 | 672,914 | | 2 | Profit/(loss) before tax | 109,069 | 107,843 | 109,069 | 107,843 | | 3 | Profit/(loss) for the period | 84,881 | 88,025 | 84,881 | 88,025 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 63,351 | 70,046 | 63,351 | 70,046 | | 5 | Basic earnings/(loss) per share (Subunit) | 20.18 | 22.33 | 20.18 | 22.33 | | 6 | Proposed/Declared dividend per share (Subunit) | 17.00 | 15.00 | 17.00 | 15.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 5.3900 | 5.1800

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|