|

|

【LOTUS 8303 交流专区】(前名 KFM)

[复制链接]

|

|

|

发表于 30-5-2017 04:47 AM

|

显示全部楼层

发表于 30-5-2017 04:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 0 | 1,459 | 0 | 3,126 | | 2 | Profit/(loss) before tax | -1,930 | -2,920 | -2,918 | -5,660 | | 3 | Profit/(loss) for the period | -1,930 | -2,920 | -2,918 | -5,660 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,930 | -2,920 | -2,918 | -5,660 | | 5 | Basic earnings/(loss) per share (Subunit) | -2.83 | -4.28 | -4.28 | -8.30 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.2000 | -0.1600 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-7-2017 01:04 AM

|

显示全部楼层

发表于 18-7-2017 01:04 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | KUANTAN FLOUR MILLS BERHAD ("the Company" or "KFM")Hearing at Pejabat Tenaga Kerja Kuantan on 24 July 2017Kes Saman Ketua Pengarah Tenaga Kerja No: KBR/10601/2017/0231 | The Board of Directors of the Company wishes to announce that an ex-employee of the Company had filed to Pejabat Tenaga Kerja Kuantan to seek for a ‘Faedah Penamatan Kerja’ of RM32,310.00.

The Company is seeking necessary legal advice on this matter.

Further development on the above matter will be announced to Bursa Malaysia Securities Berhad in due course.

This announcement is dated 17th July 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-8-2017 05:15 AM

|

显示全部楼层

发表于 24-8-2017 05:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 2,033 | 796 | 2,033 | 3,922 | | 2 | Profit/(loss) before tax | -1,265 | -1,909 | -4,183 | -7,569 | | 3 | Profit/(loss) for the period | -1,265 | -1,909 | -4,183 | -7,569 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,265 | -1,909 | -4,183 | -7,569 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.85 | -2.80 | -6.13 | -11.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.2200 | -0.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2017 02:50 AM

|

显示全部楼层

发表于 29-9-2017 02:50 AM

|

显示全部楼层

icy97 发表于 30-3-2017 04:32 AM

关丹面粉厂冀筹4844万

供还债及营运资本

2017年3月31日

(吉隆坡30日讯)关丹面粉厂(KFM,8303,主板消费产品股)计划透过私下配售高达30%的缴足股本,同时发行附加股,筹集最多约4844万令吉,用作未来2年企 ...

Type | Announcement | Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3

REGULARISATION PLAN | Description | KUANTAN FLOUR MILLS BERHAD ("KFM" OR THE "COMPANY")PROPOSED REGULARISATION PLAN OF KFM COMPRISING:-- PROPOSED PRIVATE PLACEMENT;- PROPOSED DEBT RESTRUCTURING;- PROPOSED RIGHTS ISSUE; AND- PROPOSED AMENDMENTS | (Unless otherwise stated, all abbreviations used herein shall have the same meanings as those stated in the announcement dated 29 March 2017 in relation to the Proposed Regularisation Plan)

Reference is made to the Company’s announcement dated 29 March 2017 in relation to the Proposed Regularisation Plan (“Initial Regularisation Plan”). On behalf of the Board of KFM, KAFIB wishes to announce that the Company had on today:- (i) entered into the debt settlement agreements (“DSA”) with the respective Scheme Creditors to vary the terms of the previous proposed restructuring of debts under the Initial Proposals; and

(ii) entered into a debt conversion agreement (“DCA”) with Lotus pertaining to the settlement of RM15.0 million of the advances and supplier’s credit extended by Lotus via the issuance of 150,000,000 redeemable convertible preference shares (“RCPS”).

In relation to the above, the Initial Proposals have been revised in the following manner: - (a) proposed private placement of 27,290,000 new KFM Shares, representing approximately 40% of the existing total number of KFM Shares in issue, to the Placement Investor at an issue price of RM0.10 per Placement Share (“Proposed Private Placement”);

(b) proposed restructuring of debts owing by KFM to:- - the Scheme Creditors pursuant to the DSA (“Proposed Debt Settlement”); and - Lotus pursuant to the DCA (“Proposed Debt Conversion”),

collectively referred to as the “Proposed Debt Restructuring”; and

(c) proposed renounceable rights issue of up to 477,595,420 Rights Shares at an issue price of RM0.10 per Rights Share and on the basis of five (5) Rights Shares for every one (1) KFM Share held following the Proposed Private Placement on the Entitlement Date, together with up to 238,797,710 free detachable warrants (“Warrants”) on the basis of one (1) Warrant for every two (2) Rights Shares subscribed for (“Proposed Rights Issue”);

(d) proposed amendments to the Articles of Association of the Company’s Constitution to facilitate the issuance of RCPS pursuant to the Proposed Debt Conversion (“Proposed Amendments”),

collectively referred to as the “Proposed Regularisation Plan”, “Proposals” or “Revised Proposals”.

The details of the revision to the terms of the Initial Proposals (“Revision”) are contained in the attachment attached herein.

This announcement is dated 28 September 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5557589

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-10-2017 03:42 AM

|

显示全部楼层

发表于 3-10-2017 03:42 AM

|

显示全部楼层

Date of change | 30 Sep 2017 | Name | MR CHAN SEN SAN | Age | 56 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Due to personal commitment | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No | Qualifications | - Master in Finance from RMIT University, Australia & MIM, Malaysia | Working experience and occupation | He has more than 30 years of working experience in accounting, finance, tax, corporate affairs, secretarial, administration and human resource management. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-12-2017 03:04 AM

|

显示全部楼层

发表于 6-12-2017 03:04 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 5,488 | 2 | 7,521 | 3,924 | | 2 | Profit/(loss) before tax | -8,077 | -4,524 | -12,260 | -12,093 | | 3 | Profit/(loss) for the period | -8,077 | -4,524 | -12,260 | -12,093 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -8,077 | -4,524 | -12,260 | -12,092 | | 5 | Basic earnings/(loss) per share (Subunit) | -11.84 | -6.63 | -17.97 | -17.72 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3400 | -0.1600

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2018 01:30 AM

|

显示全部楼层

发表于 6-2-2018 01:30 AM

|

显示全部楼层

本帖最后由 icy97 于 6-2-2018 03:22 AM 编辑

财报遭审计师“保留意见”

关丹面粉厂营运能力存疑

2018年2月6日

(吉隆坡5日讯)关丹面粉厂(KFM,8303,主板消费产品股)截至9月杪的2017财年经审计财报,遭到外部审计师发出“保留意见”(Qualified Opinion)。

关丹面粉厂今日向交易所报备,由于至今仍未取得交易所批准重组计划,外部审计师McMillan Woods Thomas质疑该公司持续经营的能力。

关丹面粉厂已在去年9月29日呈交重组计划。

该集团和公司在截至9月杪的2017财年,分别净亏1226万338令吉和1225万2071令吉。

此外,同期的集团和公司净负债,也分别达2897万7765令吉和2894万739令吉。【e南洋】

Type | Announcement | Subject | OTHERS | Description | KUANTAN FLOUR MILLS BERHAD (the Company or KFM)QUALIFICATION IN EXTERNAL AUDITORS' REPORT FOR THE AUDITED FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2017 | Further to the issuance of the Audited Financial Statements of the Company for the financial year ended 30 September 2017 (“AFS 2017”) to Bursa Malaysia Securities Berhad (“Bursa Securities”) and pursuant to Paragraph 9.19(37) of the Main Market Listing Requirements of Bursa Securities, the Board of Directors of the Company wishes to inform that the Company's External Auditors, McMillan Woods Thomas had qualified their report for the AFS 2017.

A copy of McMillan Woods Thomas’s report is annexed.

This announcement is dated 05 February 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5683449

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-2-2018 03:40 AM

|

显示全部楼层

发表于 10-2-2018 03:40 AM

|

显示全部楼层

本帖最后由 icy97 于 10-2-2018 05:47 AM 编辑

关丹面粉厂拟进军中国

2018年2月10日

(吉隆坡9日讯)PN17公司关丹面粉厂(KFM,8303,主板消费产品股)正在计划进军中国,扩充淀粉和预混粉业务。

关丹面粉厂向马交所报备,已与寿光市昌泰经贸有限公司(SGCT)签署谅解备忘录,协议商业合作。谅解备忘录有效期限为6个月。

根据文告,关丹面粉厂也会考虑直接收购SGCT的大部分股权来达成合作。

SGCT位于中国山东省寿光市,主要业务是售卖玉米、木薯粉和相关食物产品。

关丹面粉厂称,SGCT在中国和东盟区有稳定的进出口生意来往。

另一方面,关丹面粉厂已向马交所申请撤回在去年9月29日时呈交的重组计划。

该公司正在寻求额外9个月的期限,直到11月7日为止,来呈交新的重组计划。【e南洋】

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | KUANTAN FLOUR MILLS BERHAD (KFM OR THE COMPANY) EXECUTION OF MEMORANDUM OF UNDERSTANDING | 1. INTRODUCTION

1.1 The Board of Directors of KFM (“Board”) wishes to announce that the Company had on 9 February 2018 entered into a memorandum of understanding (“MOU”) with Shou Guang Chang Tai Economic And Trade Co. Ltd (“SGCT”) pertaining to a proposed collaboration through either a business collaboration arrangement between both parties or a direct acquisition of a majority equity interest in SGCT by KFM to facilitate the Company’s expansion of its trading of starch business as well as its premix flour in China (“Business”), subject to the terms and conditions of a definitive agreement to be entered into between the same parties (“Definitive Agreement”).

1.2 Pursuant to the MOU, the Company and SGCT have agreed to exercise their best endeavour to negotiate and finalise all terms of the Business pertaining to the Business within the duration of the MOU as given in Section 4 below.

2. INFORMATION ON SGCT

Based in Shouguang City, Shandong province of China, SGCT is principally involves in the trading and retailing of corn, tapioca and food related products. Since its establishment, SGCT has established a stable import and export business with trading partners within China and Southeast Asian countries.

3. APPROVAL REQUIRED

The MOU is not subject to the approval of the shareholders of KFM. A detailed announcement will be released to Bursa Malaysia Securities Berhad upon execution of the Definitive Agreement.

4. DURATION OF MOU

The MOU shall be terminated upon execution of the Definitive Agreement or in the event where both parties to the MOU are unable to execute the Definitive Agreement within a period of six (6) months from the date of the MOU.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors, major shareholders and/or persons connected with the Directors and major shareholders of KFM have any interest, direct or indirect, in the MOU.

This announcement is dated 9 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-2-2018 04:33 AM

|

显示全部楼层

发表于 24-2-2018 04:33 AM

|

显示全部楼层

本帖最后由 icy97 于 25-2-2018 02:43 AM 编辑

關丹麵粉 擬進軍寵物食品業

2018年2月23日

(吉隆坡23日訊)關丹麵粉(KFM,8303,主要板消費)探討與MCM Petcare私人有限公司合作,進軍寵物食品貿易及零售業。

關丹麵粉向馬證交所報備,與MCM Petcare簽署諒解備忘錄(MOU),探討雙方進行商業合作,或讓關丹麵粉直接收購MCM Petcare的多數股權,以促進公司擴大寵物食品貿易及零售業。

MCM Petcare向零售商提供寵物護理產品的全方位服務,供應寵物食品、玩具、洗髮水、美容產品、以及各種配件與產品。

在簽署諒解備忘錄后,雙方公司將在半年內,協商最終協議的條款和條件。【中国报财经】

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | KUANTAN FLOUR MILLS BERHAD ("KFM" OR "THE COMPANY")EXECUTION OF MEMORANDUM OF UNDERSTANDING | 1. INTRODUCTION 1.1 The Board of Directors of KFM (“Board”) wishes to announce that the Company had on 21 February 2018 entered into a memorandum of understanding (“MOU”) with MCM Petcare Sdn. Bhd. (“MCM”) pertaining to a proposed collaboration through either a business collaboration arrangement between both parties or a direct acquisition of a majority equity interest in MCM by KFM to facilitate the Company’s expansion of its trading and retailing of pet food products with the eventual plan of manufacturing pet foods products (“Business”), subject to the terms and conditions of a definitive agreement to be entered into between the same parties (“Definitive Agreement”). 1.2 Pursuant to the MOU, the Company and MCM have agreed to exercise their best endeavour to negotiate and finalise all terms of the Business pertaining to the Business within the duration of the MOU as given in Section 4 below.

2. INFORMATION ON MCM MCM has been specializing in providing full service distribution of quality pet care products to retailers such as super or hypermarkets and pet shops throughout Malaysia since 1999. MCM's range of products include pet foods, treats, toys, shampoos & grooming products, a complete range of accessories such as bowls, collars & leashes, cat litters and its related products, plus a wide assortment of fish, small animal products & much more.

3. APPROVAL REQUIRED The MOU is not subject to the approval of the shareholders of KFM. A detailed announcement will be released to Bursa Malaysia Securities Berhad upon execution of the Definitive Agreement.

4. DURATION OF MOU Upon the execution of this MOU, the Parties shall negotiate in good faith on the terms and conditions of the Definitive Agreement(s) to be entered into between the Parties and endeavour to execute the Definitive Agreement(s) within six (6) months from the date of this MOU (“Expiry Date").

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors, major shareholders and/or persons connected with the Directors and major shareholders of KFM have any interest, direct or indirect, in the MOU.

This announcement is dated 23 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2018 05:29 AM

|

显示全部楼层

发表于 4-3-2018 05:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 6,335 | 0 | 6,335 | 0 | | 2 | Profit/(loss) before tax | -1,284 | -988 | -1,284 | -988 | | 3 | Profit/(loss) for the period | -1,284 | -988 | -1,284 | -988 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,284 | -988 | -1,284 | -988 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.88 | -1.45 | -1.88 | -1.45 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3600 | -0.3400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-6-2018 05:51 AM

|

显示全部楼层

发表于 9-6-2018 05:51 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 9,267 | 0 | 15,602 | 0 | | 2 | Profit/(loss) before tax | -1,114 | -1,930 | -2,398 | -2,918 | | 3 | Profit/(loss) for the period | -1,114 | -1,930 | -2,398 | -2,918 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -1,113 | -1,930 | -2,397 | -2,918 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.63 | -2.83 | -3.51 | -4.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3700 | -0.3400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-6-2018 02:59 AM

|

显示全部楼层

发表于 11-6-2018 02:59 AM

|

显示全部楼层

本帖最后由 icy97 于 17-6-2018 06:37 AM 编辑

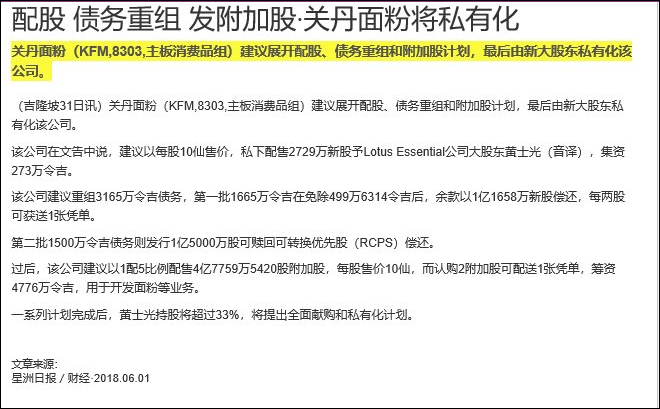

Type | Announcement | Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3

REGULARISATION PLAN | Description | KUANTAN FLOUR MILLS BERHAD ("KFM" OR THE "COMPANY")PROPOSED REGULARISATION PLAN OF KFM COMPRISING:-- PROPOSED PRIVATE PLACEMENT;- PROPOSED DEBT RESTRUCTURING;- PROPOSED RIGHTS ISSUE; AND- PROPOSED AMENDMENTS. | On behalf of the Board of Directors of KFM, KAF Investment Bank Berhad wishes to announce that the Company wishes to undertake the following proposals to regularise its financial condition in accordance with Paragraph 8.04(3) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad:- (a) proposed private placement of 27,290,000 new ordinary shares in KFM (“KFM Share(s)”) (“Placement Shares”), representing approximately 40% of the existing total number of KFM Shares in issue, to a placement investor at an issue price of RM0.10 per Placement Share (“Proposed Private Placement”);

(b) proposed restructuring of debts owing by KFM to:- - its trade creditors, whose amount owing by KFM are proposed to be settled pursuant to the debt settlement agreement entered into between KFM and the relevant trade creditors on 28 September 2017; and

- Lotus Essentials Sdn. Bhd., which the advances and supplier’s credit extended by Lotus to KFM are proposed to be settled pursuant to the debt conversion agreement entered into between KFM and Lotus on 28 September 2017 (“Proposed Debt Conversion”);

collectively referred to as the “Proposed Debt Restructuring”; and

(c) proposed renounceable rights issue of 477,595,420 new KFM Shares (“Rights Shares”) at an issue price of RM0.10 per Rights Share and on the basis of five (5) Rights Shares for every one (1) KFM Share held following the Proposed Private Placement on an entitlement date to be determined later, together with 238,797,710 free warrant in KFM (“Warrants”) on the basis of one (1) Warrant for every two (2) Rights Shares subscribed for (“Proposed Rights Issue”); and

(d) proposed amendments to the articles of association of KFM’s constitution to facilitate the issuance of the redeemable convertible preference shares pursuant to the Proposed Debt Conversion (“Proposed Amendments”),

collectively referred to as the “Proposed Regularisation Plan” or “Proposals”.

The details of the terms of the Proposals are contained in the attachment attached herein.

This announcement is dated 31 May 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5811325

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2018 05:15 AM

|

显示全部楼层

发表于 1-9-2018 05:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,488 | 2,033 | 27,090 | 2,033 | | 2 | Profit/(loss) before tax | 33 | -1,265 | -2,365 | -4,183 | | 3 | Profit/(loss) for the period | 33 | -1,265 | -2,365 | -4,183 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 33 | -1,265 | -2,364 | -4,183 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.05 | -1.85 | -3.46 | -6.13 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3700 | -0.3400 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-1-2019 07:46 AM

|

显示全部楼层

发表于 1-1-2019 07:46 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 11,917 | 5,488 | 39,007 | 7,521 | | 2 | Profit/(loss) before tax | -538 | -8,077 | -2,903 | -12,260 | | 3 | Profit/(loss) for the period | -538 | -8,077 | -2,903 | -12,260 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -537 | -8,077 | -2,901 | -12,260 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.79 | -11.84 | -4.25 | -17.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3800 | -0.3400

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-3-2019 07:56 AM

|

显示全部楼层

发表于 4-3-2019 07:56 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 12,708 | 6,335 | 12,708 | 6,335 | | 2 | Profit/(loss) before tax | -438 | -1,284 | -438 | -1,284 | | 3 | Profit/(loss) for the period | -438 | -1,284 | -438 | -1,284 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -438 | -1,284 | -438 | -1,284 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.64 | -1.88 | -0.64 | -1.88 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.3900 | -0.3800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2019 04:13 AM

|

显示全部楼层

发表于 17-4-2019 04:13 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | MR DENNIS TOW JUN FYE | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES | Date of cessation | 03 Apr 2019 | Name & address of registered holder | DENNIS TOW JUN FYENO.3, JALAN BUMIPUTERASTULANG LAUT80300 JOHOR BAHRUJOHOR |

No of securities disposed | 9,606,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Disposal | Nature of interest | Direct Interest |  | Date of notice | 04 Apr 2019 | Date notice received by Listed Issuer | 05 Apr 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2019 04:13 AM

|

显示全部楼层

发表于 17-4-2019 04:13 AM

|

显示全部楼层

Notice of Interest Sub. S-hldr (Section 137 of CA 2016)Particulars of Substantial Securities HolderName | CWL VENTURES SDN. BHD. | Address | 16-1, Jalan Rampai Niaga 2,

Rampai Business Park,

Kuala Lumpur

53300 Wilayah Persekutuan

Malaysia. | Company No. | 1315755-U | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | ORDINARY SHARES | Name & address of registered holder | CWL Ventures Sdn. Bhd.16-1, Jalan Rampai Niaga 2, Rampai Business Park 53300 Kuala Lumpur, W.P. Kuala Lumpur. |

| Date interest acquired & no of securities acquired | Date interest acquired | 03 Apr 2019 | No of securities | 9,606,000 | Circumstances by reason of which Securities Holder has interest | Acquisition | Nature of interest | Direct Interest |  | | Total no of securities after change | Direct (units) | 9,606,000 | Direct (%) | 14.079 | Indirect/deemed interest (units) |

| | Indirect/deemed interest (%) |

| | Date of notice | 04 Apr 2019 | Date notice received by Listed Issuer | 05 Apr 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-7-2019 06:47 AM

|

显示全部楼层

发表于 3-7-2019 06:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 14,355 | 9,267 | 27,063 | 15,602 | | 2 | Profit/(loss) before tax | -781 | -1,114 | -1,219 | -2,398 | | 3 | Profit/(loss) for the period | -781 | -1,114 | -1,219 | -2,398 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -781 | -1,113 | -1,219 | -2,397 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.14 | -1.63 | -1.79 | -3.51 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.4000 | -0.3800

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-7-2019 06:41 AM

|

显示全部楼层

发表于 21-7-2019 06:41 AM

|

显示全部楼层

Date of change | 01 Jul 2019 | Name | ENCIK KUSHAIRI BIN ZAIDEL | Age | 61 | Gender | Male | Nationality | Malaysia | Designation | Non Executive Chairman | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Due to other personal business commitment |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2019 06:23 AM

|

显示全部楼层

发表于 21-8-2019 06:23 AM

|

显示全部楼层

本帖最后由 icy97 于 21-8-2019 09:05 AM 编辑

原料生产成本增-关丹面粉第3季净亏51万

https://www.chinapress.com.my/20190820/原料生产成本增-关丹面粉第3季净亏51万/

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 15,125 | 11,488 | 42,188 | 27,090 | | 2 | Profit/(loss) before tax | -511 | 33 | -1,730 | -2,365 | | 3 | Profit/(loss) for the period | -511 | 33 | -1,730 | -2,365 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -511 | 33 | -1,730 | -2,364 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.75 | 0.05 | -2.54 | -3.46 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | -0.4100 | -0.3800

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|