|

|

【HUMEIND 5000 交流专区】谦工业(前名NARRA)

[复制链接]

|

|

|

发表于 1-5-2017 05:27 AM

|

显示全部楼层

发表于 1-5-2017 05:27 AM

|

显示全部楼层

EX-date | 15 May 2017 | Entitlement date | 17 May 2017 | Entitlement time | 04:00 PM | Entitlement subject | Interim Dividend | Entitlement description | An interim single tier dividend of 2.0 sen per share | Period of interest payment | to | Financial Year End | 30 Jun 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Hong Leong Share Registration Services Sdn BhdLevel 5, Wisma Hong Leong18 Jalan Perak50450 Kuala LumpurTel No. 03-21641818 | Payment date | 31 May 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 17 May 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 | Par Value | Malaysian Ringgit (MYR) 0.000 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-8-2017 03:48 AM

|

显示全部楼层

发表于 25-8-2017 03:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 188,631 | 148,190 | 662,739 | 603,302 | | 2 | Profit/(loss) before tax | 1,348 | 6,959 | 25,501 | 62,849 | | 3 | Profit/(loss) for the period | 1,243 | 8,091 | 18,716 | 48,750 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,243 | 8,091 | 18,716 | 48,750 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.26 | 1.69 | 3.91 | 10.18 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 2.00 | 3.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9300 | 0.9100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-11-2017 05:18 AM

|

显示全部楼层

发表于 9-11-2017 05:18 AM

|

显示全部楼层

本帖最后由 icy97 于 9-11-2017 07:38 AM 编辑

謙工業首季獲利挫94%

2017年11月08日

(吉隆坡8日訊)銷售價下滑,及營運成本起,拉低謙工業(HUMEIND,5000,主要板工業)截至9月底2018財年首季淨利按年下暴跌94%至45萬令吉。

謙工業向馬證交所報備,首季營業額則揚8%至1億6178萬令吉,歸功于銷量增加。

根據報備文件,雖然經商環境具挑戰,不過在大型基礎設施計劃下,該公司相信,洋灰和混凝土產品需求有望改善。

該公司當季沒有宣布任何派息。【中国报财经】

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 161,781 | 149,899 | 161,781 | 149,899 | | 2 | Profit/(loss) before tax | 597 | 11,163 | 597 | 11,163 | | 3 | Profit/(loss) for the period | 449 | 8,022 | 449 | 8,022 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 449 | 8,022 | 449 | 8,022 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.09 | 1.67 | 0.09 | 1.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9300 | 0.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-11-2017 07:08 AM

|

显示全部楼层

发表于 30-11-2017 07:08 AM

|

显示全部楼层

洋灰业露曙光.谦工业前景或改善

读者黄女士问:

看到洋灰股最新业绩表现感到担心,能不能帮忙分析一下谦工业(HUMEIND,5000,主板工业产品组)的现况与前景,合理价多少?还值得持有吗?

答:洋灰供过于求拖累谦工业表现,分析员狠砍2018至2019财政年盈利预测,现财政年降幅更高达66%。

然而,分析员指出,在大型工程动工、房产需求改善、洋灰业整合等利多带动下,洋灰业明年起有望逐步走出低迷。

洋灰业明年起有望走出低迷

根据大华继显在与谦工业管理层会面后发表的一份报告显示,洋灰业依然陷于供过于求的困境,不仅行业产能过剩,市场需求也持续疲弱,加剧了洋灰业削价战。

该行探悉,虽然洋灰业者年中多次尝试调高价格,从年初的每公吨220令吉调至每公吨240令吉,最后却因竞争剧烈而草草收兵。

目前,洋灰平均售价保持在每公吨210至220令吉。

受需求拉低平均售价拖累,洋灰公司2017年7月至9月季度表现继续让人失望。谦工业业绩相对稳定,第一季营业额按年提高7.9%至1亿6180万令吉,并转亏为盈,核心净利报40万令吉,前期为核心亏损110万令吉。

谦工业认为,虽然洋灰业挑战重重,但预期明年会逐步改善,主要是多项大型工程将陆续启动。

大华继显预期洋灰需求继续低迷,延续上半年下跌13%的颓势。即使第四季表现可望改善,也是基于前期比较数据偏低,而非需求回扬。全年来看,洋灰业估计2017年需求按年减少6%,与2016年相去不远。

目前,洋灰业运用65至70%产能,2018年可能提高到74%左右。除了大型项目,包括住宅等建筑活动也开始动工,洋灰业看好2019年产能运用可进一步突破80%,而这些目标也获得大华继显认可。

国家银行数据显示,年初至今的住宅贷款申请批准率逐步改善,胜于前两年的萎缩。

该行调低2018至2020财政年洋灰平均售价预测,从每公吨240令吉、260令吉和260令吉降至每公吨220令吉、240令吉和250令吉,并大幅下修谦工业核心净利预测66%、43%和16%。

不过,该行在调整基础年份至2019财政年后,以19倍本益比为准,保持谦工业的3令吉50仙目标价和“买进”评级。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2017.11.26 |

|

|

|

|

|

|

|

|

|

|

|

发表于 6-2-2018 01:32 AM

|

显示全部楼层

发表于 6-2-2018 01:32 AM

|

显示全部楼层

本帖最后由 icy97 于 6-2-2018 05:31 AM 编辑

金融与销售成本高企 拖累谦工业次季蒙亏

Syahirah Syed Jaafar/theedgemarkets.com

February 05, 2018 20:27 pm +08

(吉隆坡5日讯)丰隆集团子公司——建筑材料领域业者谦工业(Hume Industries Bhd)在截至2017年12月31日止次季转盈为亏,净亏444万令吉,主要是销售成本、营运开支及金融成本高企所致。

该公司在上财年同季净赚920万令吉。营业额则从上财年次季的1亿6573万令吉,按年微跌2%至现财年次季的1亿6289万令吉。

销售成本从1亿1423万令吉,增加13%至1亿2856万令吉,营运开支则从3560万令吉,上升4%至3714万令吉。金融成本劲翻约2倍至766万令吉,之前为282万令吉。

累积首半年(2018财年首半年),集团净亏399万令吉,上财年同期则净赚1722万令吉,营业额从3亿1563万令吉,按年增加3%至3亿2467万令吉。

集团表示,收益下滑主要是售价降低及营运开支上涨所致。

展望未来,集团预计商业环境将继续充满挑战。

不过,随着大型基建设施项目实行,洋灰及混凝土产品的需求将会得到改善。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 162,889 | 165,732 | 324,670 | 315,631 | | 2 | Profit/(loss) before tax | -5,445 | 11,984 | -4,848 | 23,147 | | 3 | Profit/(loss) for the period | -4,435 | 9,196 | -3,986 | 17,218 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -4,435 | 9,196 | -3,986 | 17,218 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.93 | 1.92 | -0.83 | 3.59 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.9200 | 0.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 05:20 AM

|

显示全部楼层

发表于 25-3-2018 05:20 AM

|

显示全部楼层

Date of change | 24 Mar 2018 | Name | MR HENRY CHOW TIAM CHYE | Age | 45 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Financial Officer | Reason | Pursue other career opportunities |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2018 05:21 AM

|

显示全部楼层

发表于 25-3-2018 05:21 AM

|

显示全部楼层

Date of change | 24 Mar 2018 | Name | MR LAU PING ONG | Age | 42 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Chief Financial Officer | Qualifications | Fellow of the Association of Chartered Certified Accountants (ACCA) and a Member of the Malaysian Institute of Accountants (MIA) | Working experience and occupation | Mr Lau is currently the Financial Controller of Hume Cemboard Industries Sdn Bhd, a position he held since 2016. He has over 18 years of financial experience in the building materials industry, out of which 16 years were in the cement industry. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-3-2018 05:41 AM

|

显示全部楼层

发表于 29-3-2018 05:41 AM

|

显示全部楼层

Date of change | 29 Mar 2018 | Name | DATO' QUAH THAIN KHAN | Age | 60 | Gender | Male | Nationality | Malaysia | Designation | Managing Director | Directorate | Executive | Type of change | Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-5-2018 06:38 PM

|

显示全部楼层

发表于 8-5-2018 06:38 PM

|

显示全部楼层

本帖最后由 icy97 于 11-5-2018 01:42 AM 编辑

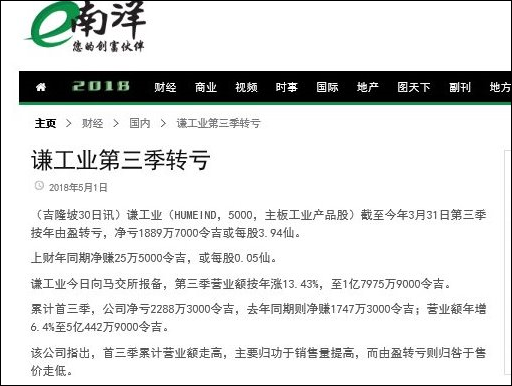

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 179,759 | 158,477 | 504,429 | 474,108 | | 2 | Profit/(loss) before tax | -26,244 | 1,006 | -31,092 | 24,153 | | 3 | Profit/(loss) for the period | -18,897 | 255 | -22,883 | 17,473 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -18,897 | 255 | -22,883 | 17,473 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.94 | 0.05 | -4.78 | 3.65 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 2.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8800 | 0.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 05:46 AM

|

显示全部楼层

发表于 31-8-2018 05:46 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 140,574 | 188,631 | 645,003 | 662,739 | | 2 | Profit/(loss) before tax | -35,671 | 1,348 | -66,763 | 25,501 | | 3 | Profit/(loss) for the period | -31,987 | 1,243 | -54,870 | 18,716 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -31,987 | 1,243 | -54,870 | 18,716 | | 5 | Basic earnings/(loss) per share (Subunit) | -6.68 | 0.26 | -11.45 | 3.91 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.8100 | 0.9300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-11-2018 12:20 AM

|

显示全部楼层

发表于 6-11-2018 12:20 AM

|

显示全部楼层

本帖最后由 icy97 于 10-11-2018 07:58 AM 编辑

谦工业委任Andi Johnny为新CEO

Amir Ridzwan Ismail/theedgemarkets.com

November 01, 2018 19:26 pm +08

(吉隆坡1日讯)谦工业(Hume Industries Bhd)宣布,委任Andi Johnny Lapon为集团总执行长,于11月1日生效。

该集团向大马交易所报备,Lapon(45岁)来自比利时,拥有22年工作经验,其中15年涉足制造业。

Lapon展开职业生涯初期,是一名会计师。后来,他于1999年至2003年初,在比利时国际船务公司Eculine担任国际财务主任。

2003年3月份,他加入世界500强企业兼全球第二大建材集团CRH Group,担任财务经理/财务总监。

之后,他更上一层楼,处理并购、转亏为盈及合理化投资组合工作。

2012年,他获委任为CRH亚洲建筑配件部门的董事经理。当时,Lapon曾担任Halfen-Moment Group的董事经理,直到2012年10月31日。

(编译:魏素雯)

Date of change | 01 Nov 2018 | Name | MR ANDI JOHNNY LAPON | Age | 45 | Gender | Male | Nationality | Belgium | Designation | Group Chief Executive Officer | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Masters | Master in Applied Economics | University Faculties Sint-Ignatius Antwerp | | | 2 | Masters | Master in Treasury Management | University of Antwerp Management School | | | 3 | Masters | Master in Controllership | Vlerick Business School | | | 4 | Masters | Master in Business Administration | Vlerick Business School | | | 5 | Others | Project Management Course | IESE Business School | |

Working experience and occupation | Andi Lapon brought with him 22 years of working experience, including 15 years of experience across the manufacturing industry. He started his early career in finance as an Accountant to complete his articleship prior to joining EcuLine, a global LCL shipping company based in Belgium from January 1999 to February 2003 as an International Controller.Subsequently, in March 2003, he moved on to CRH Group, a Fortune 500 company and the second largest Building Materials Group globally as Finance Manager/Finance Director. From a finance role, he swiftly moved up the ranks to work on merger and acquisition, turnaround and portfolio rationalisation. During his tenure in CRH Group, he managed a group of companies with sales of Euro 180 million and successfully guided those companies through the recession and successfully led the business unit to one of the best performing in terms of reporting, capital expenditure control, audit compliance, accurate budgeting and forecasting. In his later years in CRH Group, his main focus was on performance improvement. Upon his success in turning around an extrusion company in Germany where he held the position as Interim Managing Director ("MD"), he was appointed as the MD of CRH's Construction Accessories division in Asia in 2012, where he held amongst others, the position of MD of the Halfen-Moment Group, a position he held until 31 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-11-2018 05:42 AM

|

显示全部楼层

发表于 20-11-2018 05:42 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 06:29 AM

|

显示全部楼层

发表于 24-11-2018 06:29 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | HUME INDUSTRIES BERHAD ("HIB" OR THE "COMPANY")PROPOSED RENOUNCEABLE RIGHTS ISSUE OF UP TO RM172,473,768 IN NOMINAL VALUE OF 5-YEAR REDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS WITH A NOMINAL VALUE OF RM1.00 EACH ("RCULS") AT 100% OF ITS NOMINAL VALUE ON THE BASIS OF 36 RCULS FOR EVERY 100 EXISTING ORDINARY SHARES HELD IN HIB ON AN ENTITLEMENT DATE TO BE DETERMINED LATER ("PROPOSED RIGHTS ISSUE OF RCULS") | On behalf of the board of directors of HIB, Hong Leong Investment Bank Berhad wishes to announce that the Company is proposing to undertake the Proposed Rights Issue of RCULS.

Kindly refer to the attached document for the details of the Proposed Rights Issue of RCULS.

This announcement is dated 12 November 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5971853

|

|

|

|

|

|

|

|

|

|

|

|

发表于 24-11-2018 06:30 AM

|

显示全部楼层

发表于 24-11-2018 06:30 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 160,303 | 161,781 | 160,303 | 161,781 | | 2 | Profit/(loss) before tax | -23,885 | 597 | -23,885 | 597 | | 3 | Profit/(loss) for the period | -18,989 | 449 | -18,989 | 449 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -18,989 | 449 | -18,989 | 449 | | 5 | Basic earnings/(loss) per share (Subunit) | -3.96 | 0.09 | -3.96 | 0.09 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7700 | 0.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 9-2-2019 06:37 AM

|

显示全部楼层

发表于 9-2-2019 06:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 163,004 | 162,889 | 323,307 | 324,670 | | 2 | Profit/(loss) before tax | -33,250 | -5,445 | -57,139 | -4,848 | | 3 | Profit/(loss) for the period | -27,083 | -4,435 | -46,076 | -3,986 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -27,083 | -4,435 | -46,076 | -3,896 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.65 | -0.93 | -9.62 | -0.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.7200 | 0.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 14-5-2019 07:33 AM

|

显示全部楼层

发表于 14-5-2019 07:33 AM

|

显示全部楼层

EX-date | 26 Apr 2019 | Entitlement date | 30 Apr 2019 | Entitlement time | 05:00 PM | Entitlement subject | Rights Issue | Entitlement description | Renounceable rights issue of up to RM172,473,768 nominal value of 5-year 5.0% redeemable convertible unsecured loan stocks ("Rights RCULS") at 100.0% of its nominal value of RM1.00 on the basis of 36 Rights RCULS for every 100 existing ordinary shares held in Hume Industries Berhad ("HIB") ("Rights Issue of RCULS") | Period of interest payment | to | Financial Year End |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | HONG LEONG SHARE REGISTRATION SERVICES SDN BHDLevel 25, Menara Hong LeongNo. 6, Jalan DamanlelaBukit Damansara50490 Kuala LumpurTel. no.: 03-2088 8818Fax no.: 03-2088 8990 | Payment date |

| | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 30 Apr 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Ratio | Ratio | 36 : 100 | Rights Issue/Offer Price | Malaysian Ringgit (MYR) 1.000 |

Despatch date | 03 May 2019 | Date for commencement of trading of rights | 02 May 2019 | Date for cessation of trading of rights | 13 May 2019 | Date for announcement of final subscription result and basis of allotment of excess Rights Securities | 28 May 2019 | Listing Date of the Rights Securities | 03 Jun 2019 |

Last date and time for | Date | Time | Sale of provisional allotment of rights | 10 May 2019 | | 05:00:00 PM | Transfer of provisional allotment of rights | 15 May 2019 | | 04:00:00 PM | Acceptance and payment | 21 May 2019 | | 05:00:00 PM | Excess share application and payment | 21 May 2019 | | 05:00:00 PM |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-7-2019 08:33 AM

|

显示全部楼层

发表于 2-7-2019 08:33 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | HUME INDUSTIRES BERHAD ("HIB" OR THE "COMPANY")RENOUNCEABLE RIGHTS ISSUE OF RM172,473,768 NOMINAL VALUE OF 5-YEAR 5.0% REDEEMABLE CONVERTIBLE UNSECURED LOAN STOCKS ("RIGHTS RCULS") AT 100.0% OF ITS NOMINAL VALUE OF RM1.00 ON THE BASIS OF 36 RIGHTS RCULS FOR EVERY 100 EXISTING ORDINARY SHARES HELD IN HIB AS AT 5.00 P.M. ON 30 APRIL 2019 ("ENTITLEMENT DATE") ("RIGHTS ISSUE OF RCULS") | We refer to the announcements dated 12 November 2018, 30 January 2019, 14 February 2019, 21 February 2019, 14 March 2019, 27 March 2019, 12 April 2019, 16 April 2019 and 23 April 2019, as well as the abridged prospectus dated 30 April 2019 in relation to the Rights Issue of RCULS.

On behalf of the Company, Hong Leong Investment Bank Berhad wishes to announce that as at the close of acceptance and payment and excess application for the Rights Issue of RCULS at 5.00 p.m. on 21 May 2019 (“Closing Date”), HIB has received valid acceptances and excess applications for a total of RM184,779,094 nominal value of Rights RCULS. This represents a subscription level of 107.1% of the total of RM172,473,768 nominal value of Rights RCULS available for subscription under the Rights Issue of RCULS.

Details of the valid acceptances and excess applications received as at the Closing Date are as follows:

| Nominal value of Rights RCULS

(RM) | % of total Rights RCULS

(%) | Total valid acceptances | | | Total valid excess applications | | | Total valid acceptances and excess applications | | | Total Rights RCULS available for subscription | | | Over-subscription | | |

Accordingly, the board of directors of HIB has approved the allocation of excess Rights RCULS to be allotted to the applicants who have applied for the excess Rights RCULS in the priority as set out below: - firstly, to minimise the incidence of odd lots;

- secondly, for allocation to entitled shareholders who have applied for excess Rights RCULS, on a pro-rata basis and in board lots, calculated based on their respective shareholdings in HIB as at the Entitlement Date; and

- thirdly, for allocation to entitled shareholders and their renouncees and transferees (if applicable) who have applied for excess Rights RCULS, on a pro-rata basis and in board lots, calculated based on the quantum of their respective excess Rights RCULS applied for.

The Rights RCULS are expected to be admitted to the Official List of Bursa Malaysia Securities Berhad (“Bursa Securities”) and listed and quoted on the Main Market of Bursa Securities on 3 June 2019.

This announcement is dated 28 May 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-7-2019 08:43 AM

|

显示全部楼层

发表于 6-7-2019 08:43 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 152,075 | 179,759 | 475,382 | 504,429 | | 2 | Profit/(loss) before tax | -27,182 | -26,244 | -84,321 | -31,092 | | 3 | Profit/(loss) for the period | -24,192 | -18,897 | -70,268 | -22,883 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -24,192 | -18,897 | -70,268 | -22,883 | | 5 | Basic earnings/(loss) per share (Subunit) | -5.05 | -3.94 | -14.67 | -4.78 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.6700 | 0.8100

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-7-2019 08:20 AM

|

显示全部楼层

发表于 7-7-2019 08:20 AM

|

显示全部楼层

Profile for Securities of PLC

Instrument Category | Securities of PLC | Instrument Type | Loan Stocks | Description | Redeemable convertible unsecured loan stocks ("RCULS") issued under the renounceable rights issue of RM172,473,768 nominal value of 5-year 5.0% RCULS ("Rights RCULS") at 100.0% of its nominal value of RM1.00 on the basis of 36 Rights RCULS for every 100 existing ordinary shares held in Hume Industries Berhad ("HIB") ("Shares") as at 5.00 p.m. on 30 April 2019 |

Listing Date | 03 Jun 2019 | Issue Date | 30 May 2019 | Issue/ Ask Price | Malaysian Ringgit (MYR) 1.0000 | Issue Size Indicator | Currency | Issue Size in Currency | Malaysian Ringgit (MYR) 172,473,768.0000 | Maturity | Mandatory | Maturity Date | 29 May 2024 | Revised Maturity Date |

| | Name of Guarantor | Not Applicable | Name of Trustee | AmanahRaya Trustees Berhad | Coupon/Profit/Interest/Payment Rate | 5.0% per annum | Coupon/Profit/Interest/Payment Frequency | Semi-annually | Redemption | Subject to HIB giving irrevocable notice to the holders of the Rights RCULS ("RCULS Holders") at least 30 days before the Maturity Date, HIB shall have the option to redeem the outstanding Rights RCULS (if not earlier converted) in cash at 100% of its nominal value, in whole or in part, on the Maturity Date.During such notice period, but not later than the 8th market day before the Maturity Date, the RCULS Holders shall be entitled to exercise their conversion rights, subject to compliance with the conditions for conversion.Upon the exercise by HIB of its option to redeem the Rights RCULS on the Maturity Date, HIB shall also pay the RCULS Holders (no later than the Maturity Date) all unpaid coupon accruing from the immediately preceding coupon payment date until but excluding the Maturity Date.For the avoidance of doubt, the RCULS Holders shall not have the right to require HIB to redeem the Rights RCULS on the Maturity Date. | Exercise/Conversion Period | 5.00 Year(s) | Revised Exercise/Conversion Period | Not Applicable | Exercise/Strike/Conversion Price | Malaysian Ringgit (MYR) 0.7000 | Revised Exercise/Strike/Conversion Price | Not Applicable | Exercise/Conversion Ratio | 0.7:1 | Revised Exercise/Conversion Ratio | Not Applicable | Mode of satisfaction of Exercise/ Conversion price | Tendering of securities | Settlement Type/ Convertible into | Physical (Shares) |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 16-7-2019 06:17 AM

|

显示全部楼层

发表于 16-7-2019 06:17 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Conversion of Loan Stocks | Details of corporate proposal | Conversion of 5-year 5.0% Redeemable Convertible Unsecured Loan Stocks at 100% of its nominal value into new ordinary shares | No. of shares issued under this corporate proposal | 7,229,591 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.7000 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 490,995,324 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 487,424,866.800 | Listing Date | 25 Jun 2019 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|