|

|

发表于 18-3-2017 03:08 AM

|

显示全部楼层

发表于 18-3-2017 03:08 AM

|

显示全部楼层

本帖最后由 icy97 于 18-3-2017 05:02 AM 编辑

企文科技870万购安全服务公司30%股权

By Ahmad Naqib Idris / theedgemarkets.com | March 17, 2017 : 6:57 PM MYT

(吉隆坡17日讯)企文科技(K-One Technology Bhd)献议以870万令吉,收购安全咨询与服务公司AHM Consultancy & Security Services私人有限公司的30%股权。

企文科技今日向大马交易所报备,该集团正从Datin Sri Fuziah Mohd Nor、Datuk Mohammad Fadzllee Mustapa 和 Mohammed Fadzlan Mustapa的手中购入以上这批股权。

AHM主要提供安全咨询和服务,其主要客户包括政府机关和官联公司。

企文科技表示,收购AHM将为该集团提供协同效益。

“企文科技将运用其科技专长来提升和辅助AHM,好让后者可为客户提供安全服务。

“本集团将与AHM合作,将传统的安全服务与科技相结合,提升安全警卫的监控,以及通过软体应用程式来加强安全性,以提高生产力和增加安全性。”

(编译:倪嫣鴽)

Type | Announcement | Subject | OTHERS | Description | K-ONE TECHNOLOGY BERHAD ("K-ONE TECH" OR "THE COMPANY") ACQUISITION OF 30% EQUITY INTEREST OF AHM CONSULTANCY & SECURITY SERVICES SDN. BHD. ("AHM") FOR CASH CONSIDERATION OF RM8.7 MILLION ("PROPOSAL") | K-ONE TECHNOLOGY BERHAD (“K-One Tech” or “the Company”) (Company No. 539757-K) (Incorporated in Malaysia)

1. INTRODUCTION On behalf of the Board of Directors of the Company, we are pleased to announce that K-One Tech (“Purchaser”) has on 17 March 2017 entered into a Share Sale Agreement (“SSA”) with the Vendors; namely Datin Sri Fuziah binti Mohd Nor (NRIC No. 540225-05-5254), Dato’ Mohammad Fadzllee bin Mustapa (NRIC No. 791221-10-5409) and Mohammed Fadzlan bin Mustapa (NRIC No. 811112-10-5157) to acquire Four Million Five Hundred Thousand (4,500,000) ordinary shares of RM 1.00 each in the capital of AHM Consultancy & Security Services Sdn. Bhd. (Co. No. 328878-W) (“AHM”), representing thirty percent (30%) of the issued and paid-up capital of AHM for a purchase consideration of Ringgit Malaysia Eight Million and Seven Hundred Thousand (RM8,700,000) only.

2. BACKGROUND INFORMATION OF AHM AHM was founded on 29 December 1994 by its majority shareholder, Dato' Sri Mustapa bin Ali, who is the current President of the Security Services Association of Malaysia (PPKKM) and also the current President of the Asian Professional Security Association (APSA) whose members include China, Japan, Korea, Singapore, Vietnam, amongst others. It has a paid-up capital of Ringgit Malaysia Fifteen Million (RM 15,000,000). AHM specializes in the provision of security consultancy and services in the likes of static guarding, security patrol, cash-in-transit, armed escort, body guarding and private investigation. It's major customers comprise mainly of government agencies and GLCs. It is headquartered at Wisma M&F, 27 Jalan USJ 21/11, USJ City Centre, UEP Subang Jaya, Selangor with 12 branches nationwide. It is one the most established and leading security services company in Malaysia.

3. RATIONALE FOR THE PROPOSAL K-One Tech established in 2001, is a reputable technology solution provider. Its acquisition of AHM would provide synergistic effects and business potential to both parties. K-One Tech will use its technology expertise to enhance and complement AHM’s provision of security services to its customers. It will work with AHM to lace the conventional security service with technology such as enhancing the monitoring of security guards and strengthening the security of the premises via hardware cum software applications to improve productivity and added safety. In essence, K-One Tech will have new opportunities in the innovation, development and supply of security related devices and software applications to the security conscious customers through AHM. On the other hand, AHM’s security service provision will be enhanced with the integration of technology which fulfils current and impending market demands.

4. SALIENT POINTS OF THE SSA The purchase consideration is Ringgit Malaysia Eight Million Seven Hundred Thousand (RM 8,700,000) with Ringgit Malaysia Five Hundred Thousand (RM 500,000) to be paid upon signing of the SSA and the balance of Ringgit Malaysia Eight Million Two Hundred Thousand (RM 8,200,000) on completion. The acquisition is expected to be completed four (4) months from the date of the SSA. The Vendors have provided profit guarantee of Ringgit Malaysia Fourteen Million (RM 14,000,000) over a period of two (2) years commencing 1 January 2017 to 31 December 2018. Additionally, K-One Tech has the right to nominate one (1) director to AHM’s Board.

5. INTEREST OF DIRECTORS, MAJOR SHAREHOLDERS AND/OR PERSONS CONNECTED WITH THEM None of the Directors and/or major shareholders of K-One Tech and/or persons connected with them have any interests, direct or indirect in the Proposal.

6. FINANCIAL EFFECTS The Proposal is expected to have immaterial impact to the earnings per share and the net assets per share of K-One Tech for the financial year ending 2017. There is no impact on the share capital and substantial shareholders' shareholdings in the company as the Proposal is a cash transaction. The purchase consideration will be funded by internally generated funds.

7. APPLICABLE PERCENTAGE RATIOS Pursuant to Paragraph 10.02(g) of the ACE Market Listing Requirements of Bursa Malaysia Securities Berhad, the highest percentage ratio of the Proposal is 10.2%.

8. APPROVALS REQUIRED The Proposal does not require approval from the shareholders of K-One Tech or the relevant authorities.

9. DIRECTORS’ STATEMENT Having considered the rationale and the effects of the Proposal, the Board of K-One Tech is of the opinion that the Proposal is in the best interest of the company.

This announcement is dated 17 March 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 23-3-2017 04:10 AM

|

显示全部楼层

发表于 23-3-2017 04:10 AM

|

显示全部楼层

本帖最后由 icy97 于 23-3-2017 05:16 AM 编辑

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-21032017-00002 | Subject | Acquisition of 30% equity interest of AHM Consultancy & Security Services Sdn Bhd (AHM) for cash consideration of RM8.7 million (Acquisition) | Description | K-One Technology Berhad("K-One Tech" Or "The Company") Acquisition Of 30% Equity Interest Of AHM Consultancy & Security Services Sdn. Bhd. ("AHM") For Cash Consideration Of RM8.7 Million ("Proposal") | Query Letter Contents | We refer to your Company’s announcement dated 17 March 2017 in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- - The basis of arriving at the purchase consideration, other than on a “willing buyer willing seller” basis. If it was based on net assets, the year the net assets were taken into consideration, quantifying the net assets and stating whether it was based on audited financial statements.

- The net profits and net assets of AHM based on its latest audited accounts.

- K-One Technology Berhad (“K1”)’s right of recourse in the event the profit guarantee is not met.

- Particulars of all liabilities, including contingent liabilities and guarantees to be assumed by K1 arising from the Acquisition.

- The time and place where the Share Sale Agreement may be inspected.

- The prospects of AHM.

- The risks in relation to the Acquisition.

| We refer to our Company's announcement dated 17 March 2017 and Bursa Securities' letter dated 21 March 2017 seeking additional information for public release.

With regard to the above, the Board of Directors wishes to add the following:

1)Basis & Justification For The Purchase Consideration

The purchase consideration for the proposal was arrived at on a willing buyer-willing seller basis after taking into consideration the following:

a)the audited net assets of AHM as at 31 December 2015 of RM17.58 million;

b)the audited net profit of AHM as at 31 December 2015 of RM0.52 million; and

c)the profit guarantee of RM14 million over two (2) years commencing from 1 January 2017 to 31 December 2018.

2) Net Profit And Net Assets Of AHM

The net profit and net assets of AHM based on the latest audited financial statements as at 31 December 2015 are RM0.52 million and RM17.58 million respectively.

3)Profit Guarantee Recourse In The Event Of Non-Fulfillment

If the Vendors fail to meet the profit guarantee, they will be required to

either:

a) pay K-One Tech the shortfall amount within thirty(30) days from the submission of the audited accounts in the event where the actual aggregate profit after tax is less than the profit guarantee and provided that the audited accounts are submitted within six (6) months from the relevant financial year end; or

b)buy back the sale shares from K-One Tech within thirty (30) days upon notice wherein, the buy-back will be calculated based on K-One Tech's purchase consideration of RM8.7 million + Dividend of minimum of 3% per annum over the guaranteed period + Twenty (20%) of the Profit Guarantee in the event that the aggregate profit after tax is less than the profit guarantee or for the avoidance of doubt, in the event of a loss and the audited accounts are submitted after six (6) months from the relevant financial year end.

4)Liabilities To Be Assumed

K-One Tech will not assume any liabilities, including contingent liabilities and/or guarantees from the 30% proposed acquisition of AHM.

5)Documents For Inspection

The SSA is available for inspection at the registered office of K-One Tech at Unit 07-02, Level 7, Persoft Tower, 6B Persiaran Tropicana, 47410 Petaling Jaya, Selangor during normal office hours (9 am to 5 pm) from Monday to Friday(except public holidays) for a period of three (3) months from the date of this announcement.

6)Prospects Of AHM

AHM's business is expected to be robust in the foreseeable future as its major customers comprise mainly of government agencies and GLCs which are of impeccable standing. It has a well-established business relationship with them over many years. Moving forward, it expects to grow its business with these existing customers by supplementing the provision of physical security guarding with the packaging of technology hardware and software systems to enhance the security service proposition to meet current market demands. The technology aspect of security service provision provides ample new opportunities which AHM intends to tap into.

AHM also plans to diversify the provision of its integrated security service solutions into the private sector such as serving the banking industry and key multinationals. Being a forward looking company which incorporates technology into its security service provision, it expects to pose strong competition to competitors and take market share in the private sector.

With its foray into the private sector and enhancing its supply of technology devices and solutions beyond physical guarding to meet current market demands, we expect AHM's business to be vibrant in the immediate future.

7)Risks Factors

Since K-One Tech is paying the proposed acquisition in cash, there is no funding risk involved.

The completion of the acquisition is subject to the due diligence exercise in respect to the operations, financial and legal affairs being satisfactory to K-One Tech. In the event that the due diligence exercise yields unsatisfactory results, the SSA ("Sale Shares Agreement") may be terminated. Nevertheless, K-One Tech will take all reasonable and necessary steps to ensure completion of the SSA but at the same time take precautionary measures to safeguard the interest of the Company.

The proposed acquisition is subject to satisfaction of the parties of their respective obligations, duties and compliance with the relevant authorities as may be required as set out in the SSA. Any breach of material obligations is an event of default and may entitle the non-breaching party to terminate the SSA. As such, there is no assurance that K-One Tech will realize anticipated returns from the proposed acquisition and/or to recover all costs or losses incurred arising from the termination.

This announcement is dated 22 March 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 25-3-2017 05:48 AM

|

显示全部楼层

发表于 25-3-2017 05:48 AM

|

显示全部楼层

Date of change | 23 Mar 2017 | Name | MR CHOI KENG MUN | Age | 47 | Gender | Male | Nationality | Malaysia | Type of change | Appointment | Designation | Others | Qualifications | 1) Professional qualification from the Association of Chartered Certified Accountants (ACCA); and2) Member of the Malaysia Institute of Accountants (MIA). | Working experience and occupation | Mr. Choi Keng Mun joined the K-One Group as its Associate Finance & Business Director in February 2016. Following a re-organization, he will with immediate effect head the finance and accounts functions. He spent about 14 years in internal audit, IS and finance functions with various banks; CIMB, Southern Bank and Kenanga before taking up the position of General Director in a feedmeal company in Vietnam for about 2 years prior to joining the K-One Group. | Directorships in public companies and listed issuers (if any) | Nil | Family relationship with any director and/or major shareholder of the listed issuer | Nil | Any conflict of interests that he/she has with the listed issuer | Nil | Details of any interest in the securities of the listed issuer or its subsidiaries | 2,100,000 ESOS Options and 25,000 Shares. |

| Remarks : | | Mr. Choi Keng Mun's designation is Associate Finance & Business Director. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-5-2017 06:57 AM

|

显示全部楼层

发表于 20-5-2017 06:57 AM

|

显示全部楼层

本帖最后由 icy97 于 22-5-2017 12:29 AM 编辑

企文科技联手MBAN

培育有潜质初创企业

2017年5月20日

(吉隆坡19日讯)企文科技(K1,0111,创业板)与Cradle基金私人有限公司及马来西亚商业天使网络(简称MBAN)签署了解备忘录,联手培育具潜质的初创企业(Startup)。

该公司昨天向大马交易所报备,在这项为期1年的备忘录中,三方将合作支持Cradle计划,联合私人领域伙伴及初创企业,以改善初创企业的创造价值潜能。

通过该计划,企文科技可联系Cradle旗下的初创企业,探讨对双方有利益的商业协议。

企文科技称,该备忘录不会带来新业务风险,该公司也会谨慎评估初创企业投资。【e南洋】

Type | Announcement | Subject | OTHERS | Description | K-ONE TECHNOLOGY BERHAD MEMORANDUM OF UNDERSTANDING BETWEEN K-ONE TECHNOLOGY BERHAD ("K-One Tech" or "The Company"), CRADLE FUND SDN. BHD. ("CRADLE') AND MALAYSIAN BUSINESS ANGEL NETWORK ("MBAN") | Please refer to attachment for further details. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5431133

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2017 07:08 PM

|

显示全部楼层

发表于 2-6-2017 07:08 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2017 | 31 Mar 2016 | 31 Mar 2017 | 31 Mar 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 19,967 | 22,261 | 19,967 | 22,261 | | 2 | Profit/(loss) before tax | -8,438 | -1,193 | -8,438 | -1,193 | | 3 | Profit/(loss) for the period | -8,798 | -1,359 | -8,798 | -1,359 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -8,814 | -1,305 | -8,814 | -1,305 | | 5 | Basic earnings/(loss) per share (Subunit) | -1.83 | -0.29 | -1.83 | -0.29 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1603 | 0.1607

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-6-2017 02:49 AM

|

显示全部楼层

发表于 3-6-2017 02:49 AM

|

显示全部楼层

文科技前景如何?

读者TAN:

2.请分析一下企文科技(K1,0111,创业板科技组)。

文科技前景如何?

答2:先看看企文科技的业绩表现及财务状况。截至2016年12月31日为止第四季,该公司蒙受704万5000令吉的净亏损(每股净亏损为1.49仙),比较前期净利为375万8000令吉。

它的营业额也跌至2123万8000令吉,前期为3391万令吉。

去年从盈转亏

随着第四季蒙亏,它同期全年也是从盈转亏,蒙受净亏损939万3000令吉(每股净亏1.98仙),比较前期净利为1113万9000令吉(每股净利为2.58仙)。

全年营业额也减少至8186万4000令吉,较前期为3391万令吉。

该公司2016财政年转盈为亏,主要是它全面退出流动电话饰件的原厂委托设计代工(ODM)的业务,因该领域的市场竞争激烈及赚幅严重受到挤压,这使它为此业务的商誉及器材设施,分别作出550万及210万令吉的减记拨备所致。

财务状况方面,该公司的总资产为9181万令吉,主要包括短期现金基金为3750万令吉、贸易应收款项为1814万8000令吉、及现金及银行余款为1431万3000令吉。

该公司的约负债仅为1584万2000令吉,主要是贸易应付款项为1524万3000令吉。

该公司的每股资产值为16.07仙。股本为4726万6000令吉,由4亿7266万股每股面值10仙的股票组成。

目前该公司旗下制造业务,较为注重在物联网小配件、保健用品及医药器材、地面护理产品、电子头戴小型电灯以及工业产品等。

该公司业务产业主要是供出口市场(2016年99.5%出口,2015年则99.7%),主要供消费者电子市场,它拥有季节周期性,一般上下半年表现较好,主要是海外市场年终佳节期间对其产品需求较为殷切。

870万购保安公司

该公司最近的企业动作,是在今年3月18日宣布以870万令吉,收购一家保安公司——AHM谘询与保安服务有限公司的30%股权,此项收购与公司现有业务具有协作效益,并为未来成长潜在进行布局。

它甫收购公司主要为政府相关公司与政府机构提供保安、巡逻及运款等服务。卖方提供自2017年1月1至2018年12月杪,2年内的1400万令吉盈利保证。上述一点资料供参考。

文章来源:

星洲日报‧投资致富‧投资问诊‧文:李文龙‧2017.05.28 |

|

|

|

|

|

|

|

|

|

|

|

发表于 4-6-2017 05:13 AM

|

显示全部楼层

发表于 4-6-2017 05:13 AM

|

显示全部楼层

年杪贡献料增.企文冀新业务助转盈

(吉隆坡26日讯)企文科技(K1,0111,创业板科技组)放眼透过进入的朝阳行业,能够为公司注入新气象,扭转亏损窘境。

企文科技主席林明福在股东大会后,向《星洲财经》表示,预计新业务,包括物联网(IoT)、医疗保健设施及汽车零件能够在未来带来30%的营业额贡献,30%则来自现有的科技消费品、监控摄像镜头15%及剩余为地板护理产品。

他指出,尽管新业务目前贡献不显著,惟相信年杪或明年初贡献将显著及该业务将逐渐成长。

林明福指出,新业务也是以出口市场为主,目前该公司超过95%的营业额贡献来自于海外市场。

全年转亏923万

2016财政年,企文科技营业额大挫43.95%至8186万4186令吉,且由前期的1113万9242令吉净利转为922万5964令吉净亏。

林明福指出,该公司目前已完全退出早期营业额贡献占逾40%的手机配件原件设计制造(ODM)业务,不过,将透过自有品牌生产(OBM)方式,进入手机配件领域。

他说,在2个月前,企文科技已自行生产K1GO品牌的手机配件,包括USB电缆、耳机等,未来计划拓展至生活化消费品上。

林明福也表示,企文科技预计今年的资本开销为200万至300万令吉,主要作为生产及添购器材之用。

另外,林明福指出,企文科技预计在今年将收购一家可为公司带来协同效应的公司,目前在与数家公司进行协商。

至于收购AHM谘询与保安服务有限公司的进展,林明福表示,预计可在两个月后完成。

林明福也指出,在今年3月,在八打灵总部打造了“KiasuLab”,主要出租于科技业务的初创公司。

他说,KiasuLab将提供业者完整设备,一旦企文科技寻获有潜能的公司,则将会投入资金亦或可以协助业者生产产品,可谓一举多得。

林明福表示,企文科技预计在未来18个月内,在巴生河流域开设另外两家KiasuLab,一旦获得好评将考虑拓展至其他州属,而每家的开设成本约数百万令吉。

文章来源:

星洲日报/财经 ‧报道:刘玉萍 ‧2017.05.26 |

|

|

|

|

|

|

|

|

|

|

|

发表于 14-8-2017 10:58 PM

|

显示全部楼层

发表于 14-8-2017 10:58 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2017 | 30 Jun 2016 | 30 Jun 2017 | 30 Jun 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 19,493 | 18,985 | 39,460 | 41,246 | | 2 | Profit/(loss) before tax | 1,498 | 1,316 | -6,940 | 123 | | 3 | Profit/(loss) for the period | 1,040 | 1,372 | -7,758 | 13 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,034 | 1,477 | -7,780 | 172 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.20 | 0.29 | -1.55 | 0.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1623 | 0.1607

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-11-2017 06:31 AM

|

显示全部楼层

发表于 18-11-2017 06:31 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2017 | 30 Sep 2016 | 30 Sep 2017 | 30 Sep 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,261 | 19,380 | 59,721 | 60,626 | | 2 | Profit/(loss) before tax | 1,438 | -2,262 | -5,502 | -2,139 | | 3 | Profit/(loss) for the period | 1,108 | -2,361 | -6,650 | -2,348 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,105 | -2,293 | -6,659 | -2,175 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.22 | -0.50 | -1.31 | -0.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1643 | 0.1607

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-12-2017 06:40 AM

|

显示全部楼层

发表于 20-12-2017 06:40 AM

|

显示全部楼层

本帖最后由 icy97 于 23-12-2017 06:58 AM 编辑

企文科技购2英亩怡保地皮

Sangeetha Amarthalingam/theedgemarkets.com

December 18, 2017 19:24 pm +08

(吉隆坡18日讯)企文科技(K-One Technology Bhd)计划以91万令吉,购入位于怡保Jelapang Free Trade Zone 2,一块占地2英亩的地皮,作为日后拓展业务用途。

目前,集团在毗邻Silibin工业区有两间制造与商业营运厂房,预计将无法满足日后的业务需求。

企文科技是向OCI Engineering私人有限公司购入上述地皮。

企文科技说:“集团将利用这块地皮来扩大营运及制造业务,这块地皮的优势在于靠近现有厂房(仅距离1公里),可舒缓管理与物流问题。”

“同时,这块地皮位于自由贸易区,可促进出口程序。现有厂房持有制造仓库执照,比较多繁文缛节。”

集团计划通过内部融资,筹措上述资金。

在任何无可预见的情况下,预计上述收购活动在2018年5月份完成。

(编译:魏素雯)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | K-ONE TECHNOLOGY BERHAD ("K-ONE TECH" OR "THE COMPANY")ACQUISITION OF VACANT INDUSTRIAL LAND MEASURING IN AREA OF APPROXIMATELY 7,693 SQUARE METRES HELD UNDER ISSUE DOCUMENT OF TITLE DESCRIBED AS PAJAKAN NEGERI 384487; LOT 187098 MUKIM HULU KINTA, DAERAH KINTA, NEGERI PERAK BEARING MUNICIPAL ADDRESS PLOT 24, JALAN INDUSTRI 3, ZON PERDAGANGAN BEBAS JELAPANG 2, 30100 IPOH, PERAK FOR A TOTAL CASH CONSIDERATION OF RM911,000 BY K-ONE INDUSTRY SDN BHD (COMPANY NO.: 554489-P) ("THE ACQUISITION") | The Board of Directors of K-One Technology Berhad (“K-One Tech”) is pleased to announce that K-One Industry Sdn Bhd (Company No.: 554489-P) (“K-One Ind”), a wholly-owned subsidiary of the Company had on 18 December 2017 entered into a Sale and Purchase Agreement (“SPA”) with OCI Engineering Sdn Bhd (Company No.: 179502-X) (“the Vendor”) for the acquisition of all that piece of vacant industrial land measuring in area of approximately 7,693 square metres (approximately 2 acres) held under issue document of title described as Pajakan Negeri 384487; Lot 187098 Mukim Hulu Kinta, Daerah Kinta, Negeri Perak bearing municipal address Plot 24, Jalan Industri 3, Zon Perdagangan Bebas Jelapang 2, 30100 Ipoh, Perak (“the Property”) for a total cash consideration of RM911,000 (excluding 6% GST).

Please refer to the attachment for details of the Acquisition.

This announcement is dated 18 December 2017. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5640681

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-1-2018 02:33 AM

|

显示全部楼层

发表于 18-1-2018 02:33 AM

|

显示全部楼层

icy97 发表于 18-3-2017 03:08 AM

企文科技870万购安全服务公司30%股权

By Ahmad Naqib Idris / theedgemarkets.com | March 17, 2017 : 6:57 PM MYT

(吉隆坡17日讯)企文科技(K-One Technology Bhd)献议以870万令吉,收购安全咨询与服务公 ...

Type | Announcement | Subject | OTHERS | Description | K-One Technology Berhad ("K-One Tech" or "The Company")Acquisition Of 30% Equity Interest In AHM Consultancy & Security Services Sdn. Bhd. ("AHM") For Cash Consideration Of RM8.7 Million ("Proposal") | Further to the Company’s announcements on 17 March 2017, 22 March 2017, 16 June 2017, 6 October 2017 and 29 December 2017, the Board of Directors (“Board”) wishes to announce that the acquisition of a 30% equity interest in AHM Consultancy & Security Services Sdn. Bhd. (“AHM”) is completed following the transfer of the vendors’ shares to the Company and the appointment of Lim Beng Fook, Chairman of the Company to AHM’s board.

This announcement is dated 17 January 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-2-2018 06:16 AM

|

显示全部楼层

发表于 27-2-2018 06:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,547 | 21,238 | 78,268 | 81,864 | | 2 | Profit/(loss) before tax | -3,079 | -6,912 | -8,582 | -9,051 | | 3 | Profit/(loss) for the period | -2,956 | -6,877 | -9,607 | -9,225 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -2,962 | -7,043 | -9,622 | -9,218 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.57 | -1.45 | -1.88 | -1.95 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1681 | 0.1607

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 05:25 AM

|

显示全部楼层

发表于 30-5-2018 05:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 18,786 | 19,967 | 18,786 | 19,967 | | 2 | Profit/(loss) before tax | 305 | -8,438 | 305 | -8,438 | | 3 | Profit/(loss) for the period | 28 | -8,798 | 28 | -8,798 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 21 | -8,814 | 21 | -8,814 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.01 | -1.83 | 0.01 | -1.83 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1667 | 0.1651

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 13-6-2018 06:46 AM

|

显示全部楼层

发表于 13-6-2018 06:46 AM

|

显示全部楼层

Name | MR BJORN BRATEN | Nationality/Country of incorporation | Norway | Descriptions (Class) | Ordinary Shares |

Details of changesNo | Date of change | No of securities | Type of Transaction | Nature of Interest | | 1 | 05 Jun 2018 | 10,000,000 | Disposed | Direct Interest | Name of registered holder | Bjorn Braten | Address of registered holder | Jegerasen 3A N-1362 Hosle, Norway | Description of "Others" Type of Transaction | |

Circumstances by reason of which change has occurred | Disposal of shares via off market transaction | Nature of interest | Direct Interest | Direct (units) | 30,243,694 | Direct (%) | 5.826 | Indirect/deemed interest (units) | 0 | Indirect/deemed interest (%) | 0 | Total no of securities after change | 30,243,694 | Date of notice | 08 Jun 2018 | Date notice received by Listed Issuer | 08 Jun 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-6-2018 04:12 AM

|

显示全部楼层

发表于 22-6-2018 04:12 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | MR BJORN BRATEN | Nationality/Country of incorporation | Norway | Descriptions (Class) | Ordinary Shares | Date of cessation | 18 Jun 2018 | Name & address of registered holder | Bjorn BratenJegerasen 3AN-1362Hosle, Norway |

No of securities disposed | 5,000,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Disposal of shares via off market transaction | Nature of interest | Direct Interest |  | Date of notice | 20 Jun 2018 | Date notice received by Listed Issuer | 20 Jun 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 17-8-2018 02:44 AM

|

显示全部楼层

发表于 17-8-2018 02:44 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 16,147 | 19,493 | 34,933 | 39,460 | | 2 | Profit/(loss) before tax | 1,754 | 1,498 | 2,059 | -6,940 | | 3 | Profit/(loss) for the period | 1,503 | 1,040 | 1,531 | -7,758 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,496 | 1,034 | 1,517 | -7,780 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.29 | 0.20 | 0.29 | -1.55 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1703 | 0.1651

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:55 AM

|

显示全部楼层

发表于 28-8-2018 06:55 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 06:54 AM 编辑

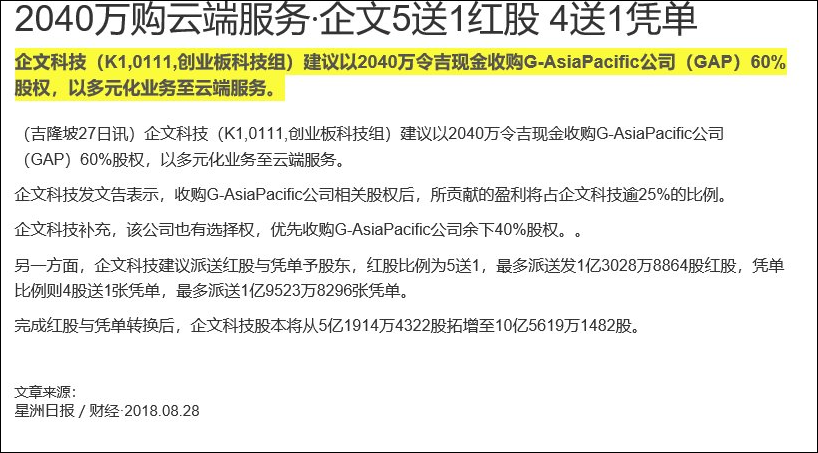

Type | Announcement | Subject | MULTIPLE PROPOSALS | Description | K-ONE TECHNOLOGY BERHAD ("K-ONE TECH" OR "COMPANY")(I) PROPOSED ACQUISITION OF 60% EQUITY INTEREST IN G-ASIAPACIFIC SDN BHD;(II) PROPOSED CALL/PUT OPTIONS;(III) PROPOSED DIVERSIFICATION;(IV) PROPOSED BONUS ISSUE OF SHARES; AND(V) PROPOSED FREE WARRANTS ISSUE(COLLECTIVELY REFERRED TO AS "PROPOSALS") | On behalf of the Board of Directors of K-One Tech (“Board”), Kenanga Investment Bank Berhad (“Kenanga IB”) wishes to announce that the Company had on 27 August 2018 entered into the following:

(i) a conditional share sale agreement (“SSA”) with Goh Kiang Kiat, Goh Kiang Kian and Chen Kak Toong (“Vendors”, collectively) for the proposed acquisition of 600,000 ordinary shares in G-AsiaPacific Sdn Bhd (“GAP”) (“GAP Shares” or “Sale Shares”), representing 60% equity interest in GAP, for a purchase consideration of RM20,400,000 (“Purchase Consideration”), to be fully satisfied in cash (“Proposed Acquisition”);

(ii) call option agreement and put option agreement with the Vendors (being the shareholders of GAP, collectively holding 40% equity interest after the Proposed Acquisition) (“Call/Put Options Agreements”) for the following:

(a) the granting by the Vendors of a call option for the Company to acquire all the remaining equity interest in GAP held by the Vendors (“Option Shares”) (“Call Option”); and

(b) the granting by the Company of a put option for the Vendors to sell all the remaining equity interest in GAP to the Company (“Put Option”).

(The Call Option and Put Option are collectively referred to as the “Proposed Call/Put Options”).

In conjunction with the Proposed Acquisition, the Company proposes to undertake a proposed diversification of the principal activities of the Company and its subsidiaries (“K-One Group” or “Group”) to include provision of cloud computing solutions and its related services (“Cloud Computing Solutions Business”) (“Proposed Diversification”) as the Company envisages that the eventual contribution arising from the Proposed Acquisition will be more than 25% of the net profits of the Group and as such will result in a diversification of the Group’s existing core business.

In addition to the above, on behalf of the Board, Kenanga IB wishes to announce that the Company proposes to undertake the following: (i) bonus issue of up to 130,288,864 new ordinary shares in K-One Tech (“K-One Tech Shares” or “Shares”) (“Bonus Shares”) on the basis of 1 Bonus Share for every 5 existing Shares held on an entitlement date to be determined and announced later (“Entitlement Date”) (“Proposed Bonus Issue of Shares”); and

(ii) proposed free warrants issue of up to 195,433,296 warrants (“Warrants”) on the basis of 1 Warrant for every 4 existing Shares held on an Entitlement Date (“Proposed Free Warrants Issue”).

Please refer to the attachment for further details of the Proposals.

This announcement is dated 27 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5895453

|

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2018 02:44 AM

|

显示全部楼层

发表于 8-10-2018 02:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-11-2018 08:03 AM

|

显示全部楼层

发表于 17-11-2018 08:03 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,091 | 20,261 | 55,024 | 59,721 | | 2 | Profit/(loss) before tax | 2,313 | 1,438 | 4,372 | -5,502 | | 3 | Profit/(loss) for the period | 2,007 | 1,108 | 3,538 | -6,650 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,017 | 1,105 | 3,534 | -6,659 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.39 | 0.22 | 0.68 | -1.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1751 | 0.1651

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-12-2018 06:54 AM

|

显示全部楼层

发表于 29-12-2018 06:54 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | ESOS | Details of corporate proposal | Exercise of Option to Subscribe | No. of shares issued under this corporate proposal | 6,600,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1650 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 525,744,322 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 54,862,991.400 | Listing Date | 26 Nov 2018 | | 2. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | ESOS | Details of corporate proposal | Exercise of Option to Subscribe | No. of shares issued under this corporate proposal | 120,000 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.1900 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 525,864,322 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 54,885,791.400 | Listing Date | 26 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|