|

|

楼主 |

发表于 21-8-2018 03:57 AM

|

显示全部楼层

EX-date | 07 Sep 2018 | Entitlement date | 13 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Dividend of 2 sen per ordinary share | Period of interest payment | to | Financial Year End | 30 Sep 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-8-2018 03:58 AM

|

显示全部楼层

EX-date | 07 Sep 2018 | Entitlement date | 13 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | Special Dividend | Entitlement description | Special Dividend of 2 sen per ordinary share | Period of interest payment | to | Financial Year End | 30 Sep 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi59200 Kuala LumpurTel:0327839299Fax:0327839222 | Payment date | 28 Sep 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-10-2018 06:34 AM

|

显示全部楼层

本帖最后由 icy97 于 25-10-2018 04:45 AM 编辑

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY")- Letter of Acceptance to Transsystem Continental Sdn. Bhd., a 60%-owned Subsidiary of EITA | 1. INTRODUCTION

The Board of Directors of EITA is pleased to announce that Transsystem Continental Sdn. Bhd. (“TSC”), a 60%-owned subsidiary of EITA, had on 23 October 2018 received a Letter of Acceptance (“LOA”) from Tenaga Nasional Berhad to carry out 132kV double circuit underground cable from Pencawang Masuk Utama (“PMU”) Ampang to PMU Taman Melawati.

2. THE CONTRACT SUM

The Contract sum is RM56,359,377.00 only.

3. DURATION OF THE CONTRACT

The Contract shall be effective from 22 October 2018 and the time for completion shall be Seven Hundred Thirty (730) days from the commencement date.

4. FINANCIAL EFFECTS

The Contract will not have any material effect on the net assets and gearing of EITA Group for the financial year ending 30 September 2019 and is expected to contribute positively to the earnings of EITA Group over the duration of the Contract.

5. THE RISK IN RELATION TO THE CONTRACT

The potential risks involved in the Contract are the same with any other projects undertaken by TSC which are considered normal operational risks.

6. DIRECTORS AND/OR MAJOR SHAREHOLDERS’ INTEREST

None of the Directors and/or major shareholders of EITA and/or persons connected with them have any interest, whether direct or indirect, in the Contract.

7. STATEMENT OF THE DIRECTORS

The Board of Directors of the Company is of the opinion that the Contract is in the ordinary course of business and in the best interest of EITA Group.

This announcement is dated 23 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-10-2018 05:35 AM

|

显示全部楼层

本帖最后由 icy97 于 31-10-2018 04:50 AM 编辑

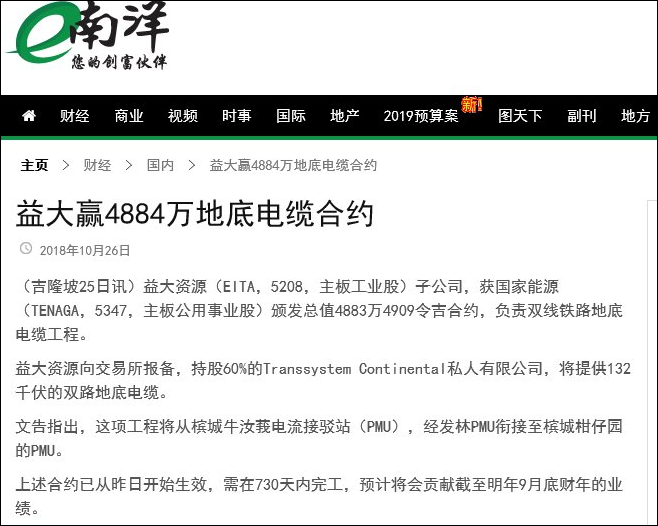

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY")- Letter of Acceptance to Transsystem Continental Sdn. Bhd., a 60%-owned Subsidiary of EITA | 1. INTRODUCTION

The Board of Directors of EITA is pleased to announce that Transsystem Continental Sdn. Bhd. (“TSC”), a 60%-owned subsidiary of EITA, had on 25 October 2018 received a Letter of Acceptance (“LOA”) from Tenaga Nasional Berhad to carry out 132kV double circuit loop in/out underground cable from Pencawang Masuk Utama (“PMU”) Gelugor to PMU Farlim into PMU Datuk Keramat.

2. THE CONTRACT SUM

The Contract sum is RM48,834,909.04 only.

3. DURATION OF THE CONTRACT

The Contract shall be effective from 25 October 2018 and the time for completion shall be Seven Hundred Thirty (730) days from the commencement date.

4. FINANCIAL EFFECTS

The Contract will not have any material effect on the net assets and gearing of EITA Group for the financial year ending 30 September 2019 and is expected to contribute positively to the earnings of EITA Group over the duration of the Contract.

5. THE RISK IN RELATION TO THE CONTRACT

The potential risks involved in the Contract are the same with any other projects undertaken by TSC which are considered normal operational risks.

6. DIRECTORS AND/OR MAJOR SHAREHOLDERS’ INTEREST

None of the Directors and/or major shareholders of EITA and/or persons connected with them have any interest, whether direct or indirect, in the Contract.

7. STATEMENT OF THE DIRECTORS

The Board of Directors of the Company is of the opinion that the Contract is in the ordinary course of business and is in the best interest of EITA Group.

This announcement is dated 25 October 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-10-2018 05:51 AM

|

显示全部楼层

本帖最后由 icy97 于 31-10-2018 08:18 AM 编辑

益大资源获本周第三份国能合约

Emir Zainul/theedgemarkets.com

October 26, 2018 19:16 pm +08

(吉隆坡26日讯)益大资源(EITA Resources Bhd)持股60%的子公司TransSystem Continental私人有限公司,获国家能源(Tenaga Nasional Bhd)颁发主变电站扩建合约,总值1828万令吉。

益大资源今日向大马交易所报备,TransSystem今日收到一份中标通知书,承接霹雳州爱大华500/275千伏主变电站扩建工程。

这项工程于本月23日开始,并将在912天内完成。

“该合约不会对截至明年9月杪2019财政年的净资产和负债有任何实质影响,但料在合约期内为盈利作出贡献。”

这份合约是TransSystem本周从国能获得的第三份合约。

益大资源昨日公布,TransSystem承接槟城132千伏双回路地下电缆工程,总值4883万令吉。周二亦获得位于安邦的类似合约,总值5636万令吉。

这3份合约的总值为1亿2347万令吉。

(编译:陈慧珊)

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY")- Letter of Acceptance to Transsystem Continental Sdn. Bhd., a 60%-owned Subsidiary of EITA | 1. INTRODUCTION The Board of Directors of EITA is pleased to announce that TransSystem Continental Sdn. Bhd. (“TSC”), a 60%-owned subsidiary of EITA, had on 26 October 2018 received a Letter of Acceptance dated 23 October 2018 (“LOA”) from Tenaga Nasional Berhad to carry out Pencawang Masuk Utama (“PMU”) 500/275kV Ayer Tawar Extension, Perak.

2. THE CONTRACT SUM The Contract sum is RM18,279,204.00 only.

3. DURATION OF THE CONTRACT The Contract shall be effective from 23 October 2018 and the time for completion shall be Nine Hundred Twelve (912) days from the commencement date.

4. FINANCIAL EFFECTS The Contract will not have any material effect on the net assets and gearing of EITA Group for the financial year ending 30 September 2019 and is expected to contribute positively to the earnings of EITA Group over the duration of the Contract.

5. THE RISK IN RELATION TO THE CONTRACT The potential risks involved in the Contract are the same with any other projects undertaken by TSC which are considered normal operational risks.

6. DIRECTORS AND/OR MAJOR SHAREHOLDERS’ INTEREST None of the Directors and/or major shareholders of EITA and/or persons connected with them have any interest, whether direct or indirect, in the Contract.

7. STATEMENT OF THE DIRECTORS The Board of Directors of the Company is of the opinion that the Contract is in the ordinary course of business and is in the best interest of EITA Group.

This announcement is dated 26 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 4-11-2018 07:52 AM

|

显示全部楼层

本帖最后由 icy97 于 20-11-2018 01:37 AM 编辑

益大资源获4894万合约-负责甲州电流接驳站工程

http://www.enanyang.my/news/20181108/益大资源获4894万合约br-负责甲州电流接驳站工程/

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY")- Letter of Acceptance to TransSystem Continental Sdn. Bhd., a 60%-owned Subsidiary of EITA | 1. INTRODUCTION

The Board of Directors of EITA is pleased to announce that TransSystem Continental Sdn. Bhd. (“TSC”), a 60%-owned subsidiary of EITA, had on 31 October 2018 received a Letter of Acceptance dated 31 October 2018 (“LOA”) from Tenaga Nasional Berhad to carry out double circuit 132kV underground cable from Pencawang Masuk Utama (“PMU”) Ujong Pasir to PMU Pulau Melaka.

2. THE CONTRACT SUM

The Contract sum is RM48,943,750.00 only.

3. DURATION OF THE CONTRACT

The Contract shall be effective from 31 October 2018 and the time for completion shall be Six Hundred Five (605) days from the commencement date.

4. FINANCIAL EFFECTS

The Contract will not have any material effect on the net assets and gearing of EITA Group for the financial year ending 30 September 2019 and is expected to contribute positively to the earnings of EITA Group over the duration of the Contract.

5. THE RISK IN RELATION TO THE CONTRACT

The potential risks involved in the Contract are the same with any other projects undertaken by TSC which are considered normal operational risks.

6. DIRECTORS AND/OR MAJOR SHAREHOLDERS’ INTEREST

None of the Directors and/or major shareholders of EITA and/or persons connected with them have any interest, whether direct or indirect, in the Contract.

7. STATEMENT OF THE DIRECTORS

The Board of Directors of the Company is of the opinion that the Contract is in the ordinary course of business and is in the best interest of EITA Group.

This announcement is dated 31 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-11-2018 12:14 AM

|

显示全部楼层

Date of change | 01 Nov 2018 | Name | MR CHONG YOKE PENG | Age | 59 | Gender | Male | Nationality | Malaysia | Designation | Executive Director | Directorate | Executive | Type of change | Resignation | Reason | Restructuring of Board composition for the purpose of applying Practice 4.1 of the Malaysian Code on Corporate Governance which recommends that at least half of the Board shall comprise Independent Directors. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-11-2018 12:38 AM

|

显示全部楼层

本帖最后由 icy97 于 18-11-2018 05:21 AM 编辑

Date of change | 01 Nov 2018 | Name | MR CHONG YOKE PENG | Age | 59 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Business Administration | Royal Melbourne Institute of Technology,Australia | | | 2 | Others | Certificate in Materials Engineering | Tunku Abdul Rahman College | |

Working experience and occupation | Mr. Chong Yoke Peng started his career in 1982 as a Quality Control Supervisor in Lion Metal Industries Sdn. Bhd. Subsequently, he joined See Sun Engineering Sdn. Bhd. as a Sales Executive in 1983 and in 1987, he left to join BBC Brown Boveri Sdn. Bhd. as a Sales Representative. He was a Sales Executive with Lim Kim Hai Electric Sdn. Bhd. in 1988 and was promoted to the position of Sales Manager in 1990. He joined EITA Electric Sdn. Bhd. as the General Manager/Executive Director in 1996 and was promoted to Managing Director in 2009.Mr. Chong has gained vast working experience over the last 30 years in managing sales and marketing of Electrical and Electronic components business in Malaysia. | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest - 4,359,236 ordinary shares of EITA Resources BerhadIndirect Interest - 130,000 ordinary shares of EITA Resources Berhad(Deemed interested by virtue of the shares held by his spouse, Jane Chew Yin Sum) |

| Remarks : | | Mr. Chong Yoke Peng is an Alternate Director to Mr. Lee Peng Sian. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-11-2018 12:39 AM

|

显示全部楼层

本帖最后由 icy97 于 18-11-2018 05:23 AM 编辑

Date of change | 01 Nov 2018 | Name | MR CHIA SEONG POW | Age | 63 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Non Independent and Non Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Diploma | Building Technology | Tunku Abdul Rahman College | |

Working experience and occupation | Mr. Chia Seong Pow is one of the founder members of QL Resources Berhad Group. He joined CBG Holdings Sdn. Bhd. as Marketing Director in 1984. He has more than 25 years of experience in the livestock and food industry covering layer farming, manufacturing, trading and shipping. Currently, Mr. Chia is an Executive Director of QL Resources Berhad and is mainly in charge of layer farming, regional merchanting trade in food grains as well as new business developments. Majority of the QL Resources Berhad's new expansion programmes were initiated by him. | Directorships in public companies and listed issuers (if any) | QL Resources Berhad | Family relationship with any director and/or major shareholder of the listed issuer | Mr. Chia Seong Pow is a major shareholder and the younger brother to Mr. Chia Seong Fatt, another major shareholder of EITA Resources Berhad. | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest - 200,000 ordinary shares of EITA Resources BerhadIndirect Interest - 29,873,259 ordinary shares of EITA Resources Berhad(Deemed interested by virtue of his beneficial interests in Farsathy Holdings Sdn. Bhd. held via the trust arrangement with Equity Trust (Malaysia) Berhad pursuant to Section 8 of the Companies Act 2016) |

| Remarks : | | Mr. Chia Seong Pow is an Alternate Director to Mr. Chia Mak Hooi. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-12-2018 03:46 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 63,975 | 60,160 | 263,376 | 270,680 | | 2 | Profit/(loss) before tax | 8,109 | 2,813 | 26,751 | 26,691 | | 3 | Profit/(loss) for the period | 5,839 | 2,063 | 20,485 | 19,770 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,817 | 2,204 | 20,085 | 19,921 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.47 | 1.70 | 15.45 | 15.32 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 3.00 | 7.00 | 5.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2900 | 1.2100

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-12-2018 03:52 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY")- PROPOSED FINAL DIVIDEND FOR THE FINANCIAL YEAR ENDED 30 SEPTEMBER 2018 | The Company is pleased to announce that the Board of Directors of EITA has recommended a Final Dividend of 3.0 sen per ordinary share in respect of the financial year ended 30 September 2018. The proposed dividend is subject to the approval of the shareholders of the Company at the forthcoming Annual General Meeting.

The entitlement and payment dates shall be finalised by the Company at a later date and announced in due course.

Together with the First Interim Dividend of 2.0 sen per ordinary share and the Special Dividend of 2.0 sen per ordinary share, which have been paid to the shareholders of the Company on 28 September 2018, it will bring the total dividend payout in respect of the financial year ended 30 September 2018 to 7.0 sen per ordinary share.

This announcement is dated 23 November 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-2-2019 07:37 AM

|

显示全部楼层

本帖最后由 icy97 于 10-2-2019 02:47 AM 编辑

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY") - SHAREHOLDERS AGREEMENT ENTERED INTO BETWEEN EITA ELEVATOR (MALAYSIA) SDN. BHD. AND KOP MANTAP BERHAD | The Board of Directors of EITA wishes to announce that EITA Elevator (Malaysia) Sdn. Bhd., a wholly-owned subsidiary of the Company, had on 29 January 2019 entered into a Shareholders Agreement with KOP Mantap Berhad.

Please refer to the attachment for the details of this announcement.

|

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6053017

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD ("EITA" OR "THE COMPANY") - SHAREHOLDERS AGREEMENT ENTERED INTO BETWEEN EITA ELEVATOR (MALAYSIA) SDN. BHD. AND KOP MANTAP BERHAD | The Board of Directors of EITA wishes to announce that EITA Elevator (Malaysia) Sdn. Bhd., a wholly-owned subsidiary of the Company, had on 29 January 2019 entered into a Shareholders Agreement with KOP Mantap Berhad.

Please refer to the attachment for the details of this announcement. Remarks:

The following amendments were made:-

1. Paragraph 3.1(a)(iv) - to correct the typo error, the value of the scholarship should be read as RM20,000.00; and 2. Paragraph 3.1(b)(i) – to provide further clarification on the salient terms of the Shareholders Agreement in relation to the obligations of KOP. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6053669

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 21-2-2019 05:42 AM

|

显示全部楼层

EX-date | 15 Mar 2019 | Entitlement date | 19 Mar 2019 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final Single-Tier Dividend of 3.0 sen per ordinary share | Period of interest payment | to | Financial Year End | 30 Sep 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN BHDUnit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi,59200 Kuala LumpurTel: 03-27839299Fax: 03-27839222 | Payment date | 02 Apr 2019 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Mar 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 6-3-2019 07:25 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 51,633 | 69,367 | 51,633 | 69,367 | | 2 | Profit/(loss) before tax | 2,461 | 7,955 | 2,461 | 7,955 | | 3 | Profit/(loss) for the period | 1,404 | 6,515 | 1,404 | 6,515 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,638 | 6,503 | 1,638 | 6,503 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.26 | 5.00 | 1.26 | 5.00 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2600 | 1.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-6-2019 05:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 67,459 | 62,438 | 119,092 | 131,805 | | 2 | Profit/(loss) before tax | 8,689 | 5,880 | 11,150 | 13,835 | | 3 | Profit/(loss) for the period | 6,373 | 4,287 | 7,777 | 10,801 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,429 | 4,300 | 8,067 | 10,802 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.95 | 3.31 | 6.21 | 8.31 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3100 | 1.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-8-2019 05:26 AM

|

显示全部楼层

本帖最后由 icy97 于 8-8-2019 07:33 AM 编辑

益大资源LRT3合约价值遭大砍65%至6745万

Justin Lim/theedgemarkets.com

August 07, 2019 20:19 pm +08

https://www.theedgemarkets.com/article/益大资源lrt3合约价值遭大砍65至6745万

(吉隆坡7日讯)益大资源(Eita Resources Bhd)为第三轻快铁计划(LRT3)提供升降机和自动扶梯的合约金额从先前的1亿9507万令吉,大砍65.42%至6745万令吉。

益大资源今日向大马交易所报备,该集团收到了LRT3项目交付伙伴(PDP)马资源乔治肯特私人有限公司(MRCB George Kent)发出的新委任书及终止通知。

益大资源表示,其子公司EITA Elevator(马)私人有限公司再次被委任为该项目的电梯和自动扶梯的供应、交付、安装、测试和调试工程配套承包商。

根据新合约,该公司将提供130个自动扶梯和66个升降机。

根据2018年2月的原始合约,益大资源子公司获国家基建公司(Prasarana Malaysia Bhd)授予一份价值8060万令吉的合约,为LRT3提供自动扶梯。

随后,该公司获得了三份合约,总值为1亿2619万令吉,用于同一目的。

上述合约价值被调整,是因为政府把LRT3总成本从316亿5000万令吉,大砍47%至166亿令吉。

LRT3路线是从八打灵再也万达镇(Bandar Utama)至巴生佐汉瑟迪亚(Johan Setia)。

(编译:魏素雯)

Type | Announcement | Subject | OTHERS | Description | EITA RESOURCES BERHAD (EITA OR THE COMPANY)- Letter of Appointment to EITA Elevator (Malaysia) Sdn. Bhd., a wholly-owned subsidiary of EITA, as the Contractor for supply, delivery, installation, testing and commissioning of lifts and escalators for Light Rail Transit Line 3 (LRT3) from Bandar Utama to Johan Setia | (Reference is made to the Company's announcements dated 28 February 2018 and 6 March 2018 in relation to the Letters of Acceptance ("Announcements"). Unless otherwise stated, all abbreviations and definitions used herein shall have the same meanings as those used in the Announcements.) 1. INTRODUCTION The Board of Directors of EITA wishes to announce that EITA Elevator (Malaysia) Sdn. Bhd. (“EEMSB”), a wholly-owned subsidiary of EITA, had on 7 August 2019 received four (4) Notices of Termination dated 6 August 2019 (“NOT”) and received a new Letter of Appointment dated 6 August 2019 (“LOA”) from MRCB George Kent Sdn. Bhd. to appoint EEMSB as the works package contractor to undertake the supply, delivery, installation, testing and commissioning of lifts and escalators for LRT3 from Bandar Utama to Johan Setia subject to the terms and conditions as stipulated in the LOA (“the Contract”). A total number of 130 units of escalator and 66 units of lift will be supplied and installed. 2. THE CONTRACT SUM The Contract sum has been revised from RM195,073,500.00 to RM67,450,000.00 only. 3. FINANCIAL EFFECTS The Contract will not have any material effect on the net assets and gearing of EITA Group for the financial year ending 30 September 2019 and is expected to contribute positively to the earnings of EITA Group over the duration of the Contract. 4. THE RISK IN RELATION TO THE CONTRACT The potential risks involved in the Contract are the same with any other projects undertaken by EEMSB which are considered normal operational risks. 5. DIRECTORS AND/OR MAJOR SHAREHOLDERS’ INTEREST None of the Directors and/or major shareholders of EITA and/or persons connected with them have any interest, whether direct or indirect, in the Contract. 6. STATEMENT OF THE DIRECTORS The Board of Directors of the Company is of the opinion that the Contract is in the ordinary course of business and is in the best interest of EITA Group. This announcement is dated 7 August 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-8-2019 06:56 AM

|

显示全部楼层

EX-date | 11 Sep 2019 | Entitlement date | 12 Sep 2019 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First Interim Dividend of 3 sen per ordinary share | Period of interest payment | to | Financial Year End | 30 Sep 2019 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | TRICOR INVESTOR & ISSUING HOUSE SERVICES SDN. BHD.Unit 32-01, Level 32, Tower A,Vertical Business Suite, Avenue 3, Bangsar South,No. 8, Jalan Kerinchi,59200 Kuala Lumpur,Wilayah PersekutuanTel: 03-2783 9299Fax: 03-2783 9222 | Payment date | 27 Sep 2019 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 12 Sep 2019 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-8-2019 07:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 81,067 | 69,308 | 200,159 | 201,113 | | 2 | Profit/(loss) before tax | 9,937 | 6,519 | 21,087 | 20,354 | | 3 | Profit/(loss) for the period | 7,467 | 5,146 | 15,244 | 15,947 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 6,915 | 4,767 | 14,982 | 15,569 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.32 | 3.67 | 11.52 | 11.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 4.00 | 3.00 | 4.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3400 | 1.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-2-2020 07:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 105,227 | 60,182 | 305,386 | 261,295 | | 2 | Profit/(loss) before tax | 7,834 | 5,292 | 28,921 | 25,646 | | 3 | Profit/(loss) for the period | 6,637 | 3,698 | 21,881 | 19,645 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,846 | 3,676 | 20,828 | 19,245 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.50 | 2.83 | 16.02 | 14.80 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 3.00 | 6.00 | 7.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.3300 | 1.2500

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 13-4-2020 06:04 AM

|

显示全部楼层

Entitlement subject | Final Dividend | Entitlement description | Final Dividend of 3.0 sen per ordinary share | Ex-Date | 28 Feb 2020 | Entitlement date | 02 Mar 2020 | Entitlement time | 05:00 PM | Financial Year End | 30 Sep 2019 | Period |

| | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Payment Date | 16 Mar 2020 | a.Securities transferred into the Depositor's Securities Account before 4:30 pm in respect of transfers | 02 Mar 2020 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units)

(If applicable) |

| | Entitlement indicator | Currency | Announced Currency | Malaysian Ringgit (MYR) | Disbursed Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | Malaysian Ringgit (MYR) 0.0300 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|