|

|

楼主 |

发表于 16-5-2018 04:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 63,821 | 96,519 | 63,821 | 96,519 | | 2 | Profit/(loss) before tax | 17,443 | -61,761 | 17,443 | -61,761 | | 3 | Profit/(loss) for the period | 17,207 | -61,874 | 17,207 | -61,874 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 0 | 0 | 0 | 0 | | 5 | Basic earnings/(loss) per share (Subunit) | 3.41 | -12.28 | 3.41 | -12.28 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.3400 | 0.3000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 25-5-2018 06:11 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | E.A. TECHNIQUE (M) BERHAD (E.A. TECHNIQUE OR THE COMPANY)CONTRACTUAL SETTLEMENT OF ENGINEERING, PROCUREMENT, CONSTRUCTION, INSTALLATION AND COMMISSIONING (EPCIC) OF A FLOATING STORAGE AND OFFLOADING (FSO) FACILITY FOR FULL FIELD DEVELOPMENT (FFD) PROJECT, NORTH MALAY BASIN | We refer to the earlier announcement made on 18 February 2015 relating to the EPCIC Contract (“Contract”) with HESS Exploration and Production Malaysia B.V (“HESS”) entered into on 22 December 2014 for the construction and delivery of a Floating, Storage and Offloading (FSO) Facility (hereinafter named “FSO Mekar Bergading”) for North Malay Basin.

The Board of Directors of E.A. Technique (“Board”) wish to announce that the Company and HESS (“Parties”) have entered into a Settlement Agreement (“Settlement”) for the FSO Mekar Bergading.

Under the Contract, valued at USD191.85 million (RM767.40 million), E.A. Technique was obliged to complete the construction and deliver the FSO Mekar Bergading to HESS’ offshore location within 22 months.

E.A. Technique was unable to deliver and install the FSO Mekar Bergading within the schedule under the Contract, and now seeks to amicably resolve the matter with Hess.

E.A. Technique have agreed to deliver and fully handover the FSO Mekar Bergarding at Malaysia Marine and Heavy Engineering (“MMHE”) yard in Pasir Gudang such that HESS may complete the final phases of construction, transportation, and installation of the facility.

The Settlement will have no effect on the issued and paid-up capital of the Company or the shareholdings of the Company’s substantial shareholders, and the transaction is expected to contribute positively towards the Company’s earnings and net assets per share.

Total costs are still to be finalised due to ongoing negotiations with sub-contractors, but the Settlement will reverse a portion of the provision for foreseeable losses.

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any direct or indirect interest in the Settlement, and the Board is of the opinion that the acceptance of the Settlement is in the best interest of the Company.

The Company received consent from HESS for the release of this announcement in relation to the Settlement.

This announcement is dated 22 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-5-2018 02:38 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | E.A. TECHNIQUE (M) BERHAD (E.A. TECHNIQUE OR THE COMPANY)CONTRACTUAL SETTLEMENT OF ENGINEERING, PROCUREMENT, CONSTRUCTION, INSTALLATION AND COMMISSIONING (EPCIC) OF A FLOATING STORAGE AND OFFLOADING (FSO) FACILITY FOR FULL FIELD DEVELOPMENT (FFD) PROJECT, NORTH MALAY BASIN | (All abbreviations used in this announcement shall have the same meanings as defined in the earlier announcement made on the date below, unless otherwise stated or defined herein)

Further to the announcement made by the Company on 22 May 2018, the Board would like to inform that E.A. Technique has agreed to deliver and fully handover the FSO Mekar Bergarding to HESS at Malaysia Marine and Heavy Engineering (“MMHE”) yard in Pasir Gudang on 8 June 2018.

This announcement is dated 24 May2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-6-2018 05:46 AM

|

显示全部楼层

本帖最后由 icy97 于 17-6-2018 03:48 AM 编辑

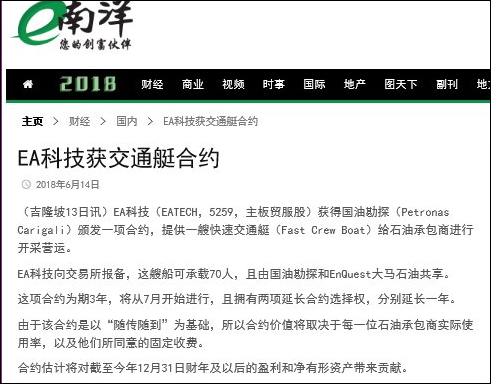

Type | Announcement | Subject | OTHERS | Description | PROVISION AND OPERATION OF ONE (1) UNIT OF FAST CREW BOAT 25 KNOTS 70 PAX; PACKAGE NO. 8 FOR PETROLEUM ARRANGEMENT CONTRACTORS (PACs) PRODUCTION OPERATIONS | 1. INTRODUCTION The Board of Directors of E.A. Technique (M) Berhad (“EATECH” or “the Company”) is pleased to announce that the Company has recently been awarded a Contract by Petronas Carigali Sdn Bhd (“PCSB”) vide Letter of Award dated 24 May 2018. The Contract is for the Provision of one (1) unit of Fast Crew Boat 25 knots 70 pax for Petroleum Arrangement Contractors (“PACs”) Production Operations, shared between PCSB and EnQuest Petroleum Production Malaysia Ltd.

2. DURATION OF THE CONTRACT

The Contract duration will be for a primary period of Three (3) years with Two (2) extension options of One (1) year each upon expiry thereof and shall commence sometime in July 2018. The services shall be performed on ‘Call-Out basis’ via an order at an agreed fixed schedule of rates to be shared between the sharing PACs based on each PAC’s actual utilization.

3. FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net tangible assets of EA for the financial year ending 31 December 2018 and beyond. Notwithstanding this, the Contract is not expected to have any material effects on the issued and paid-up capital and shareholding structure of the Company.

4. RISKS ASSOCIATED WITH THE CONTRACT

Barring any unforeseen circumstances, there are no significant risk factors associated with the Contract save for operational and execution risks such as accidents, unexpected breakdown of vessels, weather conditions, as well as political, economic and regulatory conditions. In mitigating such risks, the Company carries out routine inspections and regular maintenance based on the Company’s comprehensive planned maintenance programme. Together with the Company’s strict health, safety, security and HSSE policy and procedures, it is of the view that the likelihood and impact of these risks is manageable within an acceptable level.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors and major shareholders of persons connected to the Directors or major shareholders has any direct or indirect interest in the Contract.

6. DIRECTORS’ STATEMENT

The Board of Directors of the Company is of the opinion that the Contract is in the best interest of the Company.

This announcement is dated 13 June 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 27-6-2018 12:56 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | E.A TECHNIQUE (M) BERHAD (EATech or the Company) CONTRACTUAL UNDERTAKING BETWEEN E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY) AND MALAYSIA MARINE AND HEAVY ENGINEERING SDN BHD (MMHE) FOR THE PROVISION FOR DEMOLITION, REFURBISHMENT AND CONVERSION OF DONOR VESSEL INTO FLOATING, STORAGE AND OFFLOADING (FSO) FACILITY FOR FULL DEVELOPMENT (FFD) PROJECT, NORTH MALAY BASIN | 1. INTRODUCTION The Board of Directors of the Company is pleased to announce that EATech had entered into an agreement via a “Letter of Undertaking” with MMHE for the settlement of the sums due under the Invoices and the Additional Work Order (“AWO”).

2. BACKGROUND AND RATIONALE The Company appointed MMHE via a Letter of Award dated 9 June 2015 as the Main Contractor for refurbishment and conversion of donor vessel into a Floating, Storage and Offloading Facility for Full Development Project, North Malay Basin, hereinafter referred to as “the Contract”. During the period of the Contract, MMHE issued an AWO to EATech claiming payment for the work done. Disputes and differences have arisen between the parties in respect of the sum arrived under the Invoices and the AWO, and now both parties seek to amicably resolve the matter.

3. LETTER OF UNDERTAKING The Company and MMHE had entered into an agreement via a Letter of Undertaking (“LOU”) on 22 June 2018 in their effort to settle the sums due under the Invoices and the AWO. Under the LOU, it was agreed that the Company pay part of the amount due to MMHE and deliver certain security for the remaining amount due to MMHE. Both parties shall try to resolve the remaining disputed AWO and attempt to reach a full and final settlement within 30 days from the sail away of the FSO. In the event an agreement is not reached pursuant to the above, both Parties agreed to resolve their disputes by way of dispute resolution mechanism as provided for in the Contract. In view of the amicable settlement between the parties, the Company and MMHE have agreed to withdraw/discharge their respective application at the High Court in respect to the Contract as follows:- (i) Johor Bahru High Court Originating Summons No. JA-24NCVC-281-06/2018 Dated 19 June 2018

(ii) Johor Bahru High Court Course Action No. WA-27NCC-18-05/2018 Dated 21 June 2018.

4. APPROVALS REQUIRED No approval is required for the Company and MMHE to enter into the LOU.

5. INTERESTS OF DIRECTORS, SUBSTANTIAL SHAREHOLDERS AND PERSON CONNECTED TO THEM None of the Directors and substantial shareholders of Kulim and/or persons connected to them, as defined in the Listing Requirements of Bursa Malaysia Securities Berhad, has any interest, direct or indirect, in the proposed transaction.

6. STATEMENT BY DIRECTORS The Board of Directors, having considered all aspects of the LOU, is of the opinion that the proposed transaction is in the best interest of the Company.

7. DEPARTURE FROM THE SECURITIES COMMISSION’S POLICIES AND GUIDELINES ON ISSUE/OFFER OF SECURITIES (“SC GUIDELINES”) To the best knowledge of the Board of Directors, the proposed transaction does not depart from the SC Guidelines.

This announcement is dated 26 June 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-6-2018 01:35 AM

|

显示全部楼层

本帖最后由 icy97 于 28-6-2018 05:48 AM 编辑

Type | Announcement | Subject | OTHERS | Description | E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY) PROVISION AND OPERATION OF : 1. ONE (1) UNIT OF FAST CREW BOAT 25 KNOTS 60 PAX2. ONE (1) UNIT OF FAST CREW BOAT 25 KNOTS 60 PAX FOR PETROLEUM ARRANGEMENT CONTRACTORS (PACs) PRODUCTION OPERATIONS UNDER THE INTEGRATED LOGISTIC CONTROL TOWER (ILCT) PROGRAMME | 1. INTRODUCTION

The Board of Directors of E.A. Technique (M) Berhad (“EATECH” or “the Company”) is pleased to announce that the Company has recently been awarded two (2) contracts by ExxonMobil Exploration and Production Malaysia Inc (“ExxonMobil”) vide a conditional Letter of Award dated 23 May 2018.

The contracts awarded are for the provision and operation of:

1. One (1) unit of Fast Crew Boat 25 knots 60 pax – shared between ExxonMobil and EnQuest Petroleum Production Malaysia Ltd 2. One (1) unit of Fast Crew Boat 25 knots 60 pax – shared between ExxonMobil and EnQuest Petroleum Production Malaysia Ltd

under the Integrated Logistic Control Tower Programme.

2. DURATION OF THE CONTRACTS

The contracts duration will be for a primary period of three (3) years with two (2) extension options of one (1) year each upon expiry thereof at an agreed fixed schedule of rates and shall commence as follows:

1. One (1) unit of Fast Crew Boat 25 knots 60 pax – sometime in August 2018 2. One (1) unit of Fast Crew Boat 25 knots 60 pax – sometime in June 2018

3. FINANCIAL EFFECTS

The Contracts are expected to contribute positively to the earnings and net tangible assets of EA for the financial year ending 31 December 2018 and beyond. Notwithstanding this, the Contracts are not expected to have any material effects on the issued and paid-up capital and shareholding structure of the Company.

4. RISKS ASSOCIATED WITH THE CONTRACT

Barring any unforeseen circumstances, there are no significant risk factors associated with the contracts save for operational and execution risks such as accidents, unexpected breakdown of vessels, weather conditions, as well political, economic and regulatory conditions. In mitigating such risks, the Company carries out routine inspections, afloat repairs and regular maintenance based on the Company’s comprehensive planned maintenance programme. Together with the Company’s strict health, safety, security and HSSE policy and procedures, it is of the view that the likelihood and impact of these risks is manageable within an acceptable level.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors and major shareholders or persons connected to the Directors or major shareholders have any direct or indirect interest in the contracts.

6. DIRECTORS’ STATEMENT

The Board of Directors of the Company is of the opinion that the award of the contracts are in the best interest of the Company

This announcement is dated 27 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 29-6-2018 02:05 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-27062018-00002 | Subject | CONTRACTUAL UNDERTAKING BETWEEN E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY) AND MALAYSIA MARINE AND HEAVY ENGINEERING SDN BHD (MMHE) | Description | E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY) CONTRACTUAL UNDERTAKING BETWEEN E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY) AND MALAYSIA MARINE AND HEAVY ENGINEERING SDN BHD (MMHE) FOR THE PROVISION FOR DEMOLITION, REFURBISHMENT AND CONVERSION OF DONOR VESSEL INTO FLOATING, STORAGE AND OFFLOADING (FSO) FACILITY FOR FULL DEVELOPMENT (FFD) PROJECT, NORTH MALAY BASIN | Query Letter Contents | We refer to your Company’s announcement dated 26 June 2018, in respect of the aforesaid matter. In this connection, kindly furnish Bursa Securities with the following additional information for public release:- 1. The part payment amount to be paid by EATECH as agreed under Letter of Undertaking ("LOU") to MMHE and date of payment. 2. The details of the security to be delivered by EATECH for the remaining amount due to MMHE, and date of delivery. 3. The amount of the remaining disputed Additional Work Order that EATECH and MMHE shall try to resolve. | (All abbreviations used in this announcement shall have the same meanings as defined in the earlier announcement made on 26 June 2018, unless otherwise stated or defined herein)

Further to the announcement made by the Company on 26 June 2018, the Board would like to inform the following:-

1. The part payment amount to be paid by EATECH as agreed under Letter of Undertaking (“LOU”) to MMHE and date of payment:-

i. EATECH agrees to pay MMHE a sum of USD9.67 million within a week of signing the LOU. ii. EATECH agrees to pay MMHE a sum of USD1.09 million within a week upon receiving invoice from MMHE. iii. EATECH agrees to pay USD1.09 million by 3 months after the sail away.

2. Details of security to be delivered by EATECH for the remaining amount due to MMHE, and date of delivery:-

i. A Corporate Guarantee by parent company, within 14 days of signing the LOU. ii. Unencumbered assets own by EATECH as collateral to MMHE, within 14 days of signing the LOU.

3. The amount of the remaining disputed Additional Work Order (AWO) that EATECH and MMHE shall try to resolve is subject to verification and mutually agreed quantum. The value is within the range of minimum USD1.70 million to a maximum USD23.70 million.

This announcement is dated 28 June 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-7-2018 04:21 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-8-2018 07:29 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 69,128 | 113,400 | 132,949 | 209,919 | | 2 | Profit/(loss) before tax | 83,202 | -36,609 | 100,645 | -98,370 | | 3 | Profit/(loss) for the period | 83,155 | -36,715 | 100,362 | -98,589 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 83,155 | -36,715 | 100,362 | -98,589 | | 5 | Basic earnings/(loss) per share (Subunit) | 16.50 | -7.28 | 19.91 | -19.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5000 | 0.3000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-10-2018 02:54 AM

|

显示全部楼层

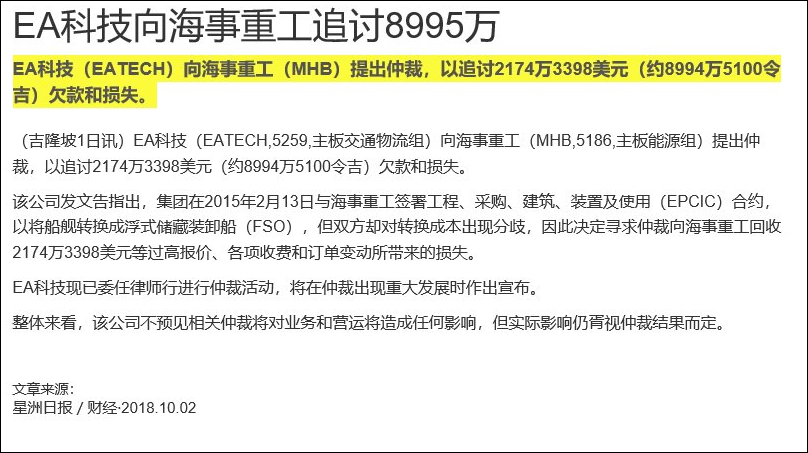

Type | Announcement | Subject | MATERIAL LITIGATION | Description | E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY)- ARBITRATION PROCEEDINGS COMMENCED BY E.A. TECHNIQUE (M) BERH AD AGAINST MALAYSIA MARINE HEAVY ENGINEERING SDN BHD | 1. INTRODUCTION

The Board of Directors of E.A. Technique (M) Berhad (“EAT” or the “Company”) wishes to announce that a Notice of Arbitration dated 27 September 2018 was filed with the Director of Asian International Arbitration Centre (“AIAC”) against Malaysia Marine Heavy Engineering Sdn Bhd. (“MMHE”).

The Company commenced arbitration against MMHE in relation to a dispute arising out of a contract in relation to the provision of demolition, refurbishment and conversion of a donor vessel into a floating storage and offloading facility dated 09.06.2015 (the “Conversion Contract”) entered into between the Company and MMHE.

2. BACKGROUND INFORMATION

On 13.02.2015, the Company entered into an engineering, procurement, construction installation and commissioning contract (the “EPCIC Contract”) with HESS Exploration & Production Malaysia B.V. (“HESS”) for the engineering, procurement, construction, installation and commissioning of a floating storage and offloading facility (the “FSO Facility”) to be deployed in the full field project in the North Malay Basin, located approximately 150 km North East off the shore of Kota Bharu in the state of Kelantan.

Pursuant to the Conversion Contract, MMHE agrees to undertake the demolition, refurbishment and conversion of the Vessel into the FSO Facility, which forms a portion of the scope of works under the EPCIC Contract. Disputes arose relating to change orders (variations) under the Conversion Agreement.

On 22.06.2018, the Company and MMHE executed a letter of undertaking (“LOU”) to settle the disputes but failed to reach settlement.

The Company’s claims against MMHE include:

(a) The recovery of overpayment of US$ 8,733,753.97 in respect of contract price for the Conversion Contract;

(b) The claim for an amount of US$ 4,009,643.75 being the backcharges under the Conversion Contract; and

(c) The recovery of US$ 9,000,000 paid to MMHE pursuant to the LOU due to unsubstantiated change orders.

3. THE BUSINESS, FINANCIAL AND OPERATIONL IMPACTS OF THE ARBITRATION PROCEEDINGS ​ The arbitration proceedings are not expected to have any potential business or operational impact on the Company. At this juncture, the Company is unable to determine reliably the financial impact of the arbitration proceedings as this is subject to any counterclaim that may be raised by MMHE in the course of the arbitration proceedings.

4. STEPS TAKEN

The Company has appointed a law firm in Malaysia to represent and assist the Company in the arbitration proceedings. The Company will announce any further developments on the arbitration proceedings as and when they arise.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-10-2018 05:44 AM

|

显示全部楼层

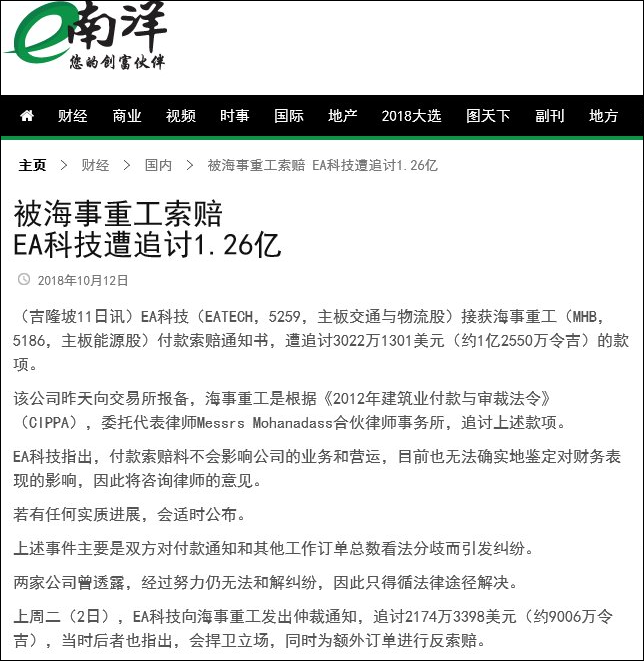

Type | Announcement | Subject | MATERIAL LITIGATION | Description | E.A TECHNIQUE (M) BERHAD (EATECH OR THE COMPANY)- PAYMENT CLAIM BY MALAYSIA MARINE HEAVY ENGINEERING SDN BHD AGAINST E. A. TECHNIQUE (M) BERHAD PURSUANT TO SECTION 5 OF THE CONSTRUCTION INDUSTRY PAYMENT AND ADJUDICATION ACT 2012 | 1. INTRODUCTION E.A. Technique (M) Berhad (“EAT” or the “Company”) refers to the following announcements made by the Company :- a) announcement dated 26 June 2018 in respect of a letter of undertaking executed between the Company and Malaysia Marine Heavy Engineering Sdn Bhd (“MMHE”) dated 22 June 2018 (the “LOU”); and b) announcement dated 1 October 2018 in respect of a Notice of Arbitration filed by the Company with the Director of Asian International Arbitration Centre (“AIAC”) against MMHE dated 27 September 2018 ( the “Arbitration”) . Further to and in connection with the LOU and the Arbitration, tThe Board of Directors of E.A. Technique (M) Berhad (“EAT” or the “Company”) the Company wishes to announce that the Company had on 8 October 2018 received a Payment Claim pursuant to Section 5 of the Construction Industry Payment and Adjudication Act 2012 dated 5 October 2018 from Malaysia Marine Heavy Engineering Sdn Bhd (“MMHE”) MMHE via its solicitor, Messrs Mohanadass Partnership for a total amount of US$ 30,221,301.42 (“CIPAA Payment Claim”).

2. BACKGROUND INFORMATION On 13 February 2015, the Company entered into an engineering, procurement, construction installation and commissioning contract (the “EPCIC Contract”) with HESS Exploration & Production Malaysia B.V. (“HESS”) for the engineering, procurement, construction, installation and commissioning of a floating storage and offloading facility (the “FSO Facility”) to be deployed in the full field project in the North Malay Basin, located approximately 150 km North East off the shore of Kota Bharu in the state of Kelantan. Pursuant to the EPCIC Contract, the Company, as the “Owner” and MMHE as the “Contractor” executed a contract under which MMHE agrees to undertake the demolition, refurbishment and conversion of a donor vessel into the FSO Facility dated 9 June 2015 (the “Conversion Contract”). Under the Conversion Contract, disputes arose relating to additional work and Variation Orders commonly described between the Company and MMHE as the Additional Work Orders (“AWOs”). The CIPAA Payment Claim is in relation to the disputes over the alleged non-payment of works done by MMHE and invoices purportedly issued by MMHE in relation to the AWOs under the Conversion Contract. The payments of the AWOs appear to be the common subject matter and issue under the CIPAA Payment Claim, LOU and the Arbitration.

3. THE BUSINESS, FINANCIAL AND OPERATION IMPACTS OF THE CIPAA PAYMENT CLAIM AND THE STEPS TAKEN The CIPAA Payment Claim is not expected to have any potential business or operational impact on the Company. At this juncture, the Company is unable to determine reliably the financial impact of the CIPAA Payment Claim as the Company is seeking advice and consultation from its solicitor to contest the matter. Further announcement will be made in respect of any material development thereof.

This announcement is dated 10 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 5-12-2018 02:35 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 67,554 | 86,714 | 200,503 | 296,633 | | 2 | Profit/(loss) before tax | 7,548 | -34,562 | 108,193 | -132,931 | | 3 | Profit/(loss) for the period | 7,301 | -30,221 | 107,663 | -128,810 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 7,301 | -30,221 | 107,663 | -128,810 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.45 | -6.00 | 21.36 | -25.56 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.5200 | 0.3000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-1-2019 06:56 AM

|

显示全部楼层

本帖最后由 icy97 于 19-1-2019 03:46 AM 编辑

ea科技赢9450万合约

http://www.enanyang.my/news/20181222/ea科技赢9450万合约/

Type | Announcement | Subject | OTHERS | Description | PROVISION AND OPERATION OF :I. ONE (1) UNIT OF 40 TONNES BOLLARD PULL HARBOUR TUGII. ONE (1) UNIT OF MULTIPURPOSE MOORING BOATIII. ONE (1) UNIT OF 60 TONNES BOLLARD PULL HARBOUR TUG NO. 1IV. ONE (1) UNIT OF 60 TONNES BOLLARD PULL HARBOUR TUG NO. 2FOR SUNGAI UDANG PORT SDN BHD (SUPSB) REGASIFICATION TERMINAL (RGT) | 1. INTRODUCTION The Board of Directors of E.A. Technique (M) Berhad (“EATECH” or “the Company”) is pleased to announce that the Company has recently been awarded Contract by Sungai Udang Port Sdn Bhd vide Letter of Award dated 10 December 2018.

2. VALUE AND DURATION OF THE CONTRACT The Contract awarded is for Provision and Operation of : i. One (1) unit of 40 Tonnes Bollard Pull Harbour Tug ii. One (1) unit of Multipurpose Mooring Boat iii. One (1) unit of 60 Tonnes Bollard Pull Harbour Tug No.1 iv. One (1) unit of 60 Tonnes Bollard Pull Harbour Tug No.2

for Sungai Udang Port Sdn Bhd (“SUPSB”) Regasification Terminal (“RGT”).

EATECH is using its own assets for item i and ii, and charter-in-vessels for item iii and iv.

The Contract duration is as follows : - For a primary period of two (2) years with an extension option of one (1) year

a) One (1) unit of 40 Tonnes Bollard Pull Harbour Tug b) One (1) unit of Multipurpose Mooring Boat c) One (1) unit of 60 Tonnes Bollard Pull Harbour Tug No.1 - For a primary period of six (6) months with an extension option of six (6) months

a) One (1) unit of 60 Tonnes Bollard Pull Harbour Tug No.2

The contract value for the above is approximately RM28.2 million, including the option period.

3. FINANCIAL EFFECTS The Contract is expected to contribute positively to the earnings and net tangible assets of EA for the financial year ending 31 December 2019 and beyond. Notwithstanding this, the Contract is not expected to have any material effects on the issued and paid-up capital and shareholding structure of the Company.

4. RISKS ASSOCIATED WITH THE CONTRACT Barring any unforeseen circumstances, there are no significant risk factors associated with the Contract save for operational and execution risks such as accidents, unexpected breakdown of vessels, weather conditions, as well as political, economic and regulatory conditions. In mitigating such risks, the Company carries out routine inspections and regular maintenance based on the Company’s comprehensive planned maintenance programme. Together with the Company’s strict health, safety, security and HSSE policy and procedures, it is of the view that the likelihood and impact of these risks is manageable within an acceptable level.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and major shareholders of persons connected to the Directors or major shareholders has any direct or indirect interest in the Contract.

6. DIRECTORS’ STATEMENT The Board of Directors of the Company is of the opinion that the Contract is in the best interest of the Company.

The announcement is dated 20 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 15-1-2019 06:57 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | AWARD OF CONTRACT FOR PROVISION FOR SUPPLY AND OPERATION OF HARBOUR TUG | 1. INTRODUCTION The Board of Directors of E.A. Technique (M) Berhad (“EATECH” or “the Company”) is pleased to announce that the Company has recently been awarded a Contract by Petroliam Nasional Berhad (“PETRONAS”) vide Letter of Award dated 29 November 2018. The Contract is for Provision for Supply and Operation of Harbour Tug.

2. VALUE AND DURATION OF THE CONTRACT The Contract duration will be for a primary period of Five (5) years with Two (2) years extension options on annual basis (5+1+1) upon expiry thereof.

The Contract awarded is for the Provision for Supply and Operation of : The contract value is approximately RM66.3 million, including the option period.

3. FINANCIAL EFFECTS The Contract is expected to contribute positively to the earnings and net tangible assets of EA for the financial year ending 31 December 2019 and beyond. Notwithstanding this, the Contract is not expected to have any material effects on the issued and paid-up capital and shareholding structure of the Company.

4. RISKS ASSOCIATED WITH THE CONTRACT Barring any unforeseen circumstances, there are no significant risk factors associated with the Contract save for operational and execution risks such as accidents, unexpected breakdown of vessels, weather conditions, as well as political, economic and regulatory conditions. In mitigating such risks, the Company carries out routine inspections and regular maintenance based on the Company’s comprehensive planned maintenance programme. Together with the Company’s strict health, safety, security and HSSE policy and procedures, it is of the view that the likelihood and impact of these risks is manageable within an acceptable level.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS None of the Directors and major shareholders of persons connected to the Directors or major shareholders has any direct or indirect interest in the Contract.

6. DIRECTORS’ STATEMENT The Board of Directors of the Company is of the opinion that the Contract is in the best interest of the Company.

The announcement is dated 20 December 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-1-2019 06:34 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-1-2019 07:06 AM

|

显示全部楼层

Date of change | 27 Dec 2018 | Name | ENCIK JOHARI SHUKRI BIN JAMIL | Age | 46 | Gender | Male | Nationality | Malaysia | Type of change | Resignation | Designation | Chief Operating Officer | Reason | To pursue his other personal interest. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-2-2019 07:52 AM

|

显示全部楼层

Notice of Person Ceasing (Section 139 of CA 2016)Particulars of Substantial Securities HolderName | DATIN HAMIDAH BINTI OMAR | Nationality/Country of incorporation | Malaysia | Descriptions (Class) | Ordinary Shares of RM0.25 each | Date of cessation | 08 Feb 2019 | Name & address of registered holder | CIMSEC Nominees (Tempatan) Sdn Bhd for Hamidah binti Omar (PB)17th Floor, Menara CIMBJalan Stesen Sentral 2Kuala Lumpur Sentral50470 Kuala Lumpur |

No of securities disposed | 800,000 | Circumstances by reason of which a person ceases to be a substantial shareholder | Disposal of Shares at Open Market | Nature of interest | Direct Interest |  | Date of notice | 11 Feb 2019 | Date notice received by Listed Issuer | 11 Feb 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-3-2019 08:16 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 218,497 | 70,337 | 419,000 | 366,970 | | 2 | Profit/(loss) before tax | -17,832 | 1,028 | 90,361 | -131,902 | | 3 | Profit/(loss) for the period | -33,431 | 7,661 | 74,232 | -121,148 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -33,431 | 7,661 | 74,232 | -121,148 | | 5 | Basic earnings/(loss) per share (Subunit) | -6.63 | 1.52 | 14.73 | -24.04 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4500 | 0.3000

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 24-6-2019 07:47 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | E.A. TECHNIQUE (M) BERHAD (E.A. TECHNIQUE OR THE COMPANY)PROVISION OF LONG-TERM TIME CHARTER COASTAL VESSEL SERVICES FOR PETCO TRADING LABUAN COMPANY LIMITED (PTLCL) |

1. INTRODUCTION

The Board of Directors of E.A. Technique (M) Berhad (“EATECH” or “the Company”) is pleased to announce that the Company has recently been awarded a Contract by PETCO Trading Labuan Company Limited (“PTLCL”) vide Letter of Award dated 8 May 2019. The Contract is for the Provision of Long-term Time Charter Coastal Vessel Services.

2. DURATION OF THE CONTRACT

The Contract duration will be for a primary period of five (5) years with five (5) extension options of one (1) year each upon expiry thereof at PTPCL's option at an agreed fixed schedule of rates and shall commence as follows :

- Vessel 1 : December 2020

- Vessel 2 : December 2020

- Vessel 3 : January 2021

The contract value is approximately RM 239.12 million, excluding the option period.

The approval on the release of the announcement was obtained from PTPCL on 15 May 2019.

3. FINANCIAL EFFECTS

The Contract is expected to contribute positively to the earnings and net tangible assets of EA for the financial year ending 31 December 2021 and beyond. Notwithstanding this, the Contract is not expected to have any material effects on the issued and paid-up capital and shareholding structure of the Company.

4. RISKS ASSOCIATED WITH THE CONTRACT

Barring any unforeseen circumstances, there are no significant risk factors associated with the Contract save for operational and execution risks such as accidents, unexpected breakdown of vessels, weather conditions, as well as political, economic and regulatory conditions. In mitigating such risks, the Company carries out routine inspections and regular maintenance based on the Company’s comprehensive planned maintenance programme. Together with the Company’s strict health, safety, security and HSSE policy and procedures, it is of the view that the likelihood and impact of these risks is manageable within an acceptable level.

5. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTERESTS

None of the Directors and major shareholders of persons connected to the Directors or major shareholders has any direct or indirect interest in the Contract.

6. DIRECTORS’ STATEMENT

The Board of Directors of the Company is of the opinion that the Contract is in the best interest of the Company.

The announcement is dated 16 May 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 7-7-2019 08:40 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 66,452 | 63,821 | 66,452 | 63,821 | | 2 | Profit/(loss) before tax | 9,131 | 17,443 | 9,131 | 17,443 | | 3 | Profit/(loss) for the period | 9,131 | 17,207 | 9,131 | 17,207 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,131 | 17,207 | 9,131 | 17,207 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.81 | 3.41 | 1.81 | 3.41 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.4700 | 0.4500

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|