|

|

【LBALUM 9326 交流专区】 廖兄弟制铝厂

[复制链接]

|

|

|

发表于 24-6-2016 03:51 AM

|

显示全部楼层

发表于 24-6-2016 03:51 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FIRST AND FINAL SINGLE TIER DIVIDEND | The Board of Directors of LB Aluminium Berhad ("the Company") is pleased to propose a first and final single tier dividend of 2.00 sen per ordinary share of RM0.50 each in respect of the financial year ended 30 April 2016 for the approval of the shareholders at the forthcoming Annual General Meeting of the Company. The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly.

This announcement is dated 23 June 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-9-2016 02:52 AM

|

显示全部楼层

发表于 1-9-2016 02:52 AM

|

显示全部楼层

EX-date | 30 Sep 2016 | Entitlement date | 05 Oct 2016 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 2 Sen per Ordinary Share of RM0.50 each in respect of the financial year ended 30 April 2016. | Period of interest payment | to | Financial Year End | 30 Apr 2016 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHDLot 10, The Highway CentreJalan 51/20546050 Petaling JayaTel:0377843922Fax:0377841988 | Payment date | 21 Oct 2016 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Oct 2016 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.02 | Par Value | Malaysian Ringgit (MYR) 0.500 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-10-2016 03:57 AM

|

显示全部楼层

发表于 2-10-2016 03:57 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2016 | 31 Jul 2015 | 31 Jul 2016 | 31 Jul 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 109,689 | 107,313 | 109,689 | 107,313 | | 2 | Profit/(loss) before tax | 6,465 | 2,001 | 6,465 | 2,001 | | 3 | Profit/(loss) for the period | 5,117 | 1,802 | 5,117 | 1,802 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,117 | 1,802 | 5,117 | 1,802 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.06 | 0.73 | 2.06 | 0.73 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1500 | 1.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 5-10-2016 11:02 PM

|

显示全部楼层

发表于 5-10-2016 11:02 PM

|

显示全部楼层

本帖最后由 icy97 于 6-10-2016 12:13 AM 编辑

LBALUM(9326)资产债务有所提升,PE = 8.16, 盈利YOY进步184%

Wednesday, October 5, 2016

http://harryteo.blogspot.my/2016/10/1354-lbalum9326pe-816-yoy184.html

笔者在上个星期参加了LBALUM在MANTIN的股东大会,业绩在当天傍晚就出炉。盈利YOY进步了184%,以今天62.5仙的价格计算,PE大约是8.16。钢铁股今年热爆全场,铝业公司也不遑多让。PMETAL, ARANK以及LBALUM都交出了亮眼的盈利。主要是因为今年的Aluminium价格有所走高,所以铝业公司的Profit Margin有所进步。

- 上图是LBALUM过往9个季度的对比,公司最近3个季度的Net Profit Margin都超过了4.5%以上,比过往几年进步了不少。

- 由于公司主要的原料都是从外国【进口】,所以大家可以看到公司大部分的时间都是蒙受外汇亏损的。(美金走高导致)

- 虽然面对不利于公司的环境,LBALUM的盈利还是保持进步。最新季度现金增加到了53.69 mil,Net Debt减低到33.01 mil的两年新低。

- 公司在FY2015的时候大笔投入Capital Expenditure,所以FY15的时候Investing cash flow花费了40.812 mil。因此公司举债扩张,也导致2015的债务一度飙升到110 mil。不过现在已经减低到86.7 mil,现金水平也是两年多的高峰。

- 股东大会上,管理层说这两年会努力清还债务,这可以减低Interest expense以及改善现金流。

- 相信未来公司的现金水平增加后,公司会有机会增加派息。

最新的Net Profit Margin是4.7%, 比过往两年进步了许多。这主要都是因为Aluminium价格走高使得卖出的货物有更高的Margin。

FY2014的时候Aluminium处在高峰,因此大家可以看到EPS = 8.89是5年以来的高点。公司的NTA连续5年不断进步,从FY2012的 0.92上升到现在的1.15。是少数NTA >股价 + PE 低于10的小型公司。

上图是从ANNUAL REPORT 转载的图表。

公司在FY2015Q1的时候马来西亚的ASSET =423,387, 两年后的今年进步到495.689 mil。主要是因为公司在FY2015买进不少机器,因此资产也跟着不断进步。

这个季度的Business volume比去年高,而且之前低价买进的原料导致Profit Margin上涨。这两样都是导致盈利走高的主因。

虽然Profit Before Tax = 6.465 mil是历史新高,但是因为今年没有Reinvestment allowance arising from capital expenditure的存在,所以Income Tax比去年同期高了不少。虽然大马的经济走低,但是公司还是会继续为公司创造盈利。

透过跟管理层的交流,笔者了解到【美金】才是主导公司盈利的主因。假设出口股会因为美金走高而获利,那么LBALUM就是美金走高的受害者。因此4-7月美金走低的时候,LBALUM的的外汇亏损也跟着走低。

只要公司未来的债务可以持续减低,LBALUM的NTA = 1.15的 足足比股价0.625高了52.5 cent。只要盈利可以持续成长,相信未来会吸引到更多投资者的注意。共勉之。

以上纯属分析,买卖请自负。

Harryt30

17.46p.m.

2016.10.05 |

|

|

|

|

|

|

|

|

|

|

|

发表于 10-12-2016 05:48 AM

|

显示全部楼层

发表于 10-12-2016 05:48 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2016 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2016 | 31 Oct 2015 | 31 Oct 2016 | 31 Oct 2015 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 118,279 | 113,862 | 227,968 | 221,175 | | 2 | Profit/(loss) before tax | 7,112 | 4,093 | 13,578 | 6,094 | | 3 | Profit/(loss) for the period | 5,777 | 2,847 | 10,895 | 4,649 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,777 | 2,847 | 10,895 | 4,649 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.32 | 1.15 | 4.38 | 1.87 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1500 | 1.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-3-2017 11:50 PM

|

显示全部楼层

发表于 31-3-2017 11:50 PM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2017 | 31 Jan 2016 | 31 Jan 2017 | 31 Jan 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 113,472 | 114,486 | 341,440 | 335,661 | | 2 | Profit/(loss) before tax | 6,081 | 6,087 | 19,657 | 12,181 | | 3 | Profit/(loss) for the period | 5,679 | 5,214 | 16,573 | 9,863 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 5,679 | 5,214 | 16,573 | 9,863 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.29 | 2.10 | 6.67 | 3.97 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1800 | 1.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-7-2017 03:16 AM

|

显示全部楼层

发表于 1-7-2017 03:16 AM

|

显示全部楼层

本帖最后由 icy97 于 2-7-2017 06:15 AM 编辑

廖兄弟制铝厂末季净利挫 拟派息2.5仙

Chong Jin Hun/theedgemarkets.com

June 30, 2017 14:18 pm MYT

(吉隆坡30日讯)廖兄弟制铝厂(LB Aluminium Bhd)末季净利按年猛挫76%至138万令吉,同期净赚586万令吉,归咎于较高的税务。

该集团今日向大马交易所发文告报备,截至2017年4月30日止的财政年末季(2017财年末季)营业额扩增至1亿2454万令吉,上财年同季报1亿916万令吉。

廖兄弟制铝厂在文告中表示,净利萎缩的原因是“上一财年的递延税款拨备不足”。

“本集团截至4月30日止的财年末季营业额年增14.1%至1亿2454万令吉,相比同期的1亿916万令吉,主要是因为业务量及平均售价增加。”

总结全年的业绩表现,净利从上财年的1572万令吉,扩大至1795万令吉;累计4季营业额报4亿6598万令吉,上财年共计4亿4482万令吉。

该集团也宣布,派发每股2.5仙的股息,惟派息计划需先征得股东的批准。

瞻望未来,廖兄弟制铝厂表示,由于铝价波动,因此,该集团将继续观察铝价走势,以保障公司的盈利赚幅,并确保产品售价保持竞争力。

(编译:倪嫣鴽)

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2017 | 30 Apr 2016 | 30 Apr 2017 | 30 Apr 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 124,537 | 109,163 | 465,976 | 444,823 | | 2 | Profit/(loss) before tax | 5,839 | 4,129 | 25,494 | 16,309 | | 3 | Profit/(loss) for the period | 1,382 | 5,859 | 17,953 | 15,721 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,382 | 5,859 | 17,953 | 15,721 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.56 | 2.36 | 7.22 | 6.33 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.50 | 2.00 | 2.50 | 2.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1900 | 1.1300

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-7-2017 03:16 AM

|

显示全部楼层

发表于 1-7-2017 03:16 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FIRST AND FINAL SINGLE TIER DIVIDEND | The Board of Directors of LB Aluminium Berhad ("the Company") is pleased to propose a first and final single tier dividend of 2.50 sen per ordinary share in respect of the financial year ended 30 April 2017 for the approval of the shareholders at the forthcoming Annual General Meeting of the Company. The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly.

This announcement is dated 30 June 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-8-2017 05:18 AM

|

显示全部楼层

发表于 30-8-2017 05:18 AM

|

显示全部楼层

EX-date | 03 Oct 2017 | Entitlement date | 05 Oct 2017 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 2.50 Sen per Ordinary Share in respect of the financial year ended 30 April 2017. | Period of interest payment | to | Financial Year End | 30 Apr 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | BINA MANAGEMENT (M) SDN BHDLot 10, The Highway CentreJalan 51/20546050 Petaling JayaSelangor Darul EhsanTel:0377843922Fax:0377841988 | Payment date | 20 Oct 2017 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 05 Oct 2017 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.025 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-9-2017 04:39 AM

|

显示全部楼层

发表于 30-9-2017 04:39 AM

|

显示全部楼层

本帖最后由 icy97 于 1-10-2017 05:02 AM 编辑

廖兄弟制铝厂首季净利跌30% 因其他营运收入减少

Syahirah Syed Jaafar/theedgemarkets.com

September 29, 2017 19:42 pm MYT

(吉隆坡29日讯)廖兄弟制铝厂(LB Aluminium Bhd)2018财政年首季净利按年下跌30%至360万令吉,同期则净赚512万令吉,归咎于其他营运收入减少。

每股盈利也从同期的2.06仙,缩减至1.45仙。

该集团截至2017年7月31日止的财年首季(2018财年首季)营业额按年增长13%至1亿2443万令吉,同期报1亿969万令吉。

廖兄弟制铝厂今日向大马交易所报备,营业额增加归因于业务量和平均售价走高。

“出口业务的营业额大幅扩增79.2%至2633万令吉,主要因为澳洲、加拿大和美国的业绩表现走好。”

展望未来,该集团表示,由于铝价波动,因此,将继续密切留意铝价走势。同时,也将略微调整定价政策,以保障赚幅,并使产品售价持续保持竞争力。

(编译:倪嫣鴽)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2017 | 31 Jul 2016 | 31 Jul 2017 | 31 Jul 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 124,425 | 109,689 | 124,425 | 109,689 | | 2 | Profit/(loss) before tax | 4,061 | 6,465 | 4,061 | 6,465 | | 3 | Profit/(loss) for the period | 3,597 | 5,117 | 3,597 | 5,117 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,597 | 5,117 | 3,597 | 5,117 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.45 | 2.06 | 1.45 | 2.06 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.2000 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-12-2017 03:13 AM

|

显示全部楼层

发表于 19-12-2017 03:13 AM

|

显示全部楼层

本帖最后由 icy97 于 22-12-2017 03:58 AM 编辑

廖兄弟制铝厂次季净利挫71%

2017年12月14日

(吉隆坡13日讯)原材料价走高挤压赚幅,导致廖兄弟制铝厂(LBALUM,9326,主板工业产品股)截至10月31日次季,净利大跌71.07%至167万1000令吉或每股0.67仙,上财年同季为577万7000令吉。

该公司向交易所报备,营业额则从上财年同季1亿1827万9000令吉,攀升7.32%至1亿2693万5000令吉,归功于较高的平均售价和亮眼的出口销售业绩。

半年净利减半

累计首半年,净利暴跌51.65%至526万8000令吉或每股2.12仙,远逊上财年同期1089万5000令吉;营业额则升10.26%,录得2亿5136万令吉。

展望未来,如无意外,公司有信心可在2018财年维持净利表现。【e南洋】

SUMMARY OF KEY FINANCIAL INFORMATION

31 Oct 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Oct 2017 | 31 Oct 2016 | 31 Oct 2017 | 31 Oct 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 126,935 | 118,279 | 251,360 | 227,968 | | 2 | Profit/(loss) before tax | 2,307 | 7,112 | 6,368 | 13,578 | | 3 | Profit/(loss) for the period | 1,671 | 5,777 | 5,268 | 10,895 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,671 | 5,777 | 5,268 | 10,895 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.67 | 2.32 | 2.12 | 4.38 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1800 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-1-2018 04:50 AM

|

显示全部楼层

发表于 27-1-2018 04:50 AM

|

显示全部楼层

本帖最后由 icy97 于 28-1-2018 07:49 AM 编辑

廖兄弟制铝厂拟多元至房产

2018年1月28日

(吉隆坡27日讯)廖兄弟制铝厂(LBALUM,9326,主板工业产品股)建议,多元化业务至产业发展,以加强未来展望。

该集团向交易所报备,多元化至新业务,将增加收入来源,有助改善股东价值。

目前,该集团的业务是制造、营销和贸易挤压铝,主要在大马营运,有大约75%的营业额来自本地销售,而剩余25%则来自出口销售。

不过,制造业越来越竞争,且受到主要原料如铝价和外汇波动的影响。

减少依赖制造业

“董事部相信,多元化将有利于未来盈利,且减少依赖在制造业务。”

同时,多元化也让集团可充分利用诱人的投资机会。

尽管如此,集团依然致力于发展现有业务,且将会继续改善业务表现。

廖兄弟制铝厂认为,国内产业市场仍面对供需失衡现象,因为不可负担住宅房屋供应过剩,且商业单位闲置。

不过,可负担房屋依然供不应求,所以仍具商机。【e南洋】

Type | Announcement | Subject | OTHERS | Description | LB ALUMINIUM BERHAD ("LBA" OR "THE COMPANY") PROPOSED DIVERSIFICATION OF THE PRINCIPAL ACTIVITIES OF LBA AND ITS SUBSIDIARIES TO INCLUDE PROPERTY DEVELOPMENT | The Board of Directors of LBA (“the Board”) wishes to announce that the Company and its subsidiaries (“LBA Group” or “the Group”) are proposing to diversify its principal activities to include property development (“Proposed Diversification”).

Please refer to the attachment for further details on the Proposed Diversification. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5677553

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-3-2018 01:10 AM

|

显示全部楼层

发表于 30-3-2018 01:10 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jan 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jan 2018 | 31 Jan 2017 | 31 Jan 2018 | 31 Jan 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 136,516 | 113,472 | 387,876 | 341,440 | | 2 | Profit/(loss) before tax | 1,111 | 6,081 | 7,478 | 19,657 | | 3 | Profit/(loss) for the period | 1,219 | 5,679 | 6,487 | 16,573 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 1,219 | 5,679 | 6,487 | 16,573 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.49 | 2.29 | 2.61 | 6.67 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1800 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 27-4-2018 05:31 AM

|

显示全部楼层

发表于 27-4-2018 05:31 AM

|

显示全部楼层

本帖最后由 icy97 于 4-5-2018 04:18 AM 编辑

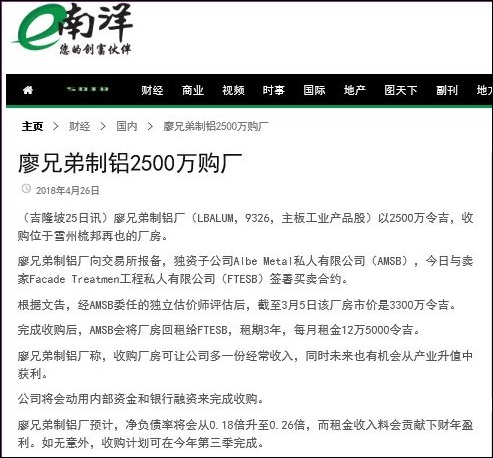

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | LB ALUMINIUM BERHAD ("LBA" OR THE "COMPANY")PROPOSED ACQUISITION OF A PARCEL OF FREEHOLD INDUSTRIAL LAND TOGETHER WITH ALL THOSE INDUSTRIAL BUILDINGS AND STRUCTURES ERECTED THEREON WITHIN LOT 755 JALAN SUBANG 3, SUNGAI PENAGA INDUSTRIAL PARK, 47610 SUBANG JAYA, SELANGOR DARUL EHSAN ("THE PROPERTY") BY A WHOLLY-OWNED SUBSIDIARY OF LBA, ALBE METAL SDN. BHD. (COMPANY NO. 562008-A) ("ALBE METAL") FROM FACADE TREATMENT ENGINEERING SDN. BHD. ("FTESB" OR "VENDOR") ("PROPOSED ACQUISITION") | Pursuant to Paragraph 10.06 of the Bursa Malaysia Securities Berhad Main Market Listing Requirements, the Board of Directors of the Company (“the Board”) wishes to announce that its wholly-owned subsidiary, Albe Metal has on 25 April 2018 entered into the following agreements with the Vendor in relation to the Proposed Acquisition:-

1. Sale and Purchase Agreement (“SPA”) for the acquisition of the Property held under Title No. GM 80, Lot 755 in Mukim of Damansara, District of Petaling, Negeri Selangor Darul Ehsan by Albe Metal from the Vendor for a total cash consideration of Ringgit Malaysia Twenty Five Million (RM25,000,000) only (excluding 6% Goods and Services Tax) (“Purchase Consideration”); and

2. Tenancy Agreement for the rent of the Property by Albe Metal to the Vendor (“Tenancy Agreement”).

Please refer to the attachment for further details on the Proposed Acquisition. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5771273

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 01:37 AM

|

显示全部楼层

发表于 29-6-2018 01:37 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Apr 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Apr 2018 | 30 Apr 2017 | 30 Apr 2018 | 30 Apr 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 121,914 | 124,537 | 509,790 | 465,976 | | 2 | Profit/(loss) before tax | 154 | 5,839 | 7,634 | 25,494 | | 3 | Profit/(loss) for the period | -392 | 1,382 | 6,097 | 17,953 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -392 | 1,382 | 6,097 | 17,953 | | 5 | Basic earnings/(loss) per share (Subunit) | -0.16 | 0.56 | 2.45 | 7.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 1.00 | 2.50 | 1.00 | 2.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.1800 | 1.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-6-2018 01:53 AM

|

显示全部楼层

发表于 29-6-2018 01:53 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FIRST AND FINAL SINGLE TIER DIVIDEND | The Board of Directors of LB Aluminium Berhad ("the Company") is pleased to propose a first and final single tier dividend of 1.00 sen per ordinary share in respect of the financial year ended 30 April 2018 for the approval of the shareholders at the forthcoming Annual General Meeting of the Company. The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly.

This announcement is dated 28 June 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-8-2018 02:33 AM

|

显示全部楼层

发表于 15-8-2018 02:33 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | LB ALUMINIUM BERHAD ("LBA" OR THE "COMPANY")PROPOSED ACQUISITION OF 20% EQUITY INTEREST IN VISTARENA DEVELOPMENT SDN BHD (COMPANY NO. 891863-T) ("VISTARENA") FROM GAN YU CHAI AND LEE KUAN KIOW (COLLECTIVELY, "VENDORS") ("PROPOSED ACQUISITION") | Pursuant to Paragraph 10.05 of the Bursa Malaysia Securities Berhad Main Market Listing Requirements, the Board of Directors of the Company wishes to announce that the Company has on 14 August 2018 entered into the following agreements :-

1. a conditional Share Sale and Purchase Agreement for the acquisition of 400,000 ordinary shares ("Sale Shares") representing 20% of the issued share capital of Vistarena by LBA from the Vendors for a total cash consideration of Ringgit Malaysia Six Million (RM6,000,000) only; and

2. a conditional Shareholders' Agreement with the Vendors, Idaman Sejiwa Development Sdn Bhd and Vistarena.

Please refer to the attachment for further details on the Proposed Acquisition. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5883513

|

|

|

|

|

|

|

|

|

|

|

|

发表于 18-8-2018 05:20 AM

|

显示全部楼层

发表于 18-8-2018 05:20 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | LB ALUMINIUM BERHAD ("LBA" OR THE "COMPANY") PROPOSED ACQUISITION OF A PARCEL OF FREEHOLD INDUSTRIAL LAND TOGETHER WITH ALL THOSE INDUSTRIAL BUILDINGS AND STRUCTURES ERECTED THEREON WITHIN LOT 755 JALAN SUBANG 3, SUNGAI PENAGA INDUSTRIAL PARK, 47610 SUBANG JAYA, SELANGOR DARUL EHSAN ("THE PROPERTY") BY A WHOLLY-OWNED SUBSIDIARY OF LBA, ALBE METAL SDN. BHD. (COMPANY NO. 562008-A) ("ALBE METAL") FROM FACADE TREATMENT ENGINEERING SDN. BHD. ("FTESB" OR "VENDOR") ("PROPOSED ACQUISITION") | Further to the announcement made on 25 April 2018 in relation to the Proposed Acquisition, the Board of Directors of the Company wishes to announce that the Proposed Acquisition has been completed on 15 August 2018.

This announcement is dated 17 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 21-8-2018 03:19 AM

|

显示全部楼层

发表于 21-8-2018 03:19 AM

|

显示全部楼层

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | LB ALUMINIUM BERHAD ("LBA" OR THE "COMPANY")PROPOSED ACQUISITION OF 20% EQUITY INTEREST IN VISTARENA DEVELOPMENT SDN BHD (COMPANY NO. 891863-T) ("VISTARENA") FROM GAN YU CHAI AND LEE KUAN KIOW (COLLECTIVELY, "VENDORS") ("PROPOSED ACQUISITION") | Further to the announcement made on 14 August 2018 in relation to the Proposed Acquisition, the Board of Directors of the Company wishes to announce that the Proposed Acquisition has been completed on 17 August 2018.

This announcement is dated 20 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 05:19 AM

|

显示全部楼层

发表于 31-8-2018 05:19 AM

|

显示全部楼层

EX-date | 02 Oct 2018 | Entitlement date | 04 Oct 2018 | Entitlement time | 05:00 PM | Entitlement subject | First and Final Dividend | Entitlement description | First and Final Single Tier Dividend of 1.00 Sen per Ordinary Share in respect of the financial year ended 30 April 2018. | Period of interest payment | to | Financial Year End | 30 Apr 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | Lot 10, The Highway CentreJalan 51/20546050 Petaling JayaTel:0377843922Fax:0377841988 | Payment date | 19 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 04 Oct 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.01 |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|