|

|

楼主 |

发表于 28-8-2018 06:15 AM

|

显示全部楼层

EX-date | 14 Sep 2018 | Entitlement date | 19 Sep 2018 | Entitlement time | 05:00 PM | Entitlement subject | First Interim Dividend | Entitlement description | First interim single-tier dividend of RM0.0011 per ordinary share in respect of the financial year ending 31 December 2018 | Period of interest payment | to | Financial Year End | 31 Dec 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 18 Oct 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 19 Sep 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.0011 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 9-9-2018 06:29 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-9-2018 05:18 AM

|

显示全部楼层

本帖最后由 icy97 于 14-9-2018 05:06 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-10-2018 05:02 AM

|

显示全部楼层

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" OR "COMPANY")MEMORANDUM OF UNDERSTANDING ("MOU") BETWEEN BIOALPHA INTERNATIONAL SDN BHD AND NORTH WEST ENTERPRISE SDN BHD ("NWESB") | Introduction The Board of Directors of Bioalpha wishes to announce that Bioalpha International Sdn Bhd (“BISB”), a wholly-owned subsidiary of Bioalpha, had on 1 October 2018 entered into a Memorandum of Understanding (“MOU”) with North West Enterprise Sdn Bhd (Company No. 51113-H) for the proposed acquisition of the business of NWESB (“Proposed Acquisition”).

Information of BISB BISB, a company incorporated under the Malaysian Companies Act, 1965 and having its business address at No. 10, Jalan P/9A, Seksyen 13, 43650 Bandar Baru Bangi, Selangor. BISB principally engaged in the manufacturing, distribution and sales of health products.

Information of NWESB NWESB, a company incorporated under the Malaysian Companies Act, 1965 and having its place of business at No. 5, Jalan Peguan U1/25, Sek U 1, Hicom-Glenmarie Industrial Park, 40150 Shah Alam, Selangor. NWESB is principally involved in manufacture, trading and supply of hotel amenities, personal care products and instant beverage in sachets for hotel and other establishments in the hospitality industry with more than 30 years of track record. BISB and NWESB are each referred to as the “Party” and collectively referred to as the “Parties”.

Salient terms of the MOU - Upon requisition by BISB in writing, NWESB shall allow BISB to perform due diligence provided that three (3) working day prior notice is given to NWESB. The final purchase price and shareholding structure shall be finalized upon the completion of the due diligence process.

- Upon execution of the MOU, NWESB will undertake not look for any other party to acquire the business during the period of this MOU.

Duration of MOU The MOU will come into effect on the date of signing and will remain in effect for a period of six (6) months from the date of signing the MOU, unless it is extended by subsequent written agreement. Upon expiry of the MOU and upon completion of the due diligence whereby there is no material deviation, it is intended that a further Acquisition Agreement between both parties shall be signed for the next phase of the cooperation.

Rationale of the MOU Bioalpha Group is in the midst of exploring various business acquisition opportunities. These may include investment and expansion of the Group’s existing businesses and/or businesses which are complementary to its existing principal activities. Should the Proposed Acquisition materialize, Bioalpha Group can offer existing clientele a new range herbal-based natural skincare products that are gentle and safe with no side effects. Additionally, Bioalpha Group can improve NWESB’s instant beverage in sachets such as coffee and tea, which are supplied to the latter’s hospitality clientele, with its herbs to enhance the products (e.g. Tongkat Ali coffee/tea or Kacip Fatimah coffee/tea). This serves as an excellent platform to enhance awareness of local herbs as well as to further promote and market Bioalpha Group’s products to overseas tourists staying at the establishments under NWESB’s clientele.

Effects of the MOU The MOU will not have any effect on the share capital and substantial shareholders’ shareholding of Bioalpha. The MOU is not expected to have any material effect on the earnings per share, net assets per share and gearing of the Bioalpha Group for the financial year ending 31 December 2018.

Directors’ and major shareholders’ interests None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the MOU.

Approvals required The MOU is not subject to the approval of the shareholders of Bioalpha or any regulatory authorities.

Directors’ opinion The Board of Director of Bioalpha, having taken into consideration all aspects of the MOU, is of the opinion that the MOU is in the best interest of Bioalpha Group.

Document available for inspection The MOU is available for inspection at the registered office of the Company at Suite 10.02, Level 10, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur from Monday to Friday (except public holidays) during normal business hours for a period of three (3) months from the date of this announcement.

This announcement is dated 1 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-10-2018 06:54 AM

|

显示全部楼层

本帖最后由 icy97 于 8-10-2018 02:03 AM 编辑

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

FUND RAISING | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" OR "THE COMPANY")PROPOSED PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN BIOALPHA, REPRESENTING NOT MORE THAN 10% OF THE ENLARGED NUMBER OF ISSUED SHARES OF BIOALPHA ("PROPOSED PRIVATE PLACEMENT") | On behalf of the Board of Directors of Bioalpha (“Board”), TA Securities Holdings Berhad (“TA Securities”) wishes to announce that the Company proposes to undertake the Proposed Private Placement. Please refer to the attachment below for further details on the announcement.

This announcement is dated 1 October 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5929389

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-10-2018 07:44 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 19-10-2018 03:24 AM

|

显示全部楼层

本帖最后由 icy97 于 20-10-2018 04:57 AM 编辑

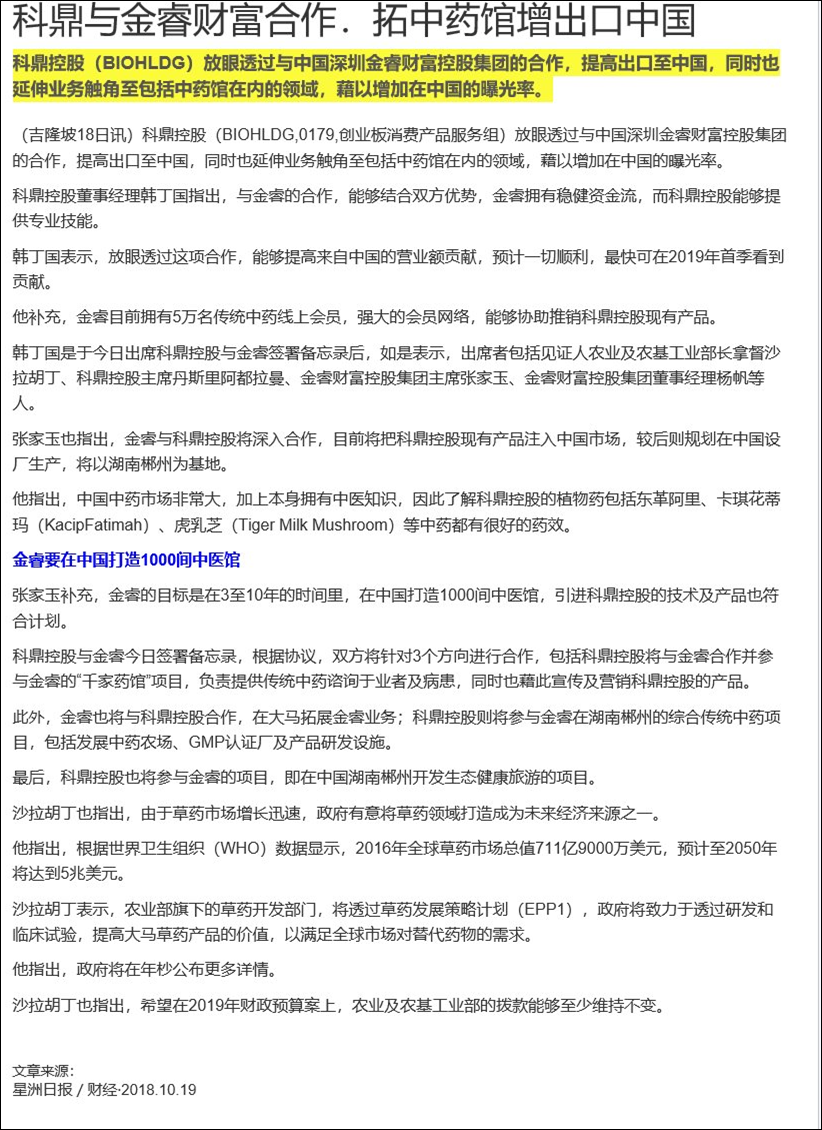

Type | Announcement | Subject | MEMORANDUM OF UNDERSTANDING | Description | BIOALPHA HOLDINGS BERHAD (BIOALPHA OR COMPANY)- MEMORANDUM OF UNDERSTANDING (MOU) BETWEEN BIOALPHA AND JINRUI FORTUNE HOLDING GROUP(JRFH) | Introduction

The Board of Directors of Bioalpha is pleased to announce that Bioalpha International Sdn Bhd (Company No. 715156-K), a wholly-owned subsidiary of Bioalpha (“BISB”) had on 18 October 2018 entered into a MOU with JRFH for the proposed collaboration on the following : i) BISB shall collaborate and participate in JRFH project, an integrated platform entitled “Thousand Medicinal Hall” which provides consultation given by top Traditional Complimentary Medicines (“TCM”) practitioners in China and provide the suitable TCM to the patients; to promote and sell BISB’s products to the China market through this platform;

ii) JRFH shall collaborate with BISB to expand JRFH’s business in Malaysia; and BISB to collaborate and participate in JRFH ChenZhou (Hunan) Integrated TCM Project, which include the development of Herb Farm, GMP Certified Factory, Product R&D Facility; and

iii) BISB shall collaborate and participate in JRFH project to develop Eco-Health Tourism in ChenZhou City, Hunan Province, China.

Duration of MOU

The MOU will come into effect on the date of signing and will remain in effect from the date of signing the MOU.

Early termination is allowed by mutual agreement in writing. In the event of termination, confidentiality of the MOU shall remain binding and enforceable notwithstanding the termination of the MOU. A separate agreement for each project to be executed by BISB and JRFH.

Background information on JRFH

JRFH is an investment operator of China's health industry. Headquartered in Shanghai, the Group has established branches in key cities such as Beijing, Shenzhen and Hefei; JRFH is an integrated traditional Chinese medicine company. The group gathers experts and top talents in various fields and is an important player and promoter of the development of China's health industry. JRFH is also working with the Chinese Association of Chinese Medicine in The National Chinese Medicine Treatment Project which has promoted the large-scale national movement of “Healthy China – Chinese Medicine Treatment and Disease Prevention Project” to build its big data platform.

Rationale of the MOU

The MOU will provide an opportunity for the parties to establish collaboration based on the respective party’s expertise and strengths. Furthermore, it provides an opportunity for Bioalpha Group to promote its products to the China market.

Effects of the MOU

The MOU will not have any effect on the share capital and substantial shareholders’ shareholding of Bioalpha.

The MOU is not expected to have any material effect on the earnings per share, net assets per share and gearing of the Bioalpha Group for the financial year ending 31 December 2018.

Directors’ and major shareholders’ interests

None of the Directors and/or major shareholders of the Company and/or persons connected with them have any interest, direct or indirect, in the MOU.

Approvals required

The MOU is not subject to the approval of the shareholders of Bioalpha or any regulatory authorities.

Directors’ opinion

The Board of Director of Bioalpha, having taken into consideration all aspects of the MOU, is of the opinion that the MOU is in the best interest of Bioalpha Group.

Document available for inspection

The MOU is available for inspection at the registered office of the Company at Suite 10.02, Level 10, The Gardens South Tower, Mid Valley City, Lingkaran Syed Putra, 59200 Kuala Lumpur from Monday to Friday (except public holidays) during normal business hours for a period of three (3) months from the date of this announcement.

This announcement is dated 18 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 20-10-2018 04:41 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-11-2018 02:05 AM

|

显示全部楼层

| 1. Details of Corporate Proposal | Involve issuance of new type/class of securities ? | No | Types of corporate proposal | Private Placement | Details of corporate proposal | PRIVATE PLACEMENT OF NEW ORDINARY SHARES IN BIOALPHA HOLDINGS BERHAD ("BIOALPHA"), REPRESENTING UP TO 10% OF THE TOTAL NUMBER OF ISSUED SHARES IN BIOALPHA (EXCLUDING TREASURY SHARES, IF ANY) ("PRIVATE PLACEMENT") | No. of shares issued under this corporate proposal | 49,509,900 | Issue price per share ($$) | Malaysian Ringgit (MYR) 0.2400 | Par Value($$) (if applicable) | Malaysian Ringgit (MYR) 0.000 | | Latest issued share capital after the above corporate proposal in the following | Units | 860,209,032 | Issued Share Capital ($$) | Malaysian Ringgit (MYR) 99,763,799.000 | Listing Date | 08 Nov 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 26-12-2018 07:45 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2018 | 30 Sep 2017 | 30 Sep 2018 | 30 Sep 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 20,182 | 14,088 | 52,191 | 35,876 | | 2 | Profit/(loss) before tax | 4,407 | 3,212 | 9,126 | 3,664 | | 3 | Profit/(loss) for the period | 4,064 | 3,120 | 8,672 | 3,492 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 4,199 | 3,142 | 8,677 | 3,656 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.52 | 0.44 | 1.07 | 0.47 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1779 | 0.1674

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 12-3-2019 07:08 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2018 | 31 Dec 2017 | 31 Dec 2018 | 31 Dec 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,313 | 18,910 | 69,504 | 55,917 | | 2 | Profit/(loss) before tax | 5,287 | 5,858 | 14,412 | 9,375 | | 3 | Profit/(loss) for the period | 3,382 | 4,211 | 12,052 | 7,477 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,020 | 4,433 | 11,998 | 7,865 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.36 | 0.55 | 1.47 | 0.98 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.10 | 0.11 | 0.10 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1842 | 0.1674

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-3-2019 04:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | BIOALPHA HOLDINGS BERHAD ("Bioalpha" or "the Company") - Collaboration Agreement entered between Bioalpha International Sdn Bhd, a wholly-owned subsidiary of Bioalpha and North West Enterprise Sdn Bhd | Reference is made to the Company’s announcements dated 1 October 2018 and 3 January 2019 respectively in relation to the Memorandum of Understanding (“MOU”) (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

The Board of Directors of Bioalpha is pleased to announce that Bioalpha International Sdn Bhd (“BISB”), a wholly-owned subsidiary of the Company had on 6 March 2019 entered into a Collaboration Agreement (“CA”) with North West Enterprise Sdn Bhd (“NWESB”) to jointly develop and market personal care and healthcare products. NWESB will market health supplement products from BISB to its customer in the hospitality sector whereas BISB will market personal care products to its own customers and the CA will supersede the previous MOU signed between BISB and NWESB.

Please refer to the attachment below for further details of this announcement.

This announcement is dated 6 March 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6088541

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 18-3-2019 04:50 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" OR "THE COMPANY") - INCORPORATION OF NEW WHOLLY-OWNED SUBSIDIARY | INTRODUCTION

Pursuant to Rule 9.19(23) of the ACE Market Listing Requirements of Bursa Malaysia Securities Berhad, the Board of Directors of Bioalpha Holdings Berhad (“Bioalpha” or “the Company”) wishes to announce that the Company had on 5 March 2019 incorporated Bioalpha Wellness Sdn. Bhd. (Company No. 1316817-H)(“BWSB”), a new wholly-owned subsidiary in Malaysia under the Companies Act, 2016 (hereinafter referred to as “Incorporation”).

INFORMATION OF BWSB

BWSB was incorporated on 5 March 2019 and is wholly-owned by Bioalpha with an issued and paid-up capital of RM100.00 comprising 100 ordinary shares. Subsequent to the incorporation, Bioalpha intends to increase the paid-up share capital of BWSB to RM5,000,000 for its working capital purpose.

The intended principal activity of BWSB is to carry on business related to distributing and trading, research and development activities, manufacturing, importing and exporting of personal care and healthcare products; and conduct advertising and promotional activities related to personal care and healthcare products.

The Directors of BWSB are Hon Tian Kok @ William and Ho Tze Hiung. The shareholder of BWSB is as follows:

Name of Shareholder | Shareholdings | % of Shareholdings | Bioalpha Holdings Berhad | 100 | 100% |

RATIONALE OF THE INCORPORATION

The Incorporation is mainly to facilitate the expansion of new business activities of the Group to market personal care and healthcare products in the hospitality sector.

FINANCIAL EFFECTS

The Incorporation will not have any material effect on the issued and paid-up capital of the Company and the substantial shareholders’ shareholding. The Incorporation also does not have any material effect on earnings per share nor net assets per share of Bioalpha and its Group for the financial year ending 31 December 2019.

INTERESTS OF DIRECTORS AND/OR SUBSTANTIAL SHAREHOLDERS AND/OR PERSON CONNECTED TO THEM

None of the Directors and/or Major Shareholders of the Company and/or persons connected with Directors and/or Major Shareholders has any interest, direct or indirect, in the Incorporation, except for Hon Tian Kok @ Willam and Ho Tze Hiung, the Directors of Bioalpha, who are also the Directors of BWSB.

APPROVAL REQUIRED

The Incorporation is not subject to the approval of the shareholders of the Company and any other regulatory authorities in Malaysia.

STATEMENT BY BOARD OF DIRECTORS

The Board of Directors of the Company, having considered the rationale and all aspects of the Incorporation, is of the opinion that the Incorporation is in the best interest of the Group.

This announcement is dated 6 March 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 30-6-2019 07:00 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2019 | 31 Mar 2018 | 31 Mar 2019 | 31 Mar 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 12,482 | 12,463 | 12,482 | 12,463 | | 2 | Profit/(loss) before tax | 1,266 | 634 | 1,266 | 634 | | 3 | Profit/(loss) for the period | 944 | 603 | 944 | 603 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 858 | 640 | 858 | 640 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.10 | 0.08 | 0.10 | 0.08 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1843 | 0.1920

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-8-2019 04:34 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" OR "THE COMPANY")UPDATE ON THE REGISTRATION OF HERB FARMS LEASES UNDER SECTION 221(4) OF THE NATIONAL LAND CODE 1965 ("NLC") IN RELATION TO THE FARMS LOCATED IN PASIR RAJA, TERENGGANU AND DESARU, JOHOR | The Board of Directors of Bioalpha wishes to announce an update on the status of the registration of Bioalpha’s herb farms’ leases under Section 221(4) of the NLC in relation to the following herb farms:

(i) a 1,003.2-acre integrated herbal cluster agricultural land located at Mukim Pasir Raja, Terengganu (“Pasir Raja Land”); and

(ii) 2 parcels of agricultural land totalling approximately 300 acres at Mukim of Pantai Timur, District of Kota Tinggi, Johor (“Desaru Land”).

Bioalpha operates the herbal farms and processing plants in both Pasir Raja Land and Desaru Land.

Please refer to the attachment below for details of the announcement.

This announcement is dated 2 August 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6243305

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 8-8-2019 05:31 AM

|

显示全部楼层

本帖最后由 icy97 于 9-8-2019 08:34 AM 编辑

科鼎获中国食品生产合约

https://www.enanyang.my/news/20190809/科鼎获中国食品生产合约//

Type | Announcement | Subject | OTHERS | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" or "THE COMPANY") - Contract Manufacturing Agreement entered between Bioalpha International Sdn Bhd, a wholly-owned subsidiary of Bioalpha and Jinrui Yandetang Co. Ltd ("JYCL") | Reference is made to the Company’s announcements dated 18 October 2018 and 18 January 2019 respectively in relation to the Memorandum of Understanding (“MOU”) (“Announcements”). Unless otherwise defined, the definitions set out in the Announcements shall apply herein.

The Board of Directors of Bioalpha is pleased to announce that Bioalpha International Sdn Bhd (“BISB”), a wholly-owned subsidiary of the Company had on 7 August 2019 entered into a Contract Manufacturing Agreement (“CMA”) with Jinrui Yandetang Co. Ltd (“JYCL”). BISB will develop formulation and manufacture food based products for JYCL whereas JYCL will responsible to ensure the products, raw materials, packaging requested are compliant with the People’s Republic of China law and will carry out the relevant processes needed with China’s custom in order for the products to be commercialized at People’s Republic of China.

Please refer to the attachment for details of the announcement.

This announcement is dated 7 August 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6247785

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 14-8-2019 05:36 AM

|

显示全部楼层

Type | Reply to Query | Reply to Bursa Malaysia's Query Letter - Reference ID | IQL-09082019-00001 | Subject | CONTRACT MANUFACTURING AGREEMENT ENTERED BETWEEN BIOALPHA INTERNATIONAL SDN BHD, A WHOLLY-OWNED SUBSIDIARY OF BIOALPHA AND JINRUI YANDETANG CO. LTD ("JYCL") ("CONTRACT") | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" OR "THE COMPANY") - Additional Information on the Contract Manufacturing Agreement entered between Bioalpha International Sdn Bhd, a wholly-owned subsidiary of Bioalpha and Jinrui Yandetang Co. Ltd ("JYCL") | Query Letter Contents | We refer to your Company’s announcement dated 7 August 2019, in respect of the aforesaid matter.

In this connection, kindly furnish Bursa Securities with the following additional information for public release:-

1. The tenure of Contract. 2. Whether the Contract is subject to renewal, and if yes, the details of such renewal. 3. The consideration to be paid to Bioalpha International Sdn Bhd or the basis for the payment. 4. The risks in relation to the Contract. | Unless otherwise stated, all abbreviations used herein shall have the same meaning as those mentioned in the announcement dated 7 August 2019 in relation to the Contract Manufacturing Agreement entered between Bioalpha International Sdn. Bhd., a wholly-owned subsidiary of Bioalpha and Jinrui Yandetang Co. Ltd (“Announcement”).

The Board of Directors of Bioalpha Holdings Berhad (“Bioalpha” or “the Company) wishes to inform that the Company has received Bursa Malaysia Securities Berhad’s request for additional information dated 9 August 2019 in relation to the Company’s announcement made on 7 August 2019. The additional information is as follows:

1. The tenure of Contract.

There is no expiry period of this Contract.

2. Whether the Contract is subject to renewal, and if yes, the details of such renewal.

There is no duration period in this Contract, therefore, not subject to any renewal. However, the Contract will be subject to both Parties mutually agreed on any extension of the Contract in the near future.

3. The consideration to be paid to Bioalpha International Sdn Bhd or the basis for the payment.

The consideration of the Contract was determined on a mutually agreed basis, after taking into consideration the costs of manufacturing eight (8) food-based products, raw materials and packaging as well as the margin of the products. The agreed consideration by both Parties will be paid to Bioalpha International Sdn Bhd by telegraphic transfer within 90 days from the date of delivery order.

4. The risks in relation to the Contract.

The risks related to the Contract are typical to any commercial contract. The Group will be exposed to certain risks inherent to the Contract. These risks include, but are not limited to changes in the general economic conditions, market conditions, credit and foreign currency risks. The management believes that the Contract allows both Parties to leverage on the competences mutually in addressing such risks. However, there can be no assurance that the changes in the factors described will not have any material adverse effects on the business and operation of the Group.

This announcement is dated 13 August 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 28-8-2019 06:49 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | BIOALPHA HOLDINGS BERHAD ("BIOALPHA" OR THE "COMPANY")(I) PROPOSED TRANSFER OF LISTING; AND(II) PROPOSED AMENDMENTS(COLLECTIVELY, THE "PROPOSALS") | On behalf of the Board of Directors of Bioalpha (“Board”), Hong Leong Investment Bank Berhad (“HLIB”) wishes to announce that the Company proposes to undertake the following proposals:

(i) proposed transfer of the listing of and quotation for the entire issued share capital and the outstanding warrants 2017/2022 of Bioalpha from the ACE Market to the Main Market of Bursa Malaysia Securities Berhad (“Proposed Transfer of Listing”); and

(ii) proposed amendments to the Constitution of Bioalpha to facilitate the implementation of the Proposed Transfer of Listing (“Proposed Amendments”).

Further details of the Proposals are set out in the attachment enclosed.

This announcement is dated 27 August 2019. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/6265321

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 3-9-2019 03:15 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2019 | 30 Jun 2018 | 30 Jun 2019 | 30 Jun 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 14,033 | 19,546 | 26,515 | 32,008 | | 2 | Profit/(loss) before tax | 2,035 | 4,086 | 3,301 | 4,720 | | 3 | Profit/(loss) for the period | 2,028 | 4,006 | 2,972 | 4,609 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 2,034 | 4,141 | 2,892 | 4,781 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.24 | 0.51 | 0.34 | 0.59 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.11 | 0.00 | 0.11 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1864 | 0.1920

|

|

|

|

|

|

|

|

|

|

|

|

|

楼主 |

发表于 10-3-2020 06:47 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

30 Sep 2019 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Sep 2019 | 30 Sep 2018 | 30 Sep 2019 | 30 Sep 2018 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 17,276 | 20,182 | 43,791 | 52,191 | | 2 | Profit/(loss) before tax | 3,516 | 4,407 | 6,816 | 9,126 | | 3 | Profit/(loss) for the period | 3,164 | 4,064 | 6,135 | 8,672 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 3,105 | 4,199 | 5,996 | 8,677 | | 5 | Basic earnings/(loss) per share (Subunit) | 0.36 | 0.52 | 0.70 | 1.07 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.11 | 0.00 | 0.11 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 0.1901 | 0.1920

|

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|