|

|

发表于 10-1-2018 06:39 AM

|

显示全部楼层

发表于 10-1-2018 06:39 AM

|

显示全部楼层

手套需求增.股价被低估.速柏玛财测上调

(吉隆坡9日讯)尽管速柏玛(SUPERMX,7106,主板工业产品组)因为创办人拿督斯里郑金升卷入内幕交易风波而引发投资者担忧,惟艾芬黄氏研究认为,该公司将因为塑料手套短缺而受惠,因此上调2018至2020财政年财测,评级和目标价也获上调。

艾芬黄氏认为,在中国缺乏乙烯塑料手套供应的情况下,速柏玛应与其同侪一样从中受惠,预计这将能推高该公司2018财政年盈利。

该行指出,预计在更好的增长前景下,速柏玛盈利增长看俏,因此,上调该公司2018至2020财政年财测,介于8%至11%。

“不过,市场对于速柏玛的前景却不那么乐观,因在2018财政年首季,该公司录得的净利,比市场全年预测仅高10%。”

艾芬黄氏认为,成功推动盈利增长,将是速柏玛短期内重估催化剂。

去年杪,速柏玛创办人郑金升因APL工业股票局内交易而被判监5年(事件尚在上诉中),继承问题成了市场焦点,而为了尽速解决此问题,该公司董事部委任郑金升女儿郑希儿和外甥陈志强(音译)为执行董事。

艾芬黄氏相信,速柏玛的利空已经反映在股价上,而上诉结果料不会对股价带来进一步的负面影响。

“尽管市场担忧速柏玛的管理团队,但是,我们相信该公司的业务将照常。”

艾芬黄氏认为,速柏玛目前遭到低估,潜在存有上扬空间,因此,上调目标价,由2令吉10仙大幅调升至3令吉10仙,评级也由“守住”调高至“买进”。

文章来源:

星洲日报·财经·报道:刘玉萍·2018.01.09 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-2-2018 04:58 AM

|

显示全部楼层

发表于 15-2-2018 04:58 AM

|

显示全部楼层

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 335,914 | 236,737 | 647,935 | 505,738 | | 2 | Profit/(loss) before tax | 57,634 | 26,985 | 98,289 | 53,473 | | 3 | Profit/(loss) for the period | 37,299 | 22,122 | 65,393 | 41,935 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 35,903 | 22,571 | 63,804 | 42,107 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.42 | 3.36 | 9.63 | 6.27 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 0.00 | 3.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5900 | 1.5700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-2-2018 04:58 AM

|

显示全部楼层

发表于 15-2-2018 04:58 AM

|

显示全部楼层

EX-date | 13 Mar 2018 | Entitlement date | 15 Mar 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single-Tier Dividend of 3.0 sen | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301 Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Mar 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 15 Mar 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-2-2018 03:33 AM

|

显示全部楼层

发表于 20-2-2018 03:33 AM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2018 02:31 AM 编辑

首半年財報超預期 速柏瑪前景看俏

2018年2月19日

(吉隆坡19日訊)速柏瑪(SUPERMX,7106,主要板工業)業績超越預期,加上新生產線有望帶來額外收入,獲券商調高財測和目標價。

肯納格證券研究指出,歸功于較預期強勁的手套銷售表現,速柏瑪2018首半年淨利按年大漲51.5%至6380萬令吉,占全年預測的66%。營業額也升28.1%,達6億4794萬令吉。

速柏瑪向馬證交所報備,截至12月底2018財年次季淨利按年升59%,至3590萬令吉;營業額增42%至3億3591萬令吉。配合業績宣布,速柏瑪將在3月28日派發每股3仙中期股息。

另外,考量其位于巴生第10和第11廠房生產線投產,可貢獻額外收入,MIDF證券研究將該公司2018至2019財年盈利預測,分別調高11.7%和12.3%,並將該股目標價從2.42令吉,上調至2.70令吉,投資評級維持“買進”。

肯納格證券研究也將該股目標價從1.70令吉,調高至1.95令吉。【中国报财经】

业绩超前 追上同行

速柏玛增长势头强劲

2018年2月20日

(吉隆坡20日讯)速柏玛(SUPERMX,7106,主板工业产品股)最新业绩普遍超越预期,虽然该股是手套领域的落后者,但分析员看好该股未来的净利增长势头强劲,与同行之间的价差料逐步收窄。

速柏玛截至12月31日次季,净利大涨59%至3590万3000令吉,并宣布派息3仙。

同期营业额也激增41.9%,报3亿3591万4000令吉。

累计上半年,净利暴涨51.5%至6380万4000令吉;营业额走高28.1%,报6亿4793万5000令吉。

速柏玛向交易所报备,营业额增长是因为手套需求殷切、且产量走高。随着营业额扬升、产能提升、和营运效率改善,该公司的净利也随之增加。

“相信随着保健意识逐步提升,天然胶和丁腈手套的全球需求将持续强稳。 ”

再加上保健领域的监管渐严、公私领域保健开销趋扬,都是推动需求增长的动力。

兴业投行研究分析员预计,随着手套需求持续殷切,速柏玛的净利增长势头仍强劲,并将2018至2020财年的净利预测上修7至9%。

目前,该股正以领域43%的折价水平交易,惟基于看好其2018财年的净利势头,分析员相信,该股与其他业者之间的价差将得以逐步收窄。

在美国流感季节盛行之际,天然胶手套的需求得到良好支撑。

惟对于速柏玛而言,原料价格飙涨、令吉走强、以及拓展至隐形眼镜业务的亏损,均是该股的风险。

财测上修逾10%

MIDF研究分析员也将2018至2019财年净利预测,分别上调11.7%和12.3%,因相信新生产线开跑后,营业额会更高。

分析员维持“买进”的投资评级,并将目标价格上调至2.70令吉。

展望未来,分析员相信天然胶手套需求强稳,对公司有利。

此外,稳定的货币环境也对手套业者有利,因为这能对营业额和开销提供能见度。

另一方面,随着委任新董事,分析员也相信,市场对管理层担忧也已经烟消云散。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-4-2018 03:40 AM

|

显示全部楼层

发表于 15-4-2018 03:40 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-4-2018 05:34 AM

|

显示全部楼层

发表于 17-4-2018 05:34 AM

|

显示全部楼层

Date of change | 14 Apr 2018 | Name | TAN SRI RAFIDAH AZIZ | Age | 74 | Gender | Female | Nationality | Malaysia | Designation | Chairman | Directorate | Independent and Non Executive | Type of change | Resignation | Reason | Personal reason |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 03:31 AM

|

显示全部楼层

发表于 4-5-2018 03:31 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 5-5-2018 05:01 AM

|

显示全部楼层

发表于 5-5-2018 05:01 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 03:29 AM

|

显示全部楼层

发表于 30-5-2018 03:29 AM

|

显示全部楼层

本帖最后由 icy97 于 15-6-2018 03:53 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 327,069 | 308,226 | 975,004 | 813,964 | | 2 | Profit/(loss) before tax | 45,454 | 20,894 | 143,743 | 74,366 | | 3 | Profit/(loss) for the period | 34,091 | 19,289 | 99,484 | 61,223 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 33,376 | 19,754 | 97,180 | 61,860 | | 5 | Basic earnings/(loss) per share (Subunit) | 5.06 | 2.94 | 14.72 | 9.22 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 2.50 | 6.00 | 2.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.6100 | 1.5700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 30-5-2018 03:58 AM

|

显示全部楼层

发表于 30-5-2018 03:58 AM

|

显示全部楼层

EX-date | 11 Jun 2018 | Entitlement date | 13 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Interim Dividend | Entitlement description | Interim Single-Tier Dividend of 3.0 sen | Period of interest payment | to | Financial Year End | 30 Jun 2018 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 28 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 13 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 15-6-2018 07:33 AM

|

显示全部楼层

发表于 15-6-2018 07:33 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 17-6-2018 04:11 AM

|

显示全部楼层

发表于 17-6-2018 04:11 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 24-7-2018 01:36 AM

|

显示全部楼层

发表于 24-7-2018 01:36 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2018 03:34 AM

|

显示全部楼层

发表于 10-8-2018 03:34 AM

|

显示全部楼层

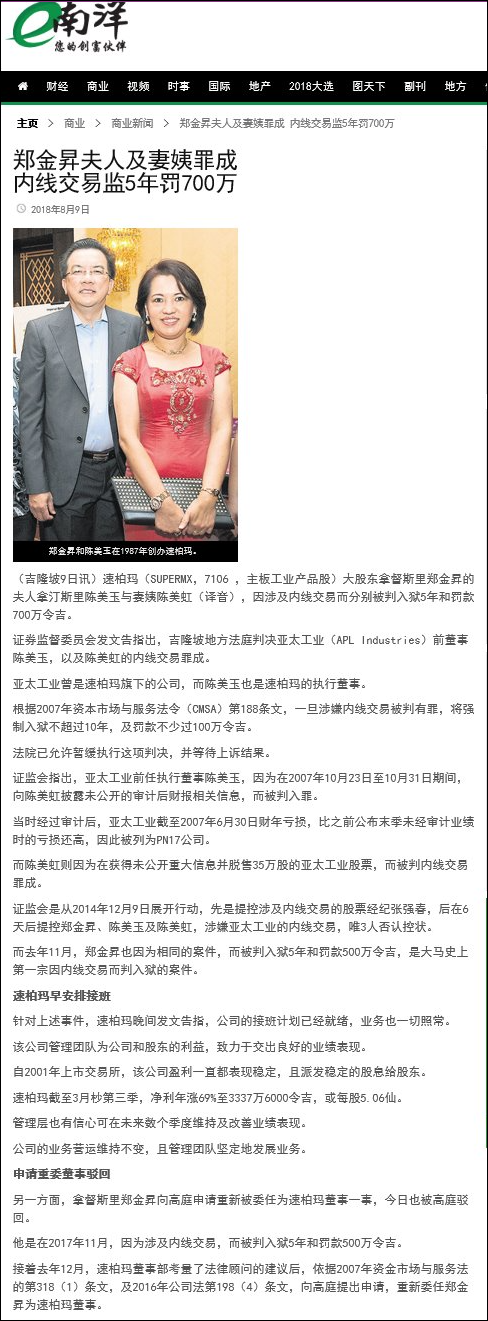

Date of change | 09 Aug 2018 | Name | DATIN SERI TAN BEE GEOK | Age | 57 | Gender | Female | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Vacation Of Office | Reason | Datin Seri Tan Bee Geok vacated office pursuant to Rule 15.05(3)(d) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 10-8-2018 03:36 AM

|

显示全部楼层

发表于 10-8-2018 03:36 AM

|

显示全部楼层

本帖最后由 icy97 于 10-8-2018 05:28 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Statement by Supermax Corporation Berhad ("Supermax" or the "Company") | This statement is issued in relation to Datin Seri Cheryl Tan, Group Executive Director of Supermax Corporation Berhad (“Supermax” or the “Company”) who has been convicted by the Kuala Lumpur Sessions Court for a single count of insider trading offence involving APL Industries shares under Section 188 of the Capital Markets and Services Act 2007. The Court has granted a stay of execution pending appeal against the conviction and sentence.

The Company wishes to inform members of the public a succession plan is in place and that it is business as usual in Supermax. Its Management team is committed to delivering good business performance and profitability in the interest of the Company and its shareholders.

Supermax has been delivering consistent profits and dividends to shareholders since its listing on Bursa Malaysia Securities Berhad in 2001. In its recent results for the third quarter of the financial year ending 30 June 2018 dated 28 May 2018, Supermax’s profit after tax rose by 76.7% year-on-year. The Management is confident of maintaining and improving the Company’s performance in the next few quarters ahead.

The position of the business remains intact and the Management stands strong in growing the business going forward.

This announcement is dated 9 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-8-2018 05:51 AM

|

显示全部楼层

发表于 11-8-2018 05:51 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 02:43 AM

|

显示全部楼层

发表于 28-8-2018 02:43 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2018 02:17 AM 编辑

Type | Announcement | Subject | OTHERS | Description | Statement by Supermax Corporation Berhad ("Supermax" or the "Company") - Fire incident | We wish to inform that a fire had occured at our smallest factory in the evening of 24 August 2018. There were no casualties and we wish to thank the Fire Department for their quick response in bringing the fire under control.

The cause of the fire is unknown at this moment. The Company shall restore back the production as soon as possible. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:32 AM

|

显示全部楼层

发表于 31-8-2018 06:32 AM

|

显示全部楼层

Type | Announcement | Subject | NEW ISSUE OF SECURITIES (CHAPTER 6 OF LISTING REQUIREMENTS)

BONUS ISSUES | Description | SUPERMAX CORPORATION BERHAD ("SUPERMAX" OR THE "COMPANY")PROPOSED BONUS ISSUE OF UP TO 680,154,880 NEW ORDINARY SHARES IN SUPERMAX ("SUPERMAX SHARE(S)") ("BONUS SHARE(S)") ON THE BASIS OF 1 BONUS SHARE FOR EVERY 1 EXISTING SUPERMAX SHARE HELD ON AN ENTITLEMENT DATE TO BE DETERMINED LATER("PROPOSED BONUS ISSUE OF SHARES") | On behalf of the Board of Directors of Supermax, UOB Kay Hian Securities (M) Sdn Bhd wishes to announce that Supermax proposes to undertake a bonus issue of up to 680,154,880 new Supermax Shares on the basis of 1 Bonus Share for every 1 existing Supermax Share held on an entitlement date to be determined later.

Please refer to the attachment for further details on the Proposed Bonus Issue of Shares.

This announcement is dated 29 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5900049

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:54 AM

|

显示全部楼层

发表于 31-8-2018 06:54 AM

|

显示全部楼层

本帖最后由 icy97 于 3-9-2018 02:04 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

30 Jun 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 30 Jun 2018 | 30 Jun 2017 | 30 Jun 2018 | 30 Jun 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 329,456 | 312,914 | 1,304,460 | 1,126,879 | | 2 | Profit/(loss) before tax | 23,444 | 33,572 | 167,187 | 107,939 | | 3 | Profit/(loss) for the period | 11,487 | 9,071 | 110,971 | 70,295 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 9,841 | 5,343 | 107,021 | 67,204 | | 5 | Basic earnings/(loss) per share (Subunit) | 1.49 | 0.80 | 16.24 | 10.03 | | 6 | Proposed/Declared dividend per share (Subunit) | 2.00 | 0.00 | 8.00 | 2.50 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 1.5600 | 1.5700

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 31-8-2018 06:55 AM

|

显示全部楼层

发表于 31-8-2018 06:55 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | PROPOSED FINAL DIVIDEND | The Board of Directors of Supermax Corporation Berhad ("Company") is pleased to propose a single-tier final dividend of 2 sen per ordinary share in respect of the financial year ended 30 June 2018 for the approval of the shareholders at the forthcoming Company's Twenty-First Annual General Meeting.

The proposed entitlement and payment dates for the final dividend shall be determined at a later date and announced accordingly. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|