|

|

发表于 24-11-2017 07:38 AM

|

显示全部楼层

发表于 24-11-2017 07:38 AM

|

显示全部楼层

产托明年上市.售非策略地库.WCT控股可筹9亿减债

(吉隆坡23日讯)WCT控股(WCT,9679,主板建筑组)2017年首9个月净利超越市场预测,分析员看好该公司旗下WCT产托(REIT)明年上市及沽售非策略地库的计划,预料可筹集9亿令吉资金以减债。

财测上调

大马投行表示,该公司2017年首9个月核心净利增长58%至1亿1620万令吉,超越该行及市场预测,即分别占全年预测的87%及79%,使该行将其2017财政年净利预测上调15%。

该行指出,该公司竞标逾60亿令吉工程合约,预料其每年攫取20亿令吉新订单料可达标。

大马投行指出,该公司计划在2018年将WCT产业投资信托上市,料可为公司筹得4亿令吉资金以减少公司债务。同时,将沽售一些非策略土地以筹集5亿令吉资金。

肯纳格研究认为,目前WCT控股合约订单达60亿令吉,提供未来2年半至3年间的盈利可见度。公司旗下产业业务未入账销售为4亿8700万令吉,或达1年半的盈利可见度。

肯纳格研究指出,公司管理层表示会继续其重新定价策略以售消库存。同时,短期内的土地沽售料是减债的部份策略。

大众研究认为,该公司产业业务今年销售目标为5亿令吉,预料大部份来自未售库存,涉及发展总值达10亿令吉,惟赚幅将缩减,主要是重新定价策略,以在市场疲软之际更具竞争力。

文章来源:

星洲日报‧财经‧报道:李文龙‧2017.11.23 |

|

|

|

|

|

|

|

|

|

|

|

发表于 15-12-2017 07:52 AM

|

显示全部楼层

发表于 15-12-2017 07:52 AM

|

显示全部楼层

本帖最后由 icy97 于 16-12-2017 04:59 AM 编辑

WCT获隆市政厅2.1亿合约

2017年12月9日

(吉隆坡8日讯)WCT控股(WCT,9679,主板建筑股)独资子公司WCT有限公司,获吉隆坡市政厅颁发2亿1152万令吉合约,兴建高架公路。

该公司今日向交易所报备,工作内容为从吉隆坡西部疏散大道(SPRINT)/马洛夫路(Jalan Maarof)路口,兴建高架公路至SPRINT/ 士文丹路(Semantan)路口。

还有,WCT控股也负责改善出入白沙罗市中心的道路。

此外,工作范围也包括清理与拆除场地、土木工程、排水工程、路面工程、道路设施、高架桥与加筋土挡墙、路面照明、环境保护工作、监测现有捷运结构与高架大道、交通管理计划和土壤调查。

工程将在下周一(11日)开始,预计30个月内竣工。【e南洋】

Type | Announcement | Subject | OTHERS | Description | Project Awarded by Dewan Bandaraya Kuala Lumpur "Cadangan Membina Jalanraya Bertingkat Dari Persimpangan Lebuhraya Sprint/Jalan Maarof ke Persimpangan Lebuhraya Sprint/Jalan Semantan dan Mengubahsuai Jalan Keluar Masuk ke Pusat Bandar Damansara, Wilayah Persekutuan Kuala Lumpur" | The Board of Directors of WCT Holdings Berhad (“WCT” or “the Company”) wishes to announce that its wholly-owned subsidiary, WCT Berhad, has been awarded a project by Dewan Bandaraya Kuala Lumpur (“the Employer”) with the commencement date on 11 December 2017 to undertake an elevated highway project known as the “Cadangan Membina Jalanraya Bertingkat Dari Persimpangan Lebuhraya Sprint/Jalan Maarof ke Persimpangan Lebuhraya Sprint/Jalan Semantan dan Mengubahsuai Jalan Keluar Masuk ke Pusat Bandar Damansara, Wilayah Persekutuan Kuala Lumpur” pursuant to the Employer’s Notice to Proceed received on 8 December 2017, for a contract sum of approximately RM211.52 million (excluding 6% goods and services tax) (“the Contract”).

The scope of works for the Contract generally includes Site Clearance and Demolition Works, Earthworks, Drainage Works, Pavement Works, Road Furniture and Miscellaneous, Elevated Flyover and Reinforced Earth Wall, Retaining Wall, Street Lighting, Environmental Protection Works, Instrumentation Monitoring Works on Existing MRT Structure and Elevated Highway Construction, Traffic Management Plans and Soil Investigation.

The works under the Contract are expected to be completed within the duration of 30 months.

None of the Directors or major shareholders of the Company or persons connected with them have any interest, direct or indirect, in the award of the Contract.

This announcement is dated 8 December 2017. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-12-2017 02:47 AM

|

显示全部楼层

发表于 22-12-2017 02:47 AM

|

显示全部楼层

本帖最后由 icy97 于 23-12-2017 02:36 AM 编辑

WCT控股

明年20亿订单在望

2017年12月12日

分析:丰隆投行研究

目标价:2.29令吉

最新进展

WCT控股(WCT,9679,主板建筑股)独资子公司WCT有限公司,获吉隆坡市政厅颁发2亿1152万令吉合约,兴建高架公路。

工作内容为从吉隆坡西部疏散大道(SPRINT)/马洛夫路(Jalan Maarof)路口,兴建高架公路至SPRINT/ 士文丹路(Semantan)路口。

行家建议

纳入最新合约,WCT控股年初至今共赢得总值19亿令吉的合约,这接近管理层全年预测的20亿令吉,超越我们全年预期16亿令吉。

该公司目前订单企于59亿令吉高位,相等于2016财年建筑营业额的4倍。

管理层预计2018财年,可取得20亿令吉新订单,这些潜在合约包括东海岸铁路(ECRL)、沙巴泛婆罗洲项目,以及马顿集团和柏威年集团的发展项目。

我们也预计,该公司近期内,有望获得敦拉萨国际贸易中心(TRX)建筑合约。

无论如何,我们仍保守维持财测,但因为业绩复苏及其减债计划,我们转向看好该公司。

根据2017和2018财年本益比的22.4倍和20.1倍,维持2.29令吉目标价。虽然本益比偏高,但值得注意的是该公司显著的土地价值。

【e南洋】

WCT控股有望获20亿新合约.林晓春潜在注入业务加强表现

(吉隆坡13日讯)WCT控股(WCT,9679,主板建筑组)接获新合约,成功推高手握订单至逾60亿令吉新高,分析员看好按年攫取20亿令吉新合约能力,且大股东丹斯里林晓春潜在注入其他业务也将加强公司表现。

WCT控股接获吉隆坡市政局颁发为期30个月,总值2亿1150万令吉的高架大道工程合约。

大马投行指出,纳入新合约后,WCT控股今年至今攫取的合约获推高至19亿7000万令吉,手握合约也增至60亿5000万令吉.该行正面看待WC T控股目前的发展,并预计在2017至2019财政年,可按年获得20亿令吉新合约。

达证券研究补充,WCT控股手握合约可供未来3至4年忙碌。

丰隆研究指出,WCT控股希望能够获得敦拉萨国际金融贸易中心的建筑合约。

“该公司放眼在2018财政年,能够取得20亿令吉的新合约。”

WCT控股目前提呈50亿令吉的竞标,潜在获得的合约包括东海岸衔接铁道、沙巴泛婆罗洲大道及从姐妹公司马顿和柏威年集团获得建筑合约。

达证券预计,假设以税前赚幅6%计算,新合约将贡献960万令吉净利,或每股盈利0.7仙。

市值有望推高至40亿

达证券在上调WCT控股今年至今攫取新合约预测至20亿令吉后,调高该公司2018及2019财政年财测,分别上调1.5%及3.4%。

丰隆正面看待WCT控股在新管理层带领下的表现,认为新管理层提出的减债计划可带来更好的业绩表现。

大马投行也认为,WCT控股最终将成为林晓春的旗舰公司,并预计将注入马顿(MALTON,6181,主板产业组)及私人业务吉隆坡柏威年及柏威年白沙罗高原,此举潜在推高WCT控股市值至40亿令吉以上。

无论如何,大马投行指出,目前尚未是公布上述企业活动的好时机,因为将涉及发售新股、资产架构及价格东向。

文章来源:

星洲日报‧财经‧报道:刘玉萍‧2017.12.13 |

|

|

|

|

|

|

|

|

|

|

|

发表于 19-1-2018 06:02 AM

|

显示全部楼层

发表于 19-1-2018 06:02 AM

|

显示全部楼层

WCT控股

2年料赢40亿订单

2018年1月19日

分析:兴业投行研究

目标价:2.18令吉

最新进展

截至去年9月杪,WCT控股(WCT,9679,主板建筑股)未完成建筑订单达60亿令吉,打破记录,可忙碌3年。

上财年该公司取得21亿令吉新合约,主要是基础建设项目。

行家建议

与管理层目标一致,我们假设WCT控股今明财年各取得20亿令吉新订单。

据悉,该公司有意竞标基建项目如东海岸铁路项目(ECRL)、西海岸大道(WCE)、泛婆罗洲大道和产业项目,譬如敦拉萨国际贸易中心(TRX)及Kwasa白沙罗。

正面看待,因基建项目息税前盈利赚幅为8%,高于非基建项目的5%至6%,也代表着WCT控股在开放竞标系统下,取得合约的能力。

另外,产业业务有进一步上行的潜力,因新管理层正改良产品,并调整现有项目组合,包括减少住宅单位面积,迎合对价格敏感的买家。

建筑业务入账将走高,分别提高今明财年盈利预测20%及23.5%,上调评级至“买入”、目标价至2.18令吉。

除了盈利强劲增长潜能,WCT控股可能通过脱售或成立产托,来释放投资产业价值。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 18-2-2018 04:48 AM

|

显示全部楼层

发表于 18-2-2018 04:48 AM

|

显示全部楼层

本帖最后由 icy97 于 21-2-2018 02:26 AM 编辑

传林晓春购梳邦Skypark 60%

2018年2月21日

(吉隆坡20日讯)消息透露,丹斯里林晓春计划从丹斯里拉温登及伙伴拿督艾萨马手上,购买梳邦Skypark私人有限公司的60%股权。

《The Edge》引述消息报道,林晓春此举是为了再发展梳邦机场周围的地皮,因为梳邦Skypark已与大马机场(AIRPORT,5014,主板贸服股)签署长期分租专营权合约,以营运该机场和综合商业航空枢纽。

不过,围绕在机场四周的地皮面积仍是个未知数。

大马机场的年报指出,该公司有60年的使用权,2066年到期。至于梳邦机场的占地面积则是1122英亩。

消息透露,林晓春将把地皮发展为楼层不高的建筑物,如商场,因为考量到靠近机场的地积比率不高。

然而,目前仍不清楚林晓春会如何进行收购,因为收购迫在眉睫,但却还在等待政府批准。

消息也称,林晓春有可能会私下买下该批股权,或通过持有19.57%的建筑与产业发展公司WCT控股(WCT,9679,主板建筑股)展开收购。

拉温登及艾萨马各持有梳邦Skypark的30%股权,而其余的40%则由Anggun Intelek私人有限公司所持有。后者是Temasek Padu私人有限公司的子公司。【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 01:23 AM

|

显示全部楼层

发表于 28-2-2018 01:23 AM

|

显示全部楼层

本帖最后由 icy97 于 28-2-2018 06:16 AM 编辑

末季净利狂飙17倍 WCT派息3仙

Wong Ee Lin/theedgemarkets.com

February 26, 2018 21:04 pm +08

(吉隆坡26日讯)营业额上扬及其他收入劲翻约6倍,刺激WCT Holdings Bhd的第四季净利狂飙接近17倍至5927万令吉,上财年同期为351万令吉。

截至2017年12月31日止季度(2017财年第四季)营业额按年弹升28%至5亿7940万令吉,上财年同期报4亿5317万令吉。

根据文告,其他收入从去年的4238万令吉,剧增至2亿4867万令吉。

该公司建议在2017财年派发每股3仙终期单层股息,但必须先征求股东的批准。若股东放行,此派息率将高过2016财年的1.25仙总派息。

尽管全年营业额从2016财年的19亿3000万令吉,按年微挫1%至2017财年的19亿1000万令吉,但2017财年全年净利骤升126%至1亿5462万令吉,2016财年全年净利为6838万令吉。

集团董事经理拿督李德福说:“我们将继续专注于改善现有项目的赚幅、效率及成本管理。考量到现有经济状况,公司在2017年取得的财务表现尚算满意。”

该公司的工程和建筑业务获得14亿令吉营业额,但却蒙受3300万令吉营运亏损,主要是被卡塔尔合约客户的减值(1亿6500万令吉)及未实现外汇兑换亏损(2000万令吉)所拖累,否则该公司将获得1亿5200万令吉营运盈利。

产业发展和产业投资与管理业务则获得3亿4600万令吉营运盈利,之前为1亿900万令吉,归功于产业投资与管理的营运业绩标青,以及投资产业升值(2亿2500万令吉)。

展望未来,WCT的工程与建筑业务将继续巩固其强大的订单,该业务在去年获得数份新基建设施合约,总值约20亿令吉。

“由于基建设施相关工程占订单的大多数,因此我们预计建筑赚幅将保持健康。”

基于房地产市场前景不乐观,WCT将谨慎推出新项目,并将继续催谷现有楼盘的销量。

该公司还指出,在去年11月开业的新山佰乐泰购物广场(Paradigm Mall Johor Bahru)表现不俗,其130万平方尺净租赁面积,租赁率高达92%。

(编译:魏素雯)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Dec 2017 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Dec 2017 | 31 Dec 2016 | 31 Dec 2017 | 31 Dec 2016 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 579,396 | 453,167 | 1,905,876 | 1,933,604 | | 2 | Profit/(loss) before tax | 81,497 | 11,367 | 230,649 | 122,000 | | 3 | Profit/(loss) for the period | 59,184 | -1,864 | 151,917 | 65,169 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 59,274 | 3,509 | 154,622 | 68,375 | | 5 | Basic earnings/(loss) per share (Subunit) | 4.19 | 0.28 | 11.29 | 5.50 | | 6 | Proposed/Declared dividend per share (Subunit) | 3.00 | 1.25 | 3.00 | 1.25 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2200 | 2.1900

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-2-2018 01:41 AM

|

显示全部楼层

发表于 28-2-2018 01:41 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WCT Holdings Berhad ("WCT" or "the Company")- Proposed Final Dividend | The Board of Directors of WCT has resolved to recommend a final single tier cash dividend of 3.0 sen per ordinary share for the financial year ended 31 December 2017, subject to the Shareholders’ approval at the forthcoming Seventh Annual General Meeting of the Company.

The date of entitlement and date of payment in respect of the aforesaid proposed final dividend will be determined and announced in due course.

This announcement is dated 26 February 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 1-3-2018 05:47 AM

|

显示全部楼层

发表于 1-3-2018 05:47 AM

|

显示全部楼层

WCT控股

有望迎来曙光

2018年2月28日

分析:肯纳格投行研究

目标价:1.90令吉

最新进展:

WCT控股(WCT,9679,主板建筑股)截至去年底的末季,净利飙涨15.89倍,至5927万4000令吉,同时派息每股3仙。

营业额则从4亿5316万7000令吉,年增27.85%,至5亿7939万6000令吉。

全年方面,净利年增126.14%,至1亿5462万2000令吉;营收则报19亿587万6000令吉,小跌1.43%。

行家建议:

在排除重估后的单次收入2亿2530万令吉,以及纳入未入账的外汇亏损2050万令吉和1亿6480万令吉减值后,WCT控股的核心净利其实只有1亿1440万令吉。

公司的核心净利表现不如预期,仅达我们和市场全年预测的77%和78%。

表现低于预期,是因为公司的联营业务意外出现亏损。不过,宣布派息3仙却是惊喜,我们原以为公司不会派发股息。

在调整建筑和产业业务的赚幅预测后,我们将今财年净利预测下调13%。

同时,将目标价由1.95令吉,下修至1.90令吉,但维持“超越大市”评级。

我们认为,在中东项目减值结束后,WCT控股的最坏日子将会过去。

另外,公司新管理团队也在持续努力着改善盈利。

【e南洋】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 24-3-2018 06:21 AM

|

显示全部楼层

发表于 24-3-2018 06:21 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | WCT HOLDINGS BERHAD ("WCT" OR "THE COMPANY")- ACQUISITION OF NEW SUBSIDIARY | The Board of Directors of WCT (“Board”) wishes to announce that its wholly-owned subsidiary, namely WCT Land Sdn Bhd (“WCTL”) had on 21 March 2018 acquired 2 ordinary shares in Skyline Domain Sdn Bhd (“SDSB”) representing 100% equity interest in SDSB for a total cash consideration of RM2.00 only (“the Acquisition”). Upon the Acquisition, SDSB shall become a wholly-owned subsidiary of WCTL.

SDSB was incorporated in Malaysia as a private limited company under the Companies Act, 2016 on 2 August 2017 and is currently dormant.

None of the Directors and major shareholders of the Company and persons connected with them has any interest, direct or indirect, in the Acquisition.

This announcement is dated 22 March 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 3-4-2018 05:06 AM

|

显示全部楼层

发表于 3-4-2018 05:06 AM

|

显示全部楼层

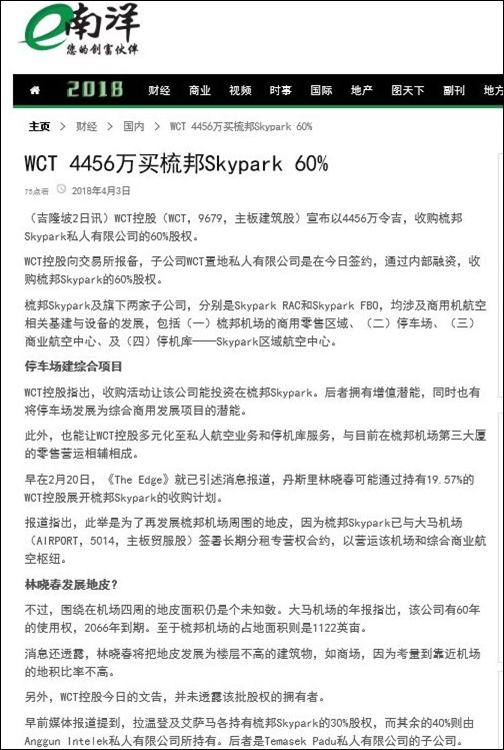

本帖最后由 icy97 于 3-4-2018 06:27 AM 编辑

Type | Announcement | Subject | OTHERS | Description | WCT HOLDINGS BERHAD ("WCT" OR "THE COMPANY")- Proposed Acquisition by Skyline Domain Sdn Bhd ("SDSB"), a wholly-owned subsidiary of WCT Land Sdn Bhd ("WCTL"), which in turn is a wholly-owned subsidiary of the Company, of 60% equity interest in Subang Skypark Sdn Bhd ("SSSB") for a cash consideration of approximately RM44.56 million ("Acquisition") | 1. DETAILS OF THE ACQUISITION The Board of Directors of WCT (“Board”) wishes to announce that SDSB, a wholly-owned subsidiary of WCTL, which in turn is a wholly-owned subsidiary of the Company has today acquired 60% equity interest in SSSB for a cash consideration of approximately RM44.56 million (“Purchase Consideration”) via a share purchase agreement (“SPA”) dated 2 April 2018.

The Purchase Consideration was arrived at on a ‘willing buyer-willing seller’ basis between SDSB and the vendors of SSSB after taking into consideration 60% of the unaudited net assets value of SSSB and its subsidiaries (“SSSB Group”) as at 30 June 2017 and the future prospects of the SSSB Group. The Acquisition shall be funded via internally generated funds of the WCT group.

SSSB together with its 2 wholly-owned subsidiaries namely Skypark RAC Sdn Bhd and Skypark FBO Sdn Bhd are principally involved in the development of commercial and aviation related infrastructure and facilities, comprising the following:-

(i) the commercial retail area of the airport terminal in Sultan Abdul Aziz Shah Airport in Subang known as Subang Skypark Terminal 3; (ii) a car parking area; (iii) a business aviation centre; and (iv) a hangarage complex known as Skypark Regional Aviation Centre.

The rationale for the Acquisition is to enable WCT Group to invest in SSSB which has potential for value enhancement as well as potential for development of the car park area into a mixed commercial development project. It also allows the WCT Group to diversify into the ground handling for private aviation business as well as hangarage services which are complementary to the existing retail operations at Terminal 3.

The Acquisition is not subject to the approval of shareholders of the Company.

2. FINANCIAL EFFECTS The Acquisition is not expected to have any material effects on the earnings per share, gearing and net assets per share of the WCT Group for the financial year ending 31 December 2018.

There will be no effects on the share capital and shareholdings of the substantial shareholders of WCT as no new shares will be issued by WCT pursuant to the Acquisition.

3. INTEREST OF DIRECTORS, MAJOR SHAREHOLDERS AND/OR PERSONS CONNECTED The Directors and major shareholders of the Company and persons connected with them do not have any interest, direct or indirect, in the Acquisition.

4. DIRECTORS’ STATEMENT The Board, after having considered all aspects of the Acquisition, is of the opinion that the Acquisition is in the best interest of the WCT Group.

This announcement is dated 2 April 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-4-2018 12:32 AM

|

显示全部楼层

发表于 6-4-2018 12:32 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

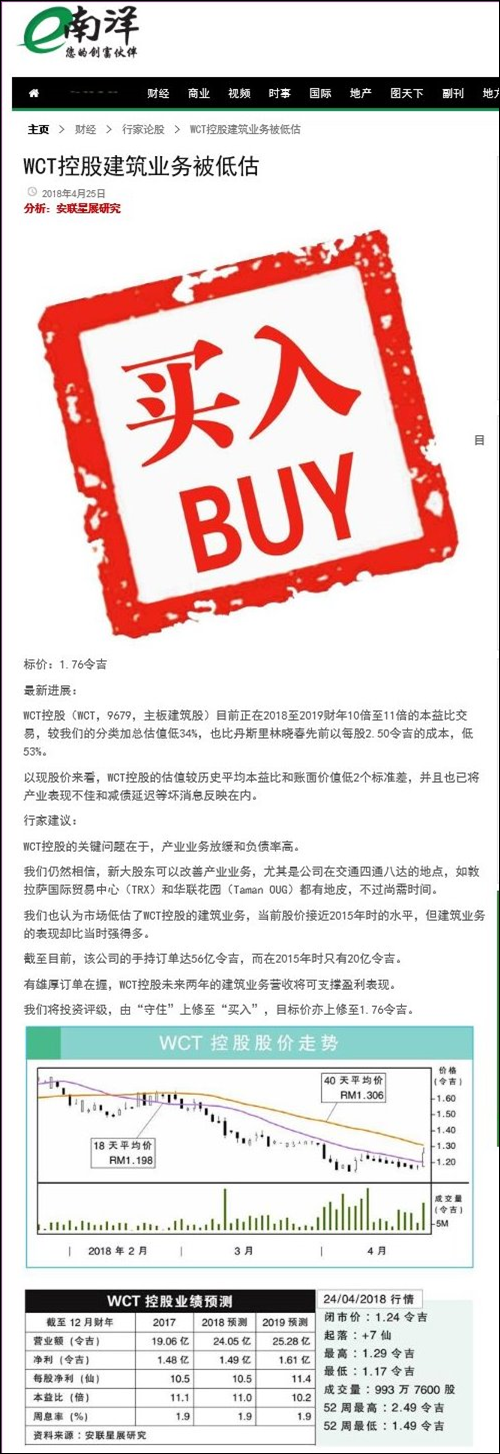

发表于 27-4-2018 05:25 AM

|

显示全部楼层

发表于 27-4-2018 05:25 AM

|

显示全部楼层

EX-date | 07 Jun 2018 | Entitlement date | 11 Jun 2018 | Entitlement time | 05:00 PM | Entitlement subject | Final Dividend | Entitlement description | Final single tier cash dividend of 3.0 sen per ordinary share for the financial year ended 31 December 2017 | Period of interest payment | to | Financial Year End | 31 Dec 2017 | Share transfer book & register of members will be | to closed from (both dates inclusive) for the purpose of determining the entitlement | Registrar or Service Provider name, address, telephone no | SYMPHONY SHARE REGISTRARS SDN BHDLevel 6, Symphony HousePusat Dagangan Dana 1Jalan PJU 1A/4647301Petaling JayaTel:0378490777Fax:0378418151 | Payment date | 22 Jun 2018 | a.Securities transferred into the Depositor's Securities Account before 4:00 pm in respect of transfers | 11 Jun 2018 | b.Securities deposited into the Depositor's Securities Account before 12:30 pm in respect of securities exempted from mandatory deposit |

| | c. Securities bought on the Exchange on a cum entitlement basis according to the Rules of the Exchange. | Number of new shares/securities issued (units) (If applicable) |

| | Entitlement indicator | Currency | Currency | Malaysian Ringgit (MYR) | Entitlement in Currency | 0.03 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 4-5-2018 04:01 AM

|

显示全部楼层

发表于 4-5-2018 04:01 AM

|

显示全部楼层

本帖最后由 icy97 于 6-5-2018 03:50 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 11-5-2018 03:01 AM

|

显示全部楼层

发表于 11-5-2018 03:01 AM

|

显示全部楼层

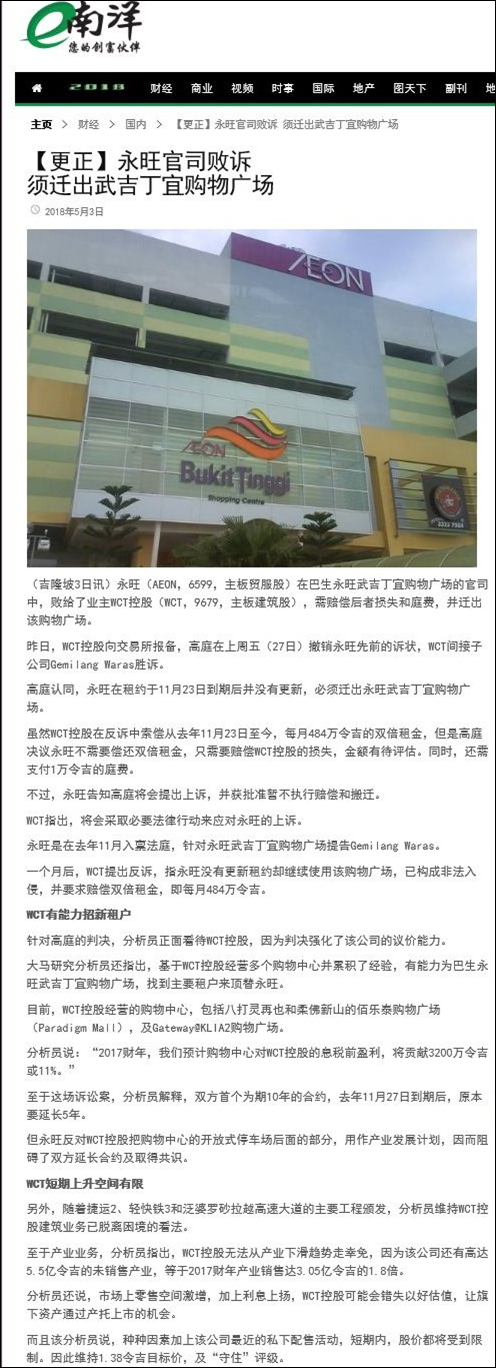

Type | Announcement | Subject | OTHERS | Description | WCT Holdings Berhad ("WCT" or "the Company") Kuala Lumpur High Court Civil Suit by AEON Co. (M) Bhd against Gemilang Waras Sdn. Bhd. | (Unless otherwise stated, all capitalised terms used in this announcement shall have the same meaning as ascribed thereto in the announcements dated 10 November 2017 and 6 December 2017 in relation to the Kuala Lumpur High Court Civil Suit by AEON Co. (M) Bhd against Gemilang Waras Sdn. Bhd.)

We refer to the announcements made on 10 November 2017 and 6 December 2017 in respect of the above matter.

The Board of Directors of WCT wishes to inform that the Kuala Lumpur High Court has delivered its judgement on 27 April 2018 (“the Decision”) in favour of the Company’s indirect wholly-owned subsidiary, Gemilang Waras Sdn Bhd (“the Defendant”), dismissing AEON Co. (M) Bhd (“the Plaintiff”)’s Suit via its Originating Summons and allowing the Defendant’s Counterclaim by making the following rulings and orders:- (i) That there was no renewal of the Lease and the Lease has expired on 23 November 2017; (ii) That the Plaintiff is to vacate the Bandar Bukit Tinggi Shopping Centre (“the Leased Property”); (iii) That the Plaintiff is to pay to the Defendant damages to be assessed, calculated from 23 November 2017 to the date vacant possession of the Leased Property is returned by the Plaintiff to the Defendant; and (iv) That the Plaintiff is to pay to the Defendant, RM10,000-00 as its legal costs for the Suit.

The Plaintiff informed the High Court that it intends to file an appeal against the Decision and a formal application for stay of execution of the Decision pending such appeal. The High Court granted an interim / temporary stay of execution pending the Plaintiff’s formal application for stay of execution which is to be filed within 14 days of the Decision.

The Defendant will oppose any appeal and any application for stay which the Plaintiff might file and will take the necessary legal steps to validly enforce the Decision.

The Company will make further announcement of any material development arising from the above proceeding as and when necessary.

This announcement is dated 2 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-5-2018 02:06 AM

|

显示全部楼层

发表于 19-5-2018 02:06 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | Incorporation of a new Subsidiary Company- WCT (MM2H) Sdn. Bhd. | The Board of Directors of WCT Holdings Berhad (the "Company" or "WCT") wishes to announce that its wholly-owned subsidiary, WCT Land Sdn Bhd, has on 17 May 2018 incorporated a wholly-owned subsidiary company, WCT (MM2H) Sdn Bhd (Company No. 1280478-M) ["WCTMM2H"] (Incorporation).

The share capital and number of issued shares of WCTMM2H is RM1.00 comprising 1 ordinary share.

The Directors and major shareholders of the Company and persons connected with them do not have any interest, direct or indirect, in the Incorporation.

This announcement dated 17 May 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 26-5-2018 06:43 AM

|

显示全部楼层

发表于 26-5-2018 06:43 AM

|

显示全部楼层

本帖最后由 icy97 于 2-6-2018 07:02 AM 编辑

SUMMARY OF KEY FINANCIAL INFORMATION

31 Mar 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Mar 2018 | 31 Mar 2017 | 31 Mar 2018 | 31 Mar 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 539,791 | 472,884 | 539,791 | 472,884 | | 2 | Profit/(loss) before tax | 55,297 | 44,532 | 55,297 | 44,532 | | 3 | Profit/(loss) for the period | 38,299 | 30,470 | 38,299 | 30,470 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | 38,385 | 32,844 | 38,385 | 32,844 | | 5 | Basic earnings/(loss) per share (Subunit) | 2.71 | 2.62 | 2.71 | 2.62 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 0.00 | 0.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 2.2200 | 2.2200

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 2-6-2018 07:38 AM

|

显示全部楼层

发表于 2-6-2018 07:38 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 18-6-2018 01:04 AM

|

显示全部楼层

发表于 18-6-2018 01:04 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 21-6-2018 03:58 AM

|

显示全部楼层

发表于 21-6-2018 03:58 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 13-7-2018 02:52 AM

|

显示全部楼层

发表于 13-7-2018 02:52 AM

|

显示全部楼层

本帖最后由 icy97 于 13-7-2018 05:26 AM 编辑

WCT获5.55亿令吉TRX综合发展工程

Supriya Surendran/theedgemarkets.com

July 12, 2018 21:11 pm +08

(吉隆坡12日讯)WCT控股(WCT Holdings Bhd)获Lendlease Projects(马)私人有限公司颁发总值5.55亿令吉的合约,以便在敦拉萨国际贸易中心(TRX)Lifestyle Quarter进行综合发展项目。

WCT控股向大马交易所报备,Lendlease在志期7月11日的信函中证实,把上述项目的决标信颁给WCT控股独资子公司WCT Bhd。

该合约包括建造一间四层购物中心、三层停车场、一个开放式景观与零售空间、一间资讯中心(未来发展),以及在敦拉萨路Seksyen 67 Lot PT157的未来发展。

根据Lendlease与WCT控股执行的初步工作协议(PWA)条款,后者将进行某些初步工作,例如采购履约保证金和相关保险、启动动员活动、动员项目人员、工厂和设备,以及向地方当局发送通知。

根据PWA,WCT控股有权获得最高2775万令吉付款,用于进行初步工程。

Lifestyle Quarter是一个占地17英亩的综合发展项目,由澳洲产业与基建设施集团Lendlease(60%)与TRX City私人有限公司(40%)的联营公司负责发展。TRX City是财政部的独资子公司。

Lendlease是Lifestyle Quarter的发展与建筑经理,该项目涵盖一间豪华酒店、六栋住宅大楼及一个连接至TRX公园的大型购物广场。

(编译:魏素雯)

Type | Announcement | Subject | OTHERS | Description | Proposed Commercial Mixed Development on Plot 1 comprising: (i) 4 levels of Shopping Complex, (ii) 3 levels of Car Park, (iii) 1 level Open Landscape with Retail Space and 1 Information Centre (future development), (iv) Future Development Plot, on Lot PT157, Seksyen 67, Jalan Tun Razak / Jalan Davis, Bandaraya Kuala Lumpur.- Trade Package No. TP 02 - Superstructure, Façade and Blockworks ("Works") | The Board of Directors of WCT Holdings Berhad (“WCT” or “the Company”) wishes to announce that Lendlease Projects (M) Sdn Bhd (“LLPM”) has via its letter dated 11 July 2018 confirmed its intent to award the Works for the project known as the “Proposed Commercial Mixed Development on Plot 1 comprising: (i) 4 levels of Shopping Complex, (ii) 3 levels of Car Park, (iii) 1 level Open Landscape with Retail Space and 1 Information Centre (future development), (iv) Future Development Plot, on Lot PT157, Seksyen 67, Jalan Tun Razak / Jalan Davis, Bandaraya Kuala Lumpur” to WCT Berhad (“WCTB”), a wholly-owned subsidiary of the Company, subject to the terms of the preliminary works agreement (“PWA”) executed between LLPM and WCTB on 12 July 2018 and the execution of a trade contract (“Trade Contract”) prior to 10 October 2018, being the expiry of the PWA. The Trade Contract sum for the Works shall be in the lump sum of RM555.0 million (excluding GST).

Pursuant to the PWA, WCTB shall proceed with certain preliminary works as set out under the PWA, forming part of the Trade Contract, which include procurement of performance bond and all relevant insurance, commencement of mobilisation activities, mobilisation of project staff, plants and equipment, local authority notifications, erection of site office, workers’ accommodation, welfare facilities, preparation of Environmental, Health & Safety plans and quality plans, safe work method statement and procurement of shop drawings and samples for façade works, preparation, mobilisation and construction works for retaining wall, core wall, column and slabs, etc. WCTB is entitled to be paid up to a maximum of RM27.75 million (excluding GST) for carrying the preliminary works under the PWA.

None of the Directors or major shareholders of the Company or persons connected with them have any interest, direct or indirect, in the award of the Works.

This announcement is dated 12 July 2018. |

|

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|