|

|

发表于 11-8-2018 06:03 AM

|

显示全部楼层

发表于 11-8-2018 06:03 AM

|

显示全部楼层

本帖最后由 icy97 于 12-8-2018 03:43 AM 编辑

|

|

|

|

|

|

|

|

|

|

|

|

发表于 22-8-2018 04:26 AM

|

显示全部楼层

发表于 22-8-2018 04:26 AM

|

显示全部楼层

本帖最后由 icy97 于 23-8-2018 02:33 AM 编辑

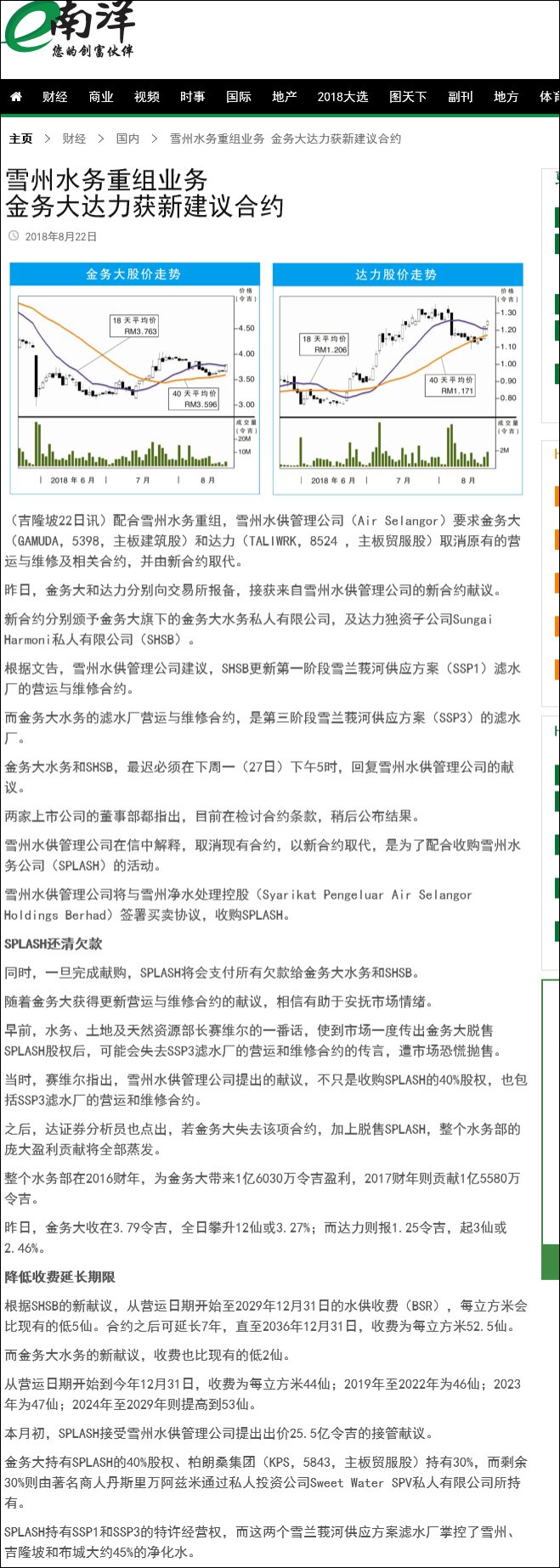

Type | Announcement | Subject | OTHERS | Description | CONSOLIDATION OF THE SELANGOR WATER INDUSTRY LETTER OF OFFER FROM PENGURUSAN AIR SELANGOR SDN BHD ("AIR SELANGOR") TO GAMUDA WATER SDN BHD (COMPANY NO. 297031-H) ("GAMUDA WATER"), A 80% OWNED SUBSIDIARY OF THE COMPANY | References are made to the announcements made by Gamuda Berhad (Company No. 29579-T) (“Gamuda” or “Company”) on 3 August 2018 and 9 August 2018 respectively, pertaining to the proposed purchase of 100% equity in Syarikat Pengeluar Air Sungai Selangor Sdn Bhd (Company No. 482346-K) (“Splash”) by Air Selangor.

The Board of Directors of Gamuda wish to announce that Gamuda Water has today received a letter of offer dated 21 August 2018 from Air Selangor (“Offer”) setting out: - i. termination of the existing operations and maintenance agreement of the Sungai Selangor Water Treatment Plant Phase 3 (“SSP3 OMA”) between Gamuda Water and Splash and settlement of the outstanding Gamuda Water’s receivable from Splash vide a Termination and Settlement Agreement to be entered into between Air Selangor, Splash and Gamuda Water; and

ii. the execution of a new SSP3 OMA between Air Selangor and Gamuda Water (“New SSP3 OMA”).

For details of the announcement, please refer the file attachment below.

This announcement is dated 21 August 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5890313

|

|

|

|

|

|

|

|

|

|

|

|

发表于 28-8-2018 06:03 AM

|

显示全部楼层

发表于 28-8-2018 06:03 AM

|

显示全部楼层

本帖最后由 icy97 于 29-8-2018 03:15 AM 编辑

金务大接受Air Selangor收购SPLASH的献议

theedgemarkets.com

August 27, 2018 19:27 pm +08

(吉隆坡27日讯)金务大(Gamuda Bhd)已接受Pengurusan Air Selangor私人有限公司收购其持股40%联号公司Syarikat Pengeluar Air Selangor Holdings Bhd(SPLASH)的献议。

根据向大马交易所的报备,金务大表示,持股80%的Gamuda Water私人有限公司及SPLASH的董事部今日接受了Air Selangor的献议。

“一旦敲定和执行终止与和解协议,以及雪兰莪河第三滤水站(SSP3)的新营运与维护协议(OMA),金务大将向马交所发布必要的公告,而这须符合并完成SPLASH与Air Selangor之间订立的购股协议为条件。”

金务大可在9月3日之前答复Air Selangor对SPLASH的献议。

SPLASH是SPLASH Holdings的独资子公司,其中金务大持有40%股权,而Kumpulan Perangsang Selangor Bhd(KPS)和商人Tan Sri Wan Azmi Wan Hamzah私人持有的Sweet Water SPV私人有限公司各持30%。

Air Selangor以25亿5000万令吉现金收购SPLASH,后者是SSP1和SSP3的特许业者,这两个滤水站占雪兰莪、吉隆坡和布城的约45%处理水供应。

Gamuda Water于上周二(21日)接获Air Selangor的献议,包括终止SSP3现有的OMA、解决SPLASH拖欠Gamuda Water的应收账款,以及执行将至2029年12月31日的SSP3新OMA。

根据新的OMA,从营运日至2018年12月31日,供水收费每立方米减2仙,至44仙;2019年1月1日至2022年12月31日为46仙;2023年1月1日至2023年12月31日47仙,以及2024年1月1日至2029年12月31日是53仙。

(编译:陈慧珊)

Type | Announcement | Subject | OTHERS | Description | CONSOLIDATION OF THE SELANGOR WATER INDUSTRY LETTER OF OFFER FROM PENGURUSAN AIR SELANGOR SDN BHD (COMPANY NO. 1082296-U) ("AIR SELANGOR") TO GAMUDA WATER SDN BHD (COMPANY NO. 297031-H) ("GAMUDA WATER"), A 80% OWNED SUBSIDIARY OF THE COMPANY ("OFFER") | Unless otherwise stated, all definitions and terms used in this announcement shall have the same meanings as defined in the previous announcements.

References are made to the announcements made by Gamuda Berhad (Company No. 29579-T) (“Gamuda” or “Company”) on 3 August 2018, 9 August 2018, 21 August 2018 and 24 August 2018 respectively in relation to the Consolidation of Selangor Water Industry.

Gamuda wishes to inform that the board of directors of Gamuda Water and Splash has on 27 August 2018 accepted the Offer from Air Selangor.

Gamuda will make the necessary announcement to Bursa Securities upon the finalisation and execution of the Termination and Settlement Agreement and the new SSP3 OMA which, inter alia, are subject to and are conditional upon the completion of the share purchase agreement to be entered into between Splash Holdings and Air Selangor.

This announcement is dated 27 August 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 19-9-2018 02:22 AM

|

显示全部楼层

发表于 19-9-2018 02:22 AM

|

显示全部楼层

本帖最后由 icy97 于 19-9-2018 05:39 AM 编辑

Type | Announcement | Subject | OTHERS | Description | TENDER FOR LAND PARCEL AT ANCHORVALE CRESCENT SITE EARMARKED FOR EXECUTIVE CONDOMINIUM DEVELOPMENT MEASURING APPROXIMATELY 51,411.90 SQUARE METERS (TENDER) | The Board of Directors of Gamuda Berhad ("Gamuda") wishes to inform that the Tender submitted by Gamuda (Singapore) Pte Ltd, a wholly owned subsidiary of Gamuda in Singapore (“Gamuda Spore”) jointly with Evia Real Estate (7) Pte Ltd (“Evia”) at a tender price of SGD318.89 million (equivalent to RM963.0 million) has emerged as the highest bidder.

The Provisional Tender Results was announced by the Housing and Development Board of Singapore (“HDB”) after the Tender closing date on 14 September 2018.

Gamuda will make the necessary announcement on the Tender upon receipt of the Letter of Acceptance which will be issued by HDB to the successful tenderer, namely Gamuda Spore-Evia Joint Venture in due course.

This announcement is dated 18 September 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 20-9-2018 07:00 AM

|

显示全部楼层

发表于 20-9-2018 07:00 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 23-9-2018 04:36 AM

|

显示全部楼层

发表于 23-9-2018 04:36 AM

|

显示全部楼层

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:28 AM

|

显示全部楼层

发表于 29-9-2018 06:28 AM

|

显示全部楼层

本帖最后由 icy97 于 2-10-2018 04:49 AM 编辑

Type | Announcement | Subject | OTHERS | Description | GAMUDA BERHAD ("GAMUDA" OR "COMPANY")PROPOSED DISPOSAL BY SYARIKAT PENGELUAR AIR SELANGOR HOLDINGS BERHAD ("SPLASH HOLDINGS"), A 40% ASSOCIATED COMPANY OF GAMUDA, OF THE ENTIRE EQUITY INTEREST AND REDEEMABLE UNSECURED LOAN STOCKS OF ITS SUBSIDIARY, SYARIKAT PENGELUAR AIR SUNGAI SELANGOR SDN BHD ("SPLASH") TO PENGURUSAN AIR SELANGOR SDN BHD ("AIR SELANGOR") ("PROPOSED DISPOSAL") | Reference is made to the earlier announcements dated 3 August 2018, 9 August 2018 and 14 September 2018 in relation to Air Selangor’s proposed purchase of 100% equity in SPLASH (“Offer”). Unless otherwise stated, words and phrases used in this announcement shall have the same meanings as defined in the aforesaid announcements.

On behalf of the Board of Directors of Gamuda, Hong Leong Investment Bank Berhad wishes to announce that SPLASH Holdings, being the associated company of Gamuda, had on 28 September 2018 entered into a conditional share purchase agreement with Air Selangor in connection with the Proposed Disposal.

Further details on the Proposed Disposal are set out in the attachment.

This announcement is dated 28 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5927125

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:39 AM

|

显示全部楼层

发表于 29-9-2018 06:39 AM

|

显示全部楼层

Date of change | 28 Sep 2018 | Name | DATO' GOON HENG WAH | Age | 62 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Resignation | Reason | Revamp of Board composition for purposes of applying Practice 4.1 of the Malaysian Code on Corporate Governance which recommends that Board members of a Large Company to comprise a majority of independent directors | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Engineering (Honours) | Polytechnic of South Bank, UK (now known as London South Bank University) | |

Working experience and occupation | A civil engineer, YBhg Dato Goon has many years of working experience in the fields of engineering, construction and infrastructure works and possesses a strong project implementation background. He held several senior management positions since joining Gamuda in 1978 and is responsible for overall oversight, including over the management and supervision of major projects such as the ongoing Klang Valley MRT project. YBhg Dato Goon also has substantial regional responsibilities for the Groups engineering and construction activities from India to the Middle East. His contribution is in his vast engineering expertise, in-depth knowledge and extensive experience in the construction industry, in particular large-scale infrastructure project mobilisation and implementation. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest:-1. 15,628,300 shares; and2. 2,741,600 Warrants 2016/2021.Deemed interested via securities held in spouse's name:-1. 5,755,432 shares; and2. 1,000,000 Warrants 2016/2021. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:40 AM

|

显示全部楼层

发表于 29-9-2018 06:40 AM

|

显示全部楼层

本帖最后由 icy97 于 29-9-2018 06:41 AM 编辑

Date of change | 28 Sep 2018 | Name | ENCIK MOHAMMED RASHDAN BIN MOHD YUSOF | Age | 48 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Appointment |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Double First Class Honours degree in Economics | University of Cambridge, UK | | | 2 | Professional Qualification | Chartered Accountant | Institute of Chartered Accountants England and Wales | Associate Member | | 3 | Others | Treasury | Association of Corporate Treasurers, UK | Associate member of |

Working experience and occupation | 2003 - 2008:Managing Director, Binafikir Sdn Bhd2008 - 2010:Chief Executive Officer, Maybank Investment Bank Berhad2010 - 2012:Executive Director (Investments), Khazanah Nasional Berhad2012 - 2017:Founder and Managing Director, Quante Phi Sdn BhdMay 2018 to presentDeputy Group Managing Director, Gamuda | Directorships in public companies and listed issuers (if any) | None | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest:1. 450,000 shares; and2. 550,000 Warrants 2016/2021. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:41 AM

|

显示全部楼层

发表于 29-9-2018 06:41 AM

|

显示全部楼层

Date of change | 28 Sep 2018 | Name | DATO' HAJI AZMI BIN MAT NOR | Age | 60 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Resignation | Reason | Revamp of Board composition for purposes of applying Practice 4.1 of the Malaysian Code on Corporate Governance which recommends that the Board members of a Large Company to comprise a majority of independent directors | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Master's of Science degree in Highway Engineering | University of Strathclyde, Glasgow, Scotland, UK | | | 2 | Degree | Bachelor of Science degree in Civil Engineering | University of Strathclyde, Glasgow, Scotland, UK | |

Working experience and occupation | A civil engineer, YBhg Dato Haji Azmi has worked as Resident Engineer at the Public Works Department (JKR) of Pahang and Selangor. His last position with the Public Works Department (JKR) was as Assistant Director of the Central Zone Design Unit of JKR Kuala Lumpur (Road Branch). YBhg Dato Haji Azmi has extensive knowledge of developing and managing the implementation of complex infrastructure concession projects in Malaysia. He is heavily involved in the implementation of the Klang Valley MRT project. His other significant contribution is in overseeing the operations of the Groups infrastructure concessions, ranging from expressways to water-related and others. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest:-1. 316,600 shares; and2. 58,200 Warrants 2016/2021. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:43 AM

|

显示全部楼层

发表于 29-9-2018 06:43 AM

|

显示全部楼层

Date of change | 28 Sep 2018 | Name | MR SOO KOK WONG | Age | 49 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Others | Description | Following the resignation of Mr. Saw Wah Theng, Mr. Soo Kok Wong shall automatically cease as his Alternate Director |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Chartered Accountant | Association of Chartered Certified Accountant, UK | Fellow Member | | 2 | Professional Qualification | Chartered Accountant | Malaysian Institute of Accountants | Member |

Working experience and occupation | A Chartered Accountant, Mr. Soo was attached to a major accounting firm in Malaysia prior to joining the Company in 1996. He has vast experience in accounting, tax, audit, finance, treasury and budgetary control and presently heads the Company's Financial Management and Accounting Department. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest:-1. 315,800 shares; and2. 57,000 Warrants 2016/2021. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:43 AM

|

显示全部楼层

发表于 29-9-2018 06:43 AM

|

显示全部楼层

Date of change | 28 Sep 2018 | Name | MR SAW WAH THENG | Age | 61 | Gender | Male | Nationality | Malaysia | Designation | Director | Directorate | Executive | Type of change | Resignation | Reason | Revamp of Board composition for purposes of applying Practice 4.1 of the Malaysian Code on Corporate Governance which recommends that the Board members of a Large Company to comprise a majority of independent directors | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Professional Qualification | Chartered Accountant | Institute of Chartered Accountants, England and Wales | Associate Member |

Working experience and occupation | Mr. Saw is the head of the finance function, who is responsible for the Groups budgetary control, treasury, tax and corporate finance including mergers and corporate restructuring exercises. He has extensive working experience in accounting, finance and corporate finance gained while he was attached to accounting and auditing firms in the United Kingdom and Malaysia, and as the Group Financial Controller of Hong Leong Industries Berhad, prior to joining the Gamuda Group. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest:-1. 804,775 shares; and2. 143,500 Warrants 2016/2021. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:44 AM

|

显示全部楼层

发表于 29-9-2018 06:44 AM

|

显示全部楼层

Date of change | 28 Sep 2018 | Name | DATO' CHOW CHEE WAH | Age | 60 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Resignation | Reason | Change of Alternate Director by Principal Director namely, Dato' Lin Yun Ling | Details of any disagreement that he/she has with the Board of Directors | No | Whether there are any matters that need to be brought to the attention of shareholders | No |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science (Honours) in Civil Engineering | University of London, UK | | | 2 | Others | Engineering | Board of Engineers, Malaysia | Professional Engineers | | 3 | Others | Engineering | The Institution of Engineers Malaysia | Member |

Working experience and occupation | A civil engineer, he has more than 36 years working experience in the design of roads, expressways, buildings and large-scale property developments. He joined Gamuda as a project coordinator after working with a leading engineering consultancy as Associate Director. In Gamuda, he held increasingly senior positions within the Group and assumed the property development portfolio in 1996 in line with the Groups business diversification. YBhg Dato Ir Chow heads the property development division as its Managing Director. YBhg Dato Ir Chows engineering expertise and vast experience working in the Group, particularly on the design and technical aspects of the construction, and in later years, on property development, enables him to contribute significantly to the Groups business and to the Board. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct Interest :1. 435,000 Ordinary Shares2. 78,000 Warrants 2016/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 06:45 AM

|

显示全部楼层

发表于 29-9-2018 06:45 AM

|

显示全部楼层

Date of change | 28 Sep 2018 | Name | MR CHAN KONG WAH | Age | 62 | Gender | Male | Nationality | Malaysia | Designation | Alternate Director | Directorate | Executive | Type of change | Others | Description | Following the resignation of Y. Bhg. Dato' Goon Heng Wah as a Director of Gamuda, Mr. Chan Kong Wah shall automatically cease as his Alternate Director |

QualificationsNo | Qualifications | Major/Field of Study | Institute/University | Additional Information | | 1 | Degree | Bachelor of Science (Engineering) degree | King's College London, University of London, UK | |

Working experience and occupation | A civil engineer, Mr Chan has over 40 years experience in civil engineering works. He was the Head of Facility Engineering Division of Pengurusan LRT, Kuala Lumpur prior to joining the Company in 1995. He is highly experienced in managing the construction of highways, airports and water supply schemes in Malaysia, the United Kingdom, Middle East and India. He was also involved in the Electrified Double-tracking Railway Project from Ipoh to Padang Besar and is currently involved in the Klang Valley MRT project in Malaysia. | Family relationship with any director and/or major shareholder of the listed issuer | None | Any conflict of interests that he/she has with the listed issuer | None | Details of any interest in the securities of the listed issuer or its subsidiaries | Direct interest:-1. 450,000 shares; and2. 71,900 Warrants 2016/2021. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 07:23 AM

|

显示全部楼层

发表于 29-9-2018 07:23 AM

|

显示全部楼层

本帖最后由 icy97 于 2-10-2018 05:04 AM 编辑

务大末季转盈为亏 归咎于脱售亏损及减值

Neily Syafiqah Eusoff/theedgemarkets.com

September 28, 2018 20:58 pm +08

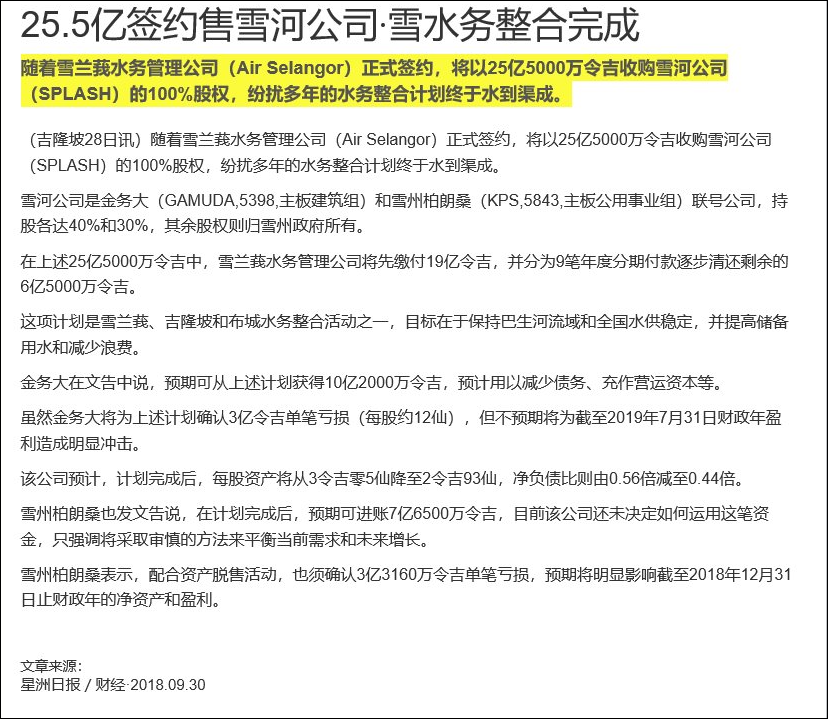

(吉隆坡28日讯)金务大(Gamuda Bhd)第四季转盈为亏,归咎于脱售持股40%的Syarikat Pengeluar Air Sungai Selangor私人有限公司(SPLASH)蒙受3亿令吉的单次亏损,以及Gamuda Water私人有限公司的投资减值总计400万令吉。

该集团今日向大马交易所报备,截至7月杪2018财政年末季净亏1亿108万令吉,或每股4.1仙,上财年同期则净赚1亿275万令吉,或每股4.2仙。

不计单次亏损和去年对Smart投资提出9800万令吉的单次减值损失,末季核心净利为2亿300万令吉,较同期的2亿100万令吉,按年微升1%。

由于越南和新加坡项目的产业销售提高,以及正在进行的建筑项目工作进展推动,末季营业额从10亿1000万令吉,上升19.9%至12亿1000万令吉。

金务大表示,产业臂膀金务大置地(Gamuda Land)在末季取得10亿令吉的产业销售,其中越南和新加坡的海外项目占70%。

然而,疲弱的季度表现拖累集团2018财年全年净利下跌14.7%至5亿1388万令吉,2017财年报6亿209万令吉;这是尽管营业额由32亿1000万令吉,攀升31.6%至42亿3000万令吉。

与此同时,金务大置地在2018财年的产业销售达创纪录的36亿令吉,超过35亿令吉的销售目标。

“由于越南的两个项目,胡志明市的Celadon City和河内的Gamuda City,还有新加坡的GEM Residences的销售强劲,产业销售较去年的24亿令吉劲扬50%。海外销售占整体产业销售的70%。”

展望2019财年,金务大置地的产业销售目标是40亿令吉。

金务大预计,随着脱售SPLASH的40%持股权,水务特许经营业务在2019财年的盈利贡献料走低。

尽管如此,该集团预计2019财年的整体表现将更佳,因海外尤其越南项目推高产业销售、在大马推出新城镇、巴生谷捷运二号线(MRT2)项目的进度持续加快,以及大道业务的盈利贡献稳定。

(编译:陈慧珊)

SUMMARY OF KEY FINANCIAL INFORMATION

31 Jul 2018 |

| | INDIVIDUAL PERIOD | CUMULATIVE PERIOD | CURRENT YEAR QUARTER | PRECEDING YEAR

CORRESPONDING

QUARTER | CURRENT YEAR TO DATE | PRECEDING YEAR

CORRESPONDING

PERIOD | 31 Jul 2018 | 31 Jul 2017 | 31 Jul 2018 | 31 Jul 2017 | $$'000 | $$'000 | $$'000 | $$'000 |

| 1 | Revenue | 1,214,812 | 1,013,156 | 4,227,060 | 3,211,403 | | 2 | Profit/(loss) before tax | -52,253 | 180,450 | 729,302 | 826,002 | | 3 | Profit/(loss) for the period | -90,162 | 123,548 | 564,357 | 656,225 | | 4 | Profit/(loss) attributable to ordinary equity holders of the parent | -101,078 | 102,753 | 513,883 | 602,093 | | 5 | Basic earnings/(loss) per share (Subunit) | -4.10 | 4.20 | 20.89 | 24.78 | | 6 | Proposed/Declared dividend per share (Subunit) | 0.00 | 0.00 | 12.00 | 12.00 |

|

| AS AT END OF CURRENT QUARTER | AS AT PRECEDING FINANCIAL YEAR END | 7

| Net assets per share attributable to ordinary equity holders of the parent ($$) | 3.0700 | 3.0500

|

|

|

|

|

|

|

|

|

|

|

|

|

发表于 29-9-2018 07:29 AM

|

显示全部楼层

发表于 29-9-2018 07:29 AM

|

显示全部楼层

本帖最后由 icy97 于 2-10-2018 05:05 AM 编辑

金务大联营公司9.63亿购狮城地

Wong Ee Lin/theedgemarkets.com

September 28, 2018 20:31 pm +08

(吉隆坡28日讯)一周前以3亿1889万新元(9亿6300万令吉)成为出价最高的竞标者后,金务大(Gamuda Bhd)今日确认收购位于新加坡安谷弯(Anchorvale Crescent)的地皮。

金务大今日向大马交易所报备,新加坡建屋发展局已接受其独资子公司金务大(新加坡)私人有限公司与毅雅地产(Evia Real Estate)的联合投标。

虽然标书最初由新加坡金务大与毅雅联合提交,但金务大表示,这幅面积5.14公顷的地皮如今将通过一家联营公司收购。这家联营公司将在适当的时候成立,持股权比例为新加坡金务大(50%)、和利集团(Ho Lee Group,30%)及毅雅(20%)。

联营公司将以现金和银行贷款支付购地款项。

金务大说:“已被指定用于发展执行共管公寓(EC)的这幅地,使金务大能够保持在新加坡的国际形象。这也增强了金务大作为一个集团在寻找新商机方面的能力,深入市场和供应链。”

“这一发展是实现上述策略的低风险选项,因有较高的压抑需求和上限的建筑成本。”

“此次收购预计对未来盈利作出贡献,从而提升股东在中长期的价值。”

由于安谷弯位于盛港(Sengkang),金务大表示,之前的EC销售表明该地区是EC市场的热点,并称该地距离盛港转换站仅一站的振林站(Cheng Lim LRT)旁,而且也靠近购物、餐饮、娱乐与休闲、学校和医院。

如无意外,该集团预计这项收购将于今年第四季完成。

(编译:陈慧珊)

Type | Announcement | Subject | TRANSACTIONS (CHAPTER 10 OF LISTING REQUIREMENTS)

NON RELATED PARTY TRANSACTIONS | Description | TENDER FOR LAND PARCEL AT ANCHORVALE CRESCENT (LOT 3142A MK 21) SITE EARMARKED FOR EXECUTIVE CONDOMINIUM HOUSING DEVELOPMENT MEASURING APPROXIMATELY 17,137.30 SQUARE METERS (PREVIOUSLY 51,411.90 SQUARE METERS WAS ALLOWABLE GROSS FLOOR AREA) ("TENDER")- LETTER OF AWARD | Reference is made to the announcement made by Gamuda Berhad (Company No. 29579-T) (“Gamuda” or “Company”) on 18 September 2018.

The Board of Directors of Gamuda wishes to announce that Gamuda has on 28 September 2018, received the Letter of Award dated 27 September 2018 issued by the Housing Development Board of Singapore confirming their acceptance of the Tender submitted jointly by Gamuda’s wholly owned subsidiary in Singapore, Gamuda (Singapore) Pte Ltd (“Gamuda Spore”) with Evia Real Estate (8) Pte Ltd (“Evia”) at the tender price of Singapore Dollars (“SGD”) 318,888,899.00 (equivalent to RM963.0 million) (“Purchase Consideration”).

For details of the announcement, please refer the file attachment below.

This announcement is dated 28 September 2018. |

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5928141

|

|

|

|

|

|

|

|

|

|

|

|

发表于 6-10-2018 07:37 AM

|

显示全部楼层

发表于 6-10-2018 07:37 AM

|

显示全部楼层

Type | Announcement | Subject | OTHERS | Description | ACQUISITION OF NEW SUBSIDIARY BY GAMUDA ENGINEERING SDN BHD, A WHOLLY OWNED SUBSIDIARY OF GAMUDA BERHAD | The Board of Directors of Gamuda Berhad (Company No. 29579-T) (“Gamuda” or “Company”) wishes to announce that Gamuda Engineering Sdn Bhd (Company No. 506869-K) ("Gamuda Engineering"), a wholly-owned subsidiary of the Company, has acquired one (1) ordinary share in Gamuda Building Ventures Sdn Bhd (formerly known as Imbangan Integrasi Sdn Bhd) (Company No. 1273882-D) (“Gamuda Building Ventures") representing 100% of the total issued share capital of Gamuda Building Ventures, for a total cash consideration of RM1.00 only ("Acquisition").

Following the Acquisition, Gamuda Building Ventures has become a wholly-owned subsidiary of Gamuda Engineering, which in turn is a wholly-owned subsidiary of Gamuda.

Gamuda Building Ventures was incorporated in Malaysia on 27 March 2018 as a private limited company under the company name, Imbangan Integrasi Sdn Bhd. On 1 October 2018, the company name was changed from Imbangan Integrasi Sdn Bhd to Gamuda Building Ventures. The total issued share capital of Gamuda Building Ventures is RM1.00 comprising one (1) ordinary share and the intended principal activity is to undertake infrastructure and building works.

None of the Directors and/or major shareholders of the Company and/or persons connected with them, has any interest, direct or indirect, in the Acquisition.

This announcement is dated 5 October 2018. |

|

|

|

|

|

|

|

|

|

|

|

|

发表于 7-10-2018 04:53 PM

来自手机

|

显示全部楼层

发表于 7-10-2018 04:53 PM

来自手机

|

显示全部楼层

财长阿柴已经终止Gamuda地底工程合约他应该颁发给自己的朋党! |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2018 04:38 AM

|

显示全部楼层

发表于 8-10-2018 04:38 AM

|

显示全部楼层

2因素拖低净利展望 金务大財测下调股价跌

財经 最后更新 2018年10月1日 21时04分

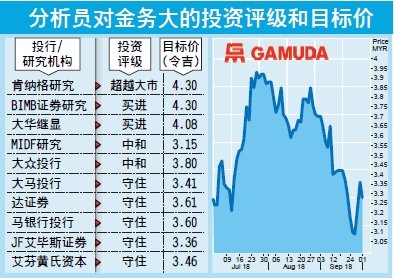

(吉隆坡1日讯)排除因认列脱售雪河输水公司(SPLASH)的一次性亏损,金务大(GAMUDA,5398,主板建筑股)2018財政年核心净利按年上涨17%,符合预期;但大部份分析员因其建筑业务將受政府缩减第二捷运(MRT2)合约价值所影响,以及SPLASH贡献减少,而下修2019財政年盈利预测。

业绩净亏及財测遭调低,导致该公司股价週一(1日)走跌,一度下跌15仙或4.46%,至全天最低水平的3.21令吉;最后则收窄跌幅,以3.28令吉闭市,全天则下滑8仙或2.38%,共有550万股易手,位居全场第17大下跌股。

由于必须认列脱售雪河输水公司(SPLASH)的一次性亏损3亿零400万令吉,金务大2018財政年末季(截至7月31日止)由盈转亏,至净亏1亿零108万令吉,营业额则按年增长19.9%,至12亿1481万令吉。全年净赚5亿1388万令吉,按年减少14.7%;营业额却上涨31.6%,至42亿2706万令吉。

排除这项减值亏损, 金务大2018財政年净利仍有17%的成长。

但2 0 1 9財政年盈利可能因受失去水务资產盈利贡献、维修协议费用减低、以及缩减第二捷运(MRT2)合约价值的影响而放缓。

展望未来, 管理层感到宽慰的是SPLASH的长期问题终於解决。儘管如此,分析员对建筑领域中期前景不太乐观,因第二捷运成本正在审查阶段。

肯纳格研究分析员指出,利好因素在于金务大未完成订单和產业未入账销售分別处在舒適的60亿令吉及23亿令吉,提供额外3年的盈利可见度。

截至2018財政年,房產销售额达到36亿令吉,超过管理层通过海外项目(即越南)的销售目標为35亿令吉。

不过,肯纳格研究分析员仍將2019財政年核心净利下修4%。该分析员认为,儘管建筑领域前景充斥不確定性,短期合约流量较小,但维持原本的投资评级和目標价。

目前的股价水平深具吸引力,2019財政年预测本益比为10倍。

大华继显分析员也下修2019至2020財政年净利预测6%及5%,並將年度订单目標从15亿令吉减至5亿令吉。同时,JF艾毕斯证券分析员表示,2018財政年录得36亿令吉的预售额,高出原定目標,主要是受越南和新加坡强劲销售所带动。

整体而言,海外项目佔预售额的67%,本地项目佔33%。管理层放眼2019財政年预售销售为40亿令吉。

「將失去SPLASH的贡献,和產业业务好转的因素纳入考量之后,我们將2019財政年盈利预测下修6.5%。」

另一方面,艾芬黄氏资本则將2019和2020財政年净利预测上调1%及3%,以反映其建筑和產业领域的增长表现,均超出分析员预期。

【东方网财经】 |

|

|

|

|

|

|

|

|

|

|

|

发表于 8-10-2018 06:30 PM

来自手机

|

显示全部楼层

发表于 8-10-2018 06:30 PM

来自手机

|

显示全部楼层

投资马蓝筹股随时饱受牺盟政府的震撼弹! |

|

|

|

|

|

|

|

|

|

| |

本周最热论坛帖子 本周最热论坛帖子

|